Vertical Divider

Strong August LCD Revenues Denote Start of Comeback

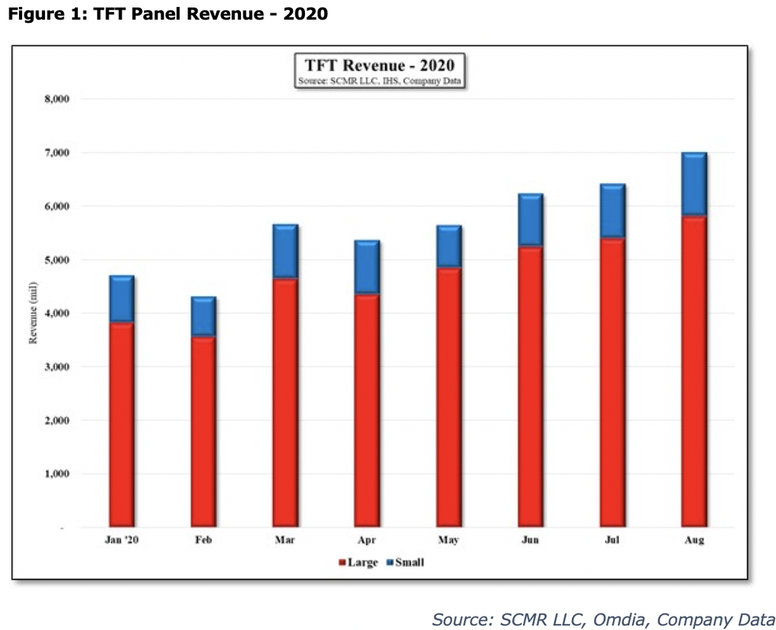

In August, LCD revenue was down 4.1% Y/Y, but the industry seems to be making a comeback, as sequential sales have been up since May.

In August, LCD revenue was down 4.1% Y/Y, but the industry seems to be making a comeback, as sequential sales have been up since May.

