Vertical Divider

Ultra-thin Glass and CPI battle for Market Supremacy as Protective Cover Lens in Foldable Displays

July 19, 2020

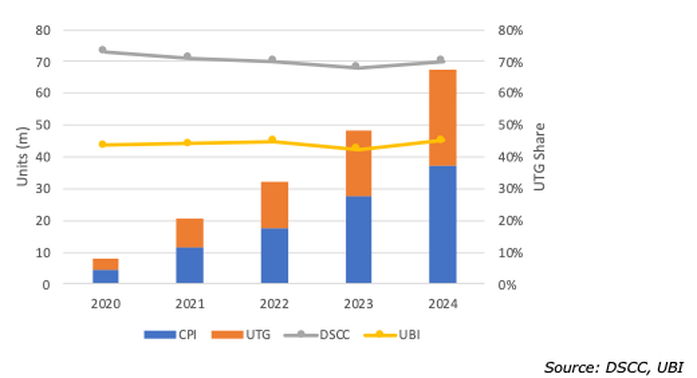

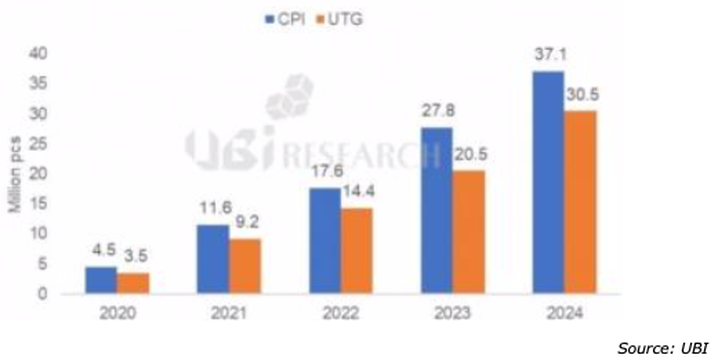

In another report, UBI estimated that foldable smartphone display makers will continue to rely on both Ultra-Thin-Glass (UTG) and Colorless Polyimide (CPI) films for at least the next five years. UBI sees demand for CPI films will reach 4.3 million units in 2020 while demand for UTG will reach 3.5 million units. Demand for both products will grow and by 2024 it will reach 37.1 million units for CPI and 30.5 million for UTG. UBI’s forecast that CPI will have a greater share of foldable display production, conflicts with the following trends:

Samsung says that its UTG cover enables it to meet more demanding customer needs compared to its 1st-gen Polyimide cover material. Samsung developed UTG, beginning in 2013 in collaboration with Dowoo Insys, using Schott's ultra-thin glass. It is 30um thick and is produced using an intensifying process to enhance its flexibility and durability. In the process, the UTG is injected with a special material up to an undisclosed depth to achieve a consistent hardness. UTG provides better hardness, feels more like non-folding phones. Colorless polyimide has better impact resistance, but feels more like plastic. Both include an anti-scratch resistant hard coat to boost hardness further.

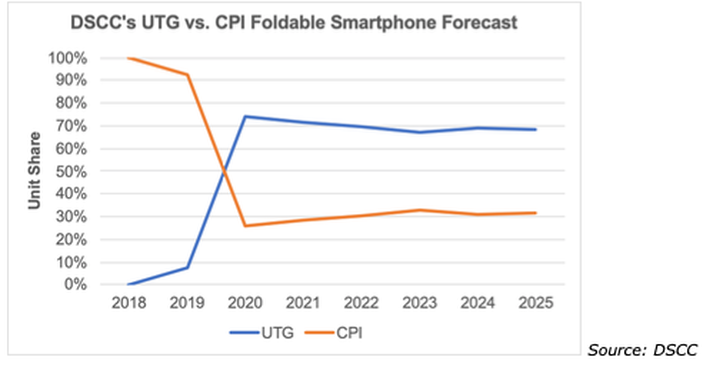

Ross Young of DSCC concluded that Schott is likely to lead this market among UTG-manufacturing firms well into the 2020s, whereas the 2nd-gen Galaxy Z Flip and Z Fold 3 will compete for the best-selling foldable in 2021. DSCC projections may contradict another leak that suggests Samsung will switch UTG providers from Schott to Corning for the Z Fold 2. On that note, Young states that Apple is likely to go with the latter when it comes time to "invent" its own foldable devices. But it is likely years down the line. At any rate DSCC is confident that UTG will be favored over CPI, starting in 2020.

Figure 1: Comparison of UTG vs. CPI Usage

July 19, 2020

In another report, UBI estimated that foldable smartphone display makers will continue to rely on both Ultra-Thin-Glass (UTG) and Colorless Polyimide (CPI) films for at least the next five years. UBI sees demand for CPI films will reach 4.3 million units in 2020 while demand for UTG will reach 3.5 million units. Demand for both products will grow and by 2024 it will reach 37.1 million units for CPI and 30.5 million for UTG. UBI’s forecast that CPI will have a greater share of foldable display production, conflicts with the following trends:

- Samsung’s use of UTG in its popular Z Fold Flip and the reports that the Z fold 2 will use UTG

- Reports that Huawei new Mate X2 will use UTG

- Leaving only the outdated Fold, Mate X, Mate X2 and Flex Pai still using CPI

Samsung says that its UTG cover enables it to meet more demanding customer needs compared to its 1st-gen Polyimide cover material. Samsung developed UTG, beginning in 2013 in collaboration with Dowoo Insys, using Schott's ultra-thin glass. It is 30um thick and is produced using an intensifying process to enhance its flexibility and durability. In the process, the UTG is injected with a special material up to an undisclosed depth to achieve a consistent hardness. UTG provides better hardness, feels more like non-folding phones. Colorless polyimide has better impact resistance, but feels more like plastic. Both include an anti-scratch resistant hard coat to boost hardness further.

Ross Young of DSCC concluded that Schott is likely to lead this market among UTG-manufacturing firms well into the 2020s, whereas the 2nd-gen Galaxy Z Flip and Z Fold 3 will compete for the best-selling foldable in 2021. DSCC projections may contradict another leak that suggests Samsung will switch UTG providers from Schott to Corning for the Z Fold 2. On that note, Young states that Apple is likely to go with the latter when it comes time to "invent" its own foldable devices. But it is likely years down the line. At any rate DSCC is confident that UTG will be favored over CPI, starting in 2020.

Figure 1: Comparison of UTG vs. CPI Usage

Figure 2: UTG vs. CPI for Foldables-DSCC Forecast

Figure 3: UTG vs. CPI for Foldables-UBI Forecast

|

Contact Us

|

Barry Young

|