Vertical Divider

September Panel Pricing – Update

TV ASPs were up 10.7% sequentially, 30.7% Y/Y and 30.5% YTD. The large jump in TV panel prices puts aggregate LCD TV panel prices back almost to where they were in January of 2019, with almost TV panel sizes profit. As a result, panels makers are shifting production toward TV panels and away from IT, which will further tighten notebook and to a lesser degree monitor supply.

Table 1: September Panel Price Change by Application

TV ASPs were up 10.7% sequentially, 30.7% Y/Y and 30.5% YTD. The large jump in TV panel prices puts aggregate LCD TV panel prices back almost to where they were in January of 2019, with almost TV panel sizes profit. As a result, panels makers are shifting production toward TV panels and away from IT, which will further tighten notebook and to a lesser degree monitor supply.

Table 1: September Panel Price Change by Application

Monitor panel demand in September was about as expected with commercial demand a bit weaker and retail demand a bit stronger than expected owing to gaming. But supply is lessening as production shifts to categories where panel prices are rising more quickly. There are still monitor driver shortages, which could push prices up a bit next month, but there is little impetus for monitor panel increases next month, especially as delays in Intel’s desktop processor will limit new PC models until after the new year.

Notebook panel demand is still being boosted by both local and global programs for remote learning and a bit of inventory is building for the holidays, while component shortages on the supply side seem to be setting up another month of similar price increases. Component shortages at a number of production points are causing cost increases. With demand remaining high and remote learning program buys will likely continuing through year end, notebook panel pricing should continue to increase.

TV panel makers are pushing up prices to revive profitability before the end of the year. But TV set brands have no pricing leverage and have had difficulty raising prices even before these large panel price increases which gives them few options during the holidays. If they push to meet volume goals, without raising prices they face loses on each set sold during the holidays, and if they cut advertising and promotions to preserve margins, they market share would fall.

Mobile phones face component shortage issues as demand has increased and smartphone brands build inventory for holiday smartphone releases. Component shortages and therefore component prices will make seasonal demand more volatile as smartphone brands continue to build inventory regardless of panel price, giving small panel producers the ability to increase margins.

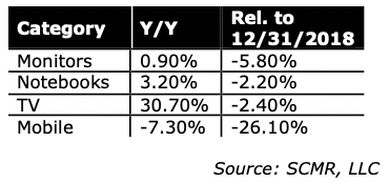

The next table compares the ASP changes in 2020 with the full year 2018 results, before the pandemic occurred. Y/Y Aps are up in 2020, except for mobile display, while in 2008, every category was down . The IT and TV categories were typical but the drop in mobile in 2018 was unprecedented and was likely a function of LCD makers lowering prices to compete with OLEDs.

Table 2: 2020 ASP Changes by Application

Notebook panel demand is still being boosted by both local and global programs for remote learning and a bit of inventory is building for the holidays, while component shortages on the supply side seem to be setting up another month of similar price increases. Component shortages at a number of production points are causing cost increases. With demand remaining high and remote learning program buys will likely continuing through year end, notebook panel pricing should continue to increase.

TV panel makers are pushing up prices to revive profitability before the end of the year. But TV set brands have no pricing leverage and have had difficulty raising prices even before these large panel price increases which gives them few options during the holidays. If they push to meet volume goals, without raising prices they face loses on each set sold during the holidays, and if they cut advertising and promotions to preserve margins, they market share would fall.

Mobile phones face component shortage issues as demand has increased and smartphone brands build inventory for holiday smartphone releases. Component shortages and therefore component prices will make seasonal demand more volatile as smartphone brands continue to build inventory regardless of panel price, giving small panel producers the ability to increase margins.

The next table compares the ASP changes in 2020 with the full year 2018 results, before the pandemic occurred. Y/Y Aps are up in 2020, except for mobile display, while in 2008, every category was down . The IT and TV categories were typical but the drop in mobile in 2018 was unprecedented and was likely a function of LCD makers lowering prices to compete with OLEDs.

Table 2: 2020 ASP Changes by Application

|

Contact Us

|

Barry Young

|