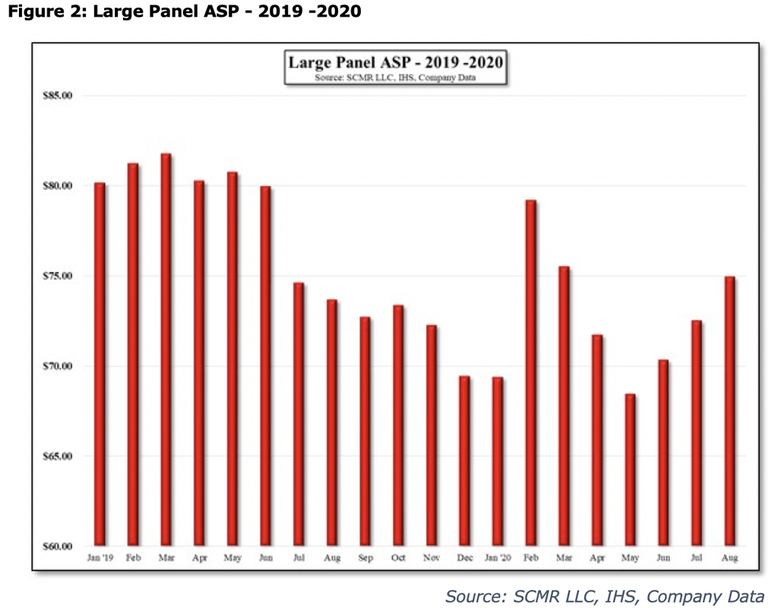

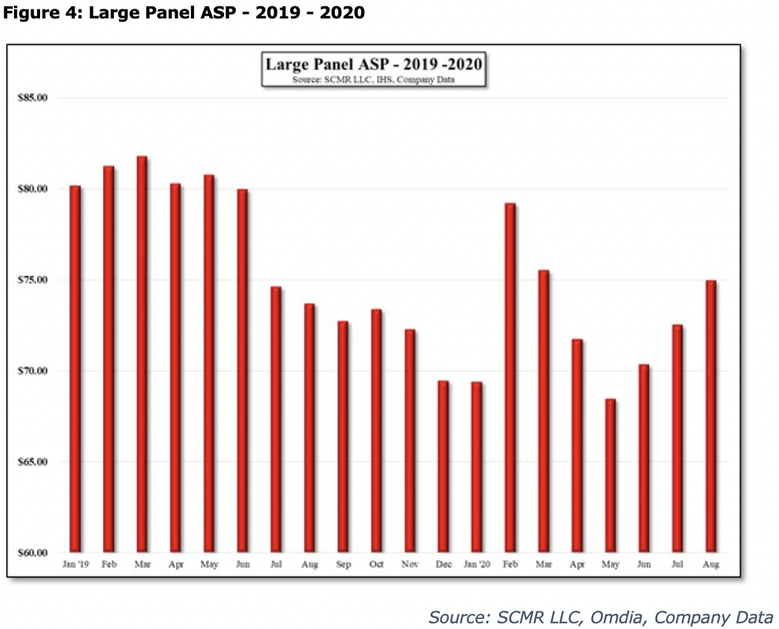

Large panels which represented 82.9% of total sales in August, improved, Y/Y as ASPs continue to increase. The next figure shows how severe the large panel price drops were last year. Q320 could be the peak for panel producer revenue this year, driven by high notebook and monitor demand, which is offsetting weak demand in the TV space.

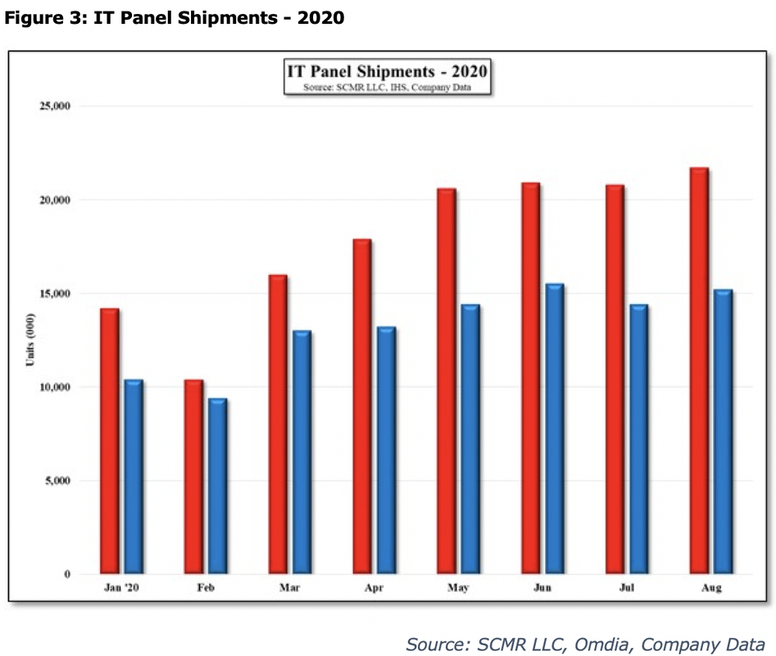

Notebook demand continued growing into August, fueled by programs targeting students doing remote learning, but monitor demand has leveled off.

Small panel revenue ticked up in August as smartphone production for new models to be released during the holidays started. While the dollar amount is small relative to large panel sales, it is important to those that are based primarily on small panel production such as HannStar, InfoVision and Tianma, with only Tianma seeing a monthly decrease in small panel revenue in August, despite the 17.5% sequential increase in overall small panel revenue. These panel makers are focused almost entirely on small panel production but represent (August) only ~21% of industry small panel sales.

Overall LCD sales in August were up 9.1% sequentially, better than the 2.9% sequential increase in July, but not as good as the 10.9% increase in June. In the first 2 months of Q320, total industry revenue is up 21.9% and 21.0% over the first two months of Q319.

Overall LCD sales in August were up 9.1% sequentially, better than the 2.9% sequential increase in July, but not as good as the 10.9% increase in June. In the first 2 months of Q320, total industry revenue is up 21.9% and 21.0% over the first two months of Q319.

|

Contact Us

|

Barry Young

|