Vertical Divider

|

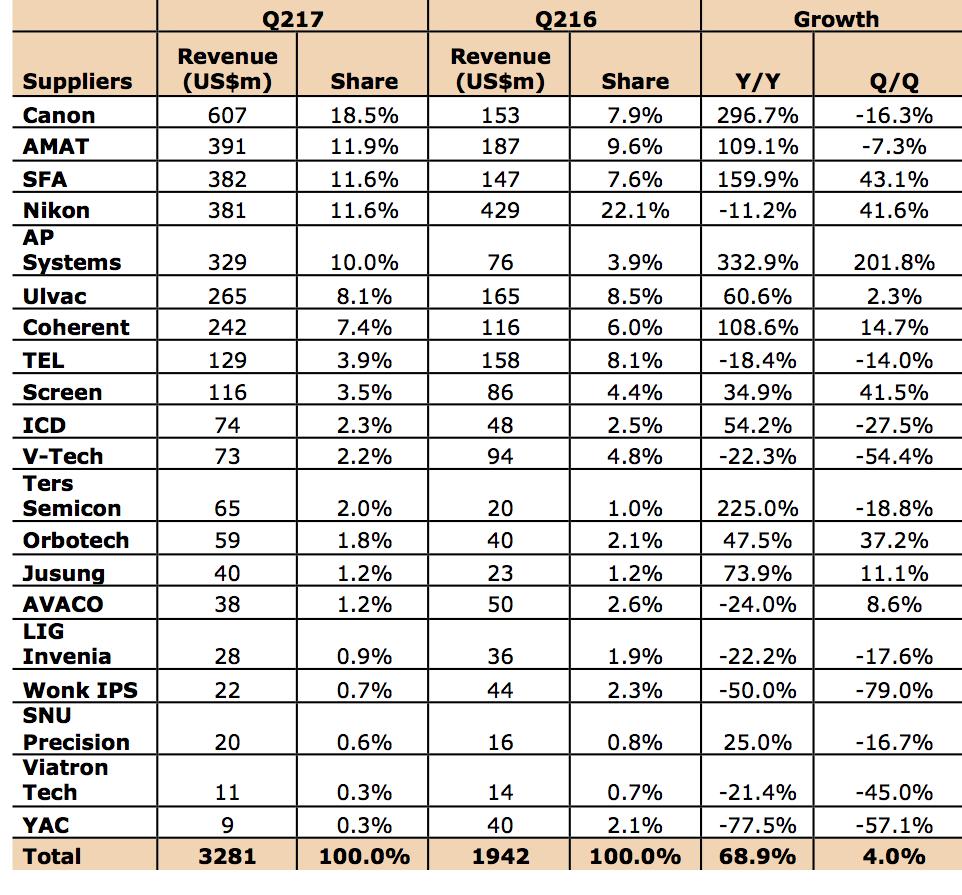

Tool Makers Experience Another Strong Quarter up 68.9% Y/Y

September 18, 2017 DSSC reported another robust quarter for public equipment vendors with revenue up 68.9% Y/Y to US$3.28b as shipments for OLED fabs dominated the market. DSSC believes that revenues form the non-public companies would take the total to over US$5b. Canon once again led the market due to its strong position in the litho and FMM VTE markets. Canon lost its top position in the litho market in Q2’17 with its share falling from 54% to 37% on a 30% Q/Q decline in shipments. However, it is expected to move back into the lead tin the 2H’17 based on forecasts from Nikon and Canon and could generate another $1.4B in revenues in 2H’17 between litho and VTE. Nikon slipped to #4 overall but enjoyed strong growth on a 41% increase in litho unit shipments which enabled its Q2’17 litho share to rise from 46% to 63%. Despite the strong Q/Q growth, its revenues were down Y/Y as its litho share was more dominant a year ago at 73%. Applied was #2 with revenues of US$391m, up 109.1% Y/Y followed by SFA at US$382m up 159% Y/Y. In terms of growth AP Systems was the leader with revenues of $329m up 333% Table 1: Q217 Display Toolmaker Revenue Source: DSCC

Note: data from 20 publicly traded firms. |

|

|

Contact Us

|

Barry Young

|