Vertical Divider

|

Xiaomi Restructures IPO Plans Again

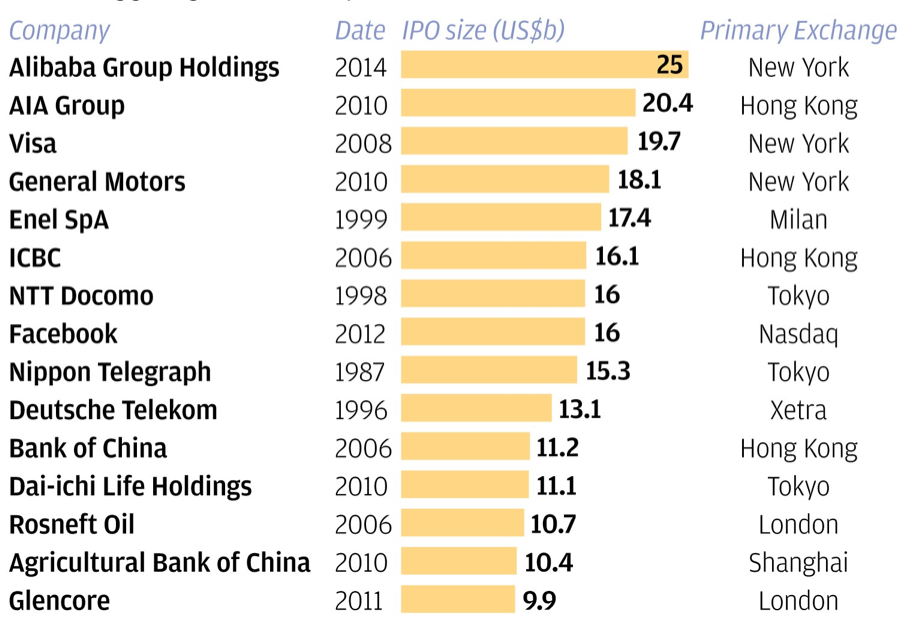

June 25, 2018 Xiaomi Corp. has set tentative terms for the world’s biggest initial public offering in nearly two years, aiming to raise as much as $6.1 billion in Hong Kong. The Chinese smartphone maker and existing investors plan to offer 2.18 billion shares at HK$17 to HK$22 apiece, according to sources, not identified because the information is private. China Mobile Ltd., the nation’s biggest wireless carrier, and U.S. wireless-chip giant Qualcomm Inc. are among firms in talks to become cornerstone investors. Xiaomi, led by serial entrepreneur Lei Jun, was the first to file for a Hong Kong IPO with a weighted-voting rights structure after the city’s bourse changed its rules in April. The deal could become the world’s biggest first-time share sale since September 2016, when Postal Savings Bank of China Co. raised $7.6 billion in a Hong Kong IPO, data compiled by Bloomberg show. China Mobile and Qualcomm have been discussing potential investments of around $100 million each in the Xiaomi IPO, according to the people with knowledge of the matter. An affiliate of Chinese express delivery firm SF Holding Co. is in talks to buy about $30 million of stock, the people said. CMB International’s private equity arm has been discussing a potential HK$1.5 billion ($191 million) investment, while an investment fund run by China Development Bank is in talks to buy HK$518 million of shares in the Xiaomi offering, the people said. A fund backed by China Merchants Group is negotiating the purchase of about HK$220 million in stock, according to the people. Qualcomm, whose Snapdragon chips have been used in Xiaomi’s flagship phones, is preparing to buy stock in the IPO amid increasing trade tensions between China and the U.S. It has also been waiting for formal acknowledgment that Chinese antitrust authorities have approved its $43 billion acquisition of NXP Semiconductors NV. Qualcomm’s venture capital arm is an existing investor in Xiaomi, its website shows. Xiaomi planned to seek about $10 billion combined from the Hong Kong IPO and a near-simultaneous offering to Mainland Chinese investors using Chinese depositary receipts (CDR), but delayedfloating CDRs in Shanghai, which was part of the government’s long-term goal of getting its biggest technology firms to list locally. Reuters said the decision was mainly because of a dispute between the company and Chinese regulators over the valuation of its CDRs, but the company denied this. “We’ve had many rounds of discussions with the regulators and reached a consensus that to ensure the quality of our CDR issuance, it’s better that we go public in Hong Kong first,” Xiaomi’s chief financial officer, Shou Zi Chew, told a news conference in Hong Kong. In a move guaranteed to make buyers a little cautious, Xiaomi awarded its chief executive and co-founder Lei Jun about $1.5 billion worth of shares for his contribution to the company, it said in an updated regulatory filing this week, in one of the largest one-off share-based corporate bonuses in years. Figure 1: 15 Largest IPO’s Source: Bloomberg

|

|

|

Contact Us

|

Barry Young

|