Vertical Divider

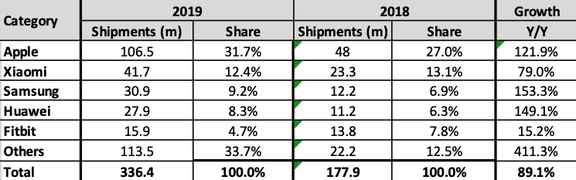

Wearable Device Market Up 82.3% for Q419 and 89% for the Year

March 22, 2020

The worldwide market for wearable devices grew 82.3% in the fourth quarter of 2019, reaching a new high of 118.9 million devices shipped, according to IDC.

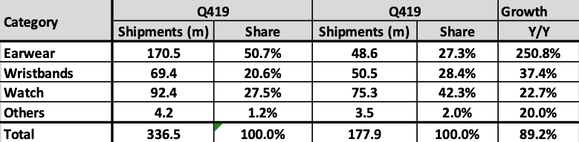

The stunning growth was largely due to the proliferation of hearables, which captured 55.3% of the entire market. Other popular categories that also experienced growth during the quarter included smartwatches (15.3% on year) and wrist bands (17.7% on year). Wrist-worn devices captured 43.8% of the total market, down from 68.6% last holiday season. Though the share for wrist-worn devices declined, the category itself grew 16.3% over the same period. For the entire year, vendors shipped a total of 336.5 million wearable devices worldwide, resulting in an 89% increase from the 178 million units shipped in 2018.

Table 1: Q419 Wearable Shipments, Share and Growth

March 22, 2020

The worldwide market for wearable devices grew 82.3% in the fourth quarter of 2019, reaching a new high of 118.9 million devices shipped, according to IDC.

The stunning growth was largely due to the proliferation of hearables, which captured 55.3% of the entire market. Other popular categories that also experienced growth during the quarter included smartwatches (15.3% on year) and wrist bands (17.7% on year). Wrist-worn devices captured 43.8% of the total market, down from 68.6% last holiday season. Though the share for wrist-worn devices declined, the category itself grew 16.3% over the same period. For the entire year, vendors shipped a total of 336.5 million wearable devices worldwide, resulting in an 89% increase from the 178 million units shipped in 2018.

- Apple led the market with 43.4 million units shipped in the fourth quarter of 2019 thanks to its refreshed AirPods, AirPods Pro, and Apple Watch as well as its Beats products spanning multiple price points. However, as the company's products did well overall during the quarter, Apple Watch shipments declined 5.2% on year as the company experienced supply shortages.

- Xiaomi ranked second shipping 12.8 million wearables of which 73.3% (9.4 million) were wristbands. The share of wristbands within Xiaomi's overall wearables portfolio declined from fourth quarter of 2018 when they accounted for 81.8% of shipments, reflecting a growing trend towards hearables and, to a lesser extent, watches landing in China.

- Samsung finished in third place thanks to a strong portfolio of products as well as multiple brands under its belt, including JBL and Infinity. Key to its success was its Galaxy Active and Active 2 smartwatches, broadening its audience from multi-purpose device users to health and fitness-focused enthusiasts.

- Huawei grew its wearable device shipments 63.4% with overall. Wristbands accounted for the vast majority of its shipment volumes but growing the most were its watches with several kids' watches and the GT2. Huawei also added several new hearables to its portfolio, keeping its selection aligned with the other market leaders.

- Fitbit (soon to be Google) rounded out the top-5 and saw its shipments rebound for the first time following two consecutive years of declining volumes. The company still relied on its fitness trackers to drive volumes, but its smartwatches nevertheless reached a new record with six million units shipped for the year thanks to the release of its Versa 2 and discounted Versa Lite and Ionic.

Table 1: Q419 Wearable Shipments, Share and Growth

Source: IDC

Table 2: Q419 Wearable Shipments, Share and Growth by Application

Source: IDC

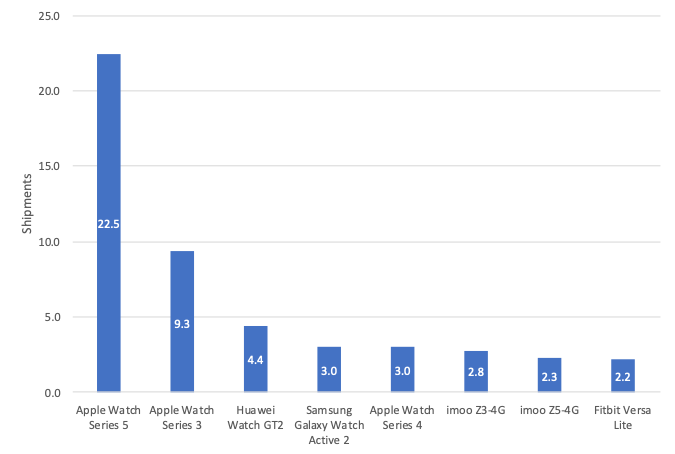

Figure 1: Q419 Top 10 Smart Watch Shipments by Model

Source: Counterpoint

|

Contact Us

|

Barry Young

|