Vertical Divider

|

UDC Announces Record Quarterly and Annual Results for Both Top and Bottom Lines – Stock Down in After Hours Trading

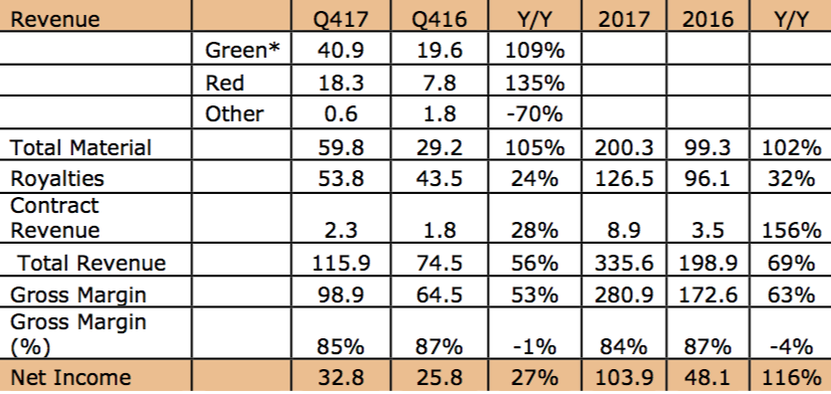

February 26, 2018 UDC reported record revenue and net income in Q417 and in 2017. Revenues were US$115.9m up 56% in Q417 and US$335.6m up 69% for the year as shown in the following table. However, what stunned the analysts was the revenue outlook for 2018, which was US$350m to US$380m, a Y/Y increase of only 4% to 13%. Sid Rosenblatt, CFO claimed that there was US$15m to US$20m in material revenue that was pushed forward from Q118 to Q417 and that capacity growth in 2018 would be small, shifting to 2019, which he claimed would result in a 50% increase in capacity from 2017 to 2019. Shifting US$20m from Q417 to 2018, would have resulted in a annual revenue growth of 26% in 2018. No mention was made of the slower than expected iPhone X sales, which has pushed Samsung to reduce the A3 utilization by 10% for at least the 1st 2 quarters of 2018. UDC claimed that A3 has a capacity of 130K substrates/month, so 10% reduction is ~ 23m 6.1” yielded panels out of Samsung’s production of 400m (in 2017). Note that Samsung’s reduction will be offset by an increase in mobile display capacity (m2) of 52% according to DSCC, which diverges from UDC’s claim. Rosenblatt also claimed that LG’s growth in TV shipments from 1.7m in 2017 to 2.7m in 2018 is partially due to an increase in yields, which wouldn’t affect UDC’s material sales, although it does affect royalties. However, LG added a Gen 8.5 fab in the 2nd half of 2017, resulting in an effective capacity increase of 31% in 2018 vs. 2017. Moreover, LG is now using 2 phosphorescent layers instead of 1, which apparently started in the 2nd quarter of 2017. The market reacted negatively to the outlook and the stock was down ~US$20 in after hours trading. Rosenblatt also discussed an accounting change, which would affect when license revenues are recognized. Previously they were recognized 1 quarter in arrears and now they will be recognized quarterly based on a pro rata of material revenue collected as a percentage of total contract revenue times (using weighted ASP) the total license fee over the life of the contract. Rosenblatt didn’t distinguish between the way license fees and royalties were handled. Table 1: UDC Selected Financial Items – Q417 & 2017 *Includes Yellow Data Source: Company Data

|

|

|

Contact Us

|

Barry Young

|