Vertical Divider

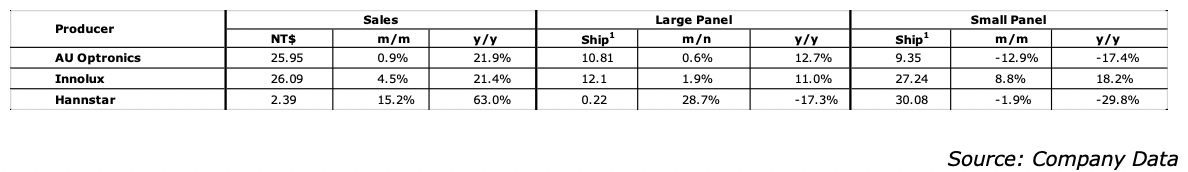

Top 3 Taiwan Display Makers Report M/M Increases in November Sales

Not unexpectedly all three Taiwan based panel producers saw positive m/m total panel sales increases in November as panel prices continued to rise. Large panel shipments rose modestly (Although HannStar saw a large percentage increase in small panel sales, they represent a very small portion of the company’s overall business), while small panel shipments were mixed both m/m and y/y. While HannStar has indicated a more cautious tone for December, as component shortages are limiting the company’s ability to fill customer orders, there seemed to be relatively little sequential difference in their overall sales and their small panel shipments in November.

Table 1: November’20 Sales Data—AUO, Innolux, HannStar

Not unexpectedly all three Taiwan based panel producers saw positive m/m total panel sales increases in November as panel prices continued to rise. Large panel shipments rose modestly (Although HannStar saw a large percentage increase in small panel sales, they represent a very small portion of the company’s overall business), while small panel shipments were mixed both m/m and y/y. While HannStar has indicated a more cautious tone for December, as component shortages are limiting the company’s ability to fill customer orders, there seemed to be relatively little sequential difference in their overall sales and their small panel shipments in November.

Table 1: November’20 Sales Data—AUO, Innolux, HannStar

AU Optronics’ monthly sales stabilized since September and a flat December would put full year sales flat with 2019. Shipments, both large and small, have tailed off a bit, but remain at fairly consistent levels. Innolux has followed a similar sales and shipment pattern, however, assuming flat sales in December 2020 sales will be up ~6.7% y/y, due largely to Hon Hai’s ODM business, which can draw from subsidiary Innolux for both large and small panels.

HannStar is an outlier relative to AUO and Innolux as it is primarily a small panel producer, and therefore is not influenced by large panel pricing or demand, but we were most surprised by HannStar’s small panel sales and shipments in November, given they were up 15.2% and were the highest since October 2017. As we noted previously and above, HannStar recently indicated that it would be unable to meet all of its contractual delivery obligations because of component shortages, which did not seem to happen in November, but even assuming that December sees a 20% drop in small panel sales, this will be HannStar’s best year since 2017.

AUO and Innolux made up in in the 2nd half of 2020, what they lost in 1H due to the COVID-19 outbreak. For 2021, the environment should be positive for the two company, greater demand for TVs and notebooks, flat monitor sales accompanied by level supply.

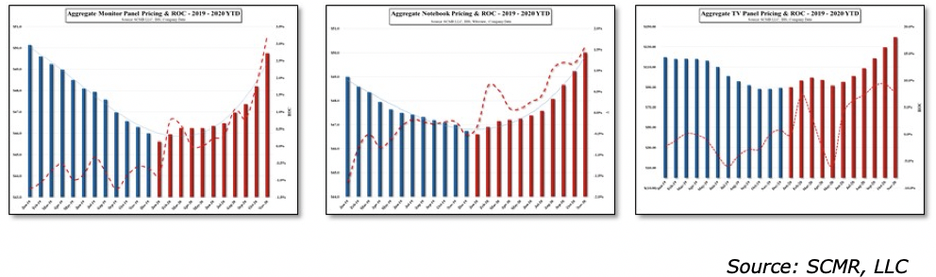

Figure 1:Monitor, Notebook and TV Panel Pricing

HannStar is an outlier relative to AUO and Innolux as it is primarily a small panel producer, and therefore is not influenced by large panel pricing or demand, but we were most surprised by HannStar’s small panel sales and shipments in November, given they were up 15.2% and were the highest since October 2017. As we noted previously and above, HannStar recently indicated that it would be unable to meet all of its contractual delivery obligations because of component shortages, which did not seem to happen in November, but even assuming that December sees a 20% drop in small panel sales, this will be HannStar’s best year since 2017.

AUO and Innolux made up in in the 2nd half of 2020, what they lost in 1H due to the COVID-19 outbreak. For 2021, the environment should be positive for the two company, greater demand for TVs and notebooks, flat monitor sales accompanied by level supply.

Figure 1:Monitor, Notebook and TV Panel Pricing

|

Contact Us

|

Barry Young

|