Vertical Divider

|

Why Bother?

September 03, 2019 As LG celebrated the opening of its Gen 8.5 OLED Fab in Guangzhou, LG’s market cap dropped to 1/3 of its highest value and the Korean display industry is undergoing a rapid transformation as the threat from China is compounded by a slowing growth in panel demand. As we discussed last week, Samsung and LG Display are closing or converting all of their LCD TV fabs such that they will have no large area LCD capacity at the end of 1 or 2 years. The closing will reduce supply by 70m TV panels in a market that is currently oversupplied with a 250m panel demand and a committed capacity growth of 70m large area panels. As TV set demand increases by ~2% per year and the average panel size increases by 3-5% per year, the elimination of Korean supply could put TV capacity in balance. But Samsung is building a Gen 8.5 pilot line for QD/OLEDs and if successful, would likely build a Gen 8.5 production line and LG Display is building a Gen 10.5 OLED production line in Paju. The unlikely winners in all of this turmoil are AUO and Innolux. If the supply demand curve falls back into equilibrium, panel ASPs will rise similar to 2017 and they will be profitable again and there would also be more room for OLED TVs. Rumors were rampant in Guangzhou that LGD would soon announce significant management layoffs in an attempt to bolster profitability and that a new CEO would be in place by the end of the year. |

|

Looking at the structure of the Samsung QD/OLED device, which we also published last week there are three blue florescent layers deposited by an in-line open mask system, similar to what LGD uses and it will have an IGZO backplane that reportedly uses more 15-17 masks ~5 more than the LG approach. LG creates colors with a traditional color filter, while Samsung will use a colorless transparent layer for blue and red and green QDs that function as a color filter. One problem that Samsung faces is the conversion rate of the QDs, which has been reported to be between 85% and 90%. The issue is whether the unconverted blue photons will distort the color. If so, some type of color filter will be required. So, what is the difference? Samsung has been claiming that OLED TVs have an image sticking problem, but their configuration doesn’t help. In addition, QD/OLED is totally dependent on the luminance level of the blue fluorescent material, which means 1,000 nit max, today. So, Samsung will likely spend US$8b in R&D and capex to position itself to be the equal of LGD.

Now, here’s a thought! Have you seen the price of LGD’s stock. It is barely hanging at ~$6.00 a share and that puts the market cap at $3.8b. If Samsung wants to get into OLED TVs, why don’t they just buy LGD, which would take out a big competitor, increase their small/medium OLED capacity and spend ½ as much as fully developing QD/OLEDs. There is , of course, the matter of LGD’s debt of ~$10b, but it’s still less than what Samsung would have to invest to replicate the fab assets.

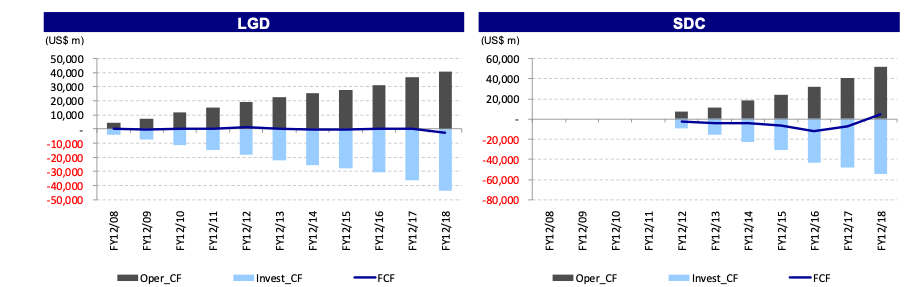

Figure 1: LGD and SDC -- Free Cash

Now, here’s a thought! Have you seen the price of LGD’s stock. It is barely hanging at ~$6.00 a share and that puts the market cap at $3.8b. If Samsung wants to get into OLED TVs, why don’t they just buy LGD, which would take out a big competitor, increase their small/medium OLED capacity and spend ½ as much as fully developing QD/OLEDs. There is , of course, the matter of LGD’s debt of ~$10b, but it’s still less than what Samsung would have to invest to replicate the fab assets.

Figure 1: LGD and SDC -- Free Cash

Source: Bloomberg

|

Contact Us

|

Barry Young

|