Vertical Divider

TVs

The End of an Era in LCD TV Panel Production

February 02, 2020

LG and SDC LCD TV panel makers are undergoing fab restructuring and shutdowns in 2020, which is causing changes to the supply chain that will spur TV makers to shift their supply base to China and perhaps Taiwan. Deborah Yang, IHS Markit | Technology director said, “The global top-three TV brands are set to increase their purchasing from Chinese suppliers to 62.6 million displays in 2020, an increase of 35 percent from 2019.” The competition between BOE Technology and China Star Optoelectronics Technology is intensifying, particularly in the realm of LCD panel supplies from Gen 10.5 fabs. Meanwhile supply availability is improving at emerging Chinese panel makers such as HKC, Nanjing CEC-Panda LCD Technology and Xianyang Caihong Optoelectronics Technology (CHOT). Although panel supply still exceeds demand, top-tier TV brands are signing long-term supply agreements with both captive and selective external panel suppliers to ensure they get the highest priority business in 2020. In-house support, both on the supply and demand sides, is becoming critical and LCD panel suppliers and TV makers are building a strong fully integrated TV (FIT) business model. The strong supply push from panel makers and strong demand pull from TV brands together can streamline supply chain efficiency and drive cost efficiency. Most leading TV makers have diversified panel sources, and they aim to gain stronger sourcing power to enhance their own competitiveness. However, they do not necessarily carry the responsibility of consuming excess panel supplies from captive suppliers.

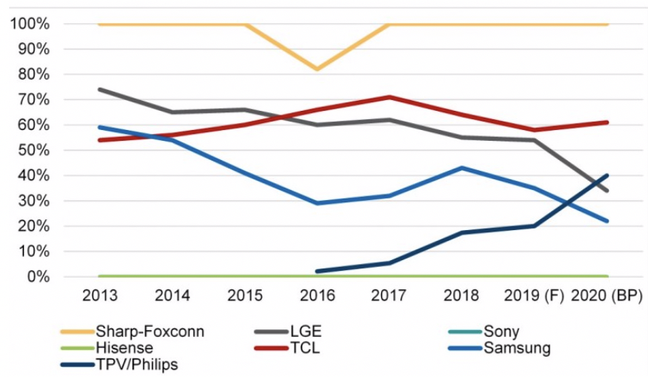

Figure 1: TV Brand Sourcing from Captive Suppliers

The End of an Era in LCD TV Panel Production

February 02, 2020

LG and SDC LCD TV panel makers are undergoing fab restructuring and shutdowns in 2020, which is causing changes to the supply chain that will spur TV makers to shift their supply base to China and perhaps Taiwan. Deborah Yang, IHS Markit | Technology director said, “The global top-three TV brands are set to increase their purchasing from Chinese suppliers to 62.6 million displays in 2020, an increase of 35 percent from 2019.” The competition between BOE Technology and China Star Optoelectronics Technology is intensifying, particularly in the realm of LCD panel supplies from Gen 10.5 fabs. Meanwhile supply availability is improving at emerging Chinese panel makers such as HKC, Nanjing CEC-Panda LCD Technology and Xianyang Caihong Optoelectronics Technology (CHOT). Although panel supply still exceeds demand, top-tier TV brands are signing long-term supply agreements with both captive and selective external panel suppliers to ensure they get the highest priority business in 2020. In-house support, both on the supply and demand sides, is becoming critical and LCD panel suppliers and TV makers are building a strong fully integrated TV (FIT) business model. The strong supply push from panel makers and strong demand pull from TV brands together can streamline supply chain efficiency and drive cost efficiency. Most leading TV makers have diversified panel sources, and they aim to gain stronger sourcing power to enhance their own competitiveness. However, they do not necessarily carry the responsibility of consuming excess panel supplies from captive suppliers.

Figure 1: TV Brand Sourcing from Captive Suppliers

Source: Informa Tech

“When the market becomes dominated by a few powerful players, TV makers and panel makers may face various dilemmas and risks as they attempt to hold on to bargaining power,” Yang observed. In 2020, Samsung’s panel sourcing from its captive supplier, Samsung Display, will be further reduced. Samsung Display has plans to convert its LCD TV panel capacity to quantum dot displays. Additionally, the availability of Samsung Display’s LCD-TV panels will be limited from this year onwards, significantly cutting down its panel supply to external customers, particularly Chinese TV makers. LG Electronics’ sourcing volumes from LG Display will also be slashed in 2020. Nevertheless, LG is likely to purchase from external vendors such as BOE Technology, HKC and Nanjing CEC-Panda LCD Technology to make up for the possible loss of LCD TV panel supply availability from LG Display in 2020. From: Display Daily

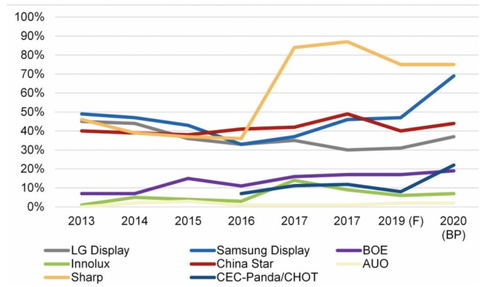

Figure 2: Panel makers Share to Captive Brands

Source: Informa Tech

|

Contact Us

|

Barry Young

|