Vertical Divider

Semiconductor Shortage – Minor Impact on Smartphones

Strains in the semiconductor supply chain have worsened in some areas as trends such as remote working combine with an industrial recovery from last year's pandemic slump to drive chip demand, the head of Germany's Infineon said.

The ability of chipmakers to add capacity is limited, while some in Asia face further production constraints as they seek to contain COVID-19 outbreaks in their workforces, CEO Reinhard Ploss told Reuters.

Infineon, the leading supplier of power semiconductors to the automotive industry, relies heavily on contract chip manufacturers such as TSMC with which it is in a "deep dialogue" on meeting customer needs, said Ploss. The chip supply crunch has provoked debate in Europe about whether to invest in new production capacity to reduce its dependence on imports from the Asian manufacturers that dominate the industry. Ploss questioned the goal set by Brussels of building a state-of-the-art 2 nanometer plant. Ploss points to the dearth of computer and smartphone producers in Europe to explain why Europe doesn’t need a 2nm semiconductor fab. The same argument could be made for the US as Apple, HP, Dell and others assemble their products in Asia.

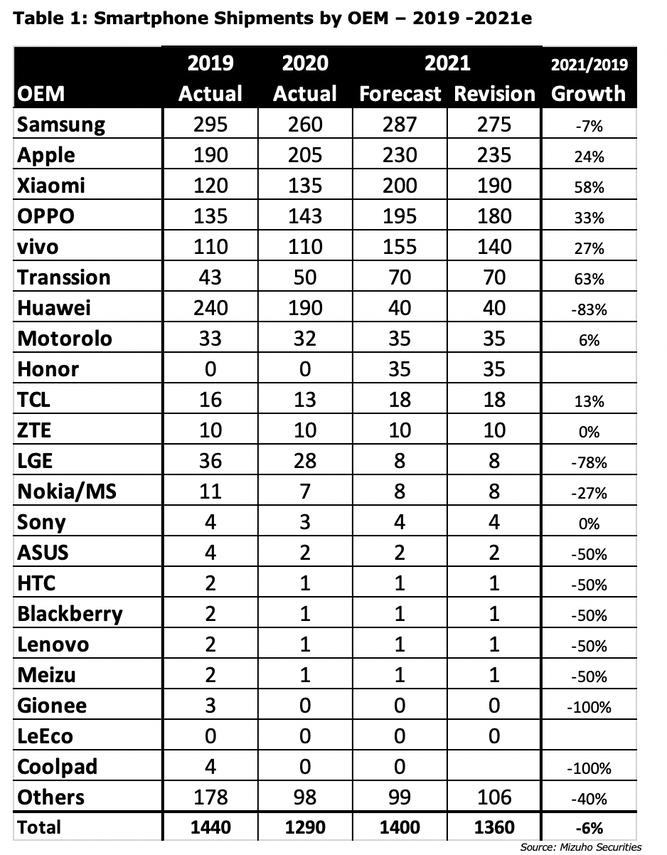

Even the highly publicized shortages in the smartphone market are having only a minor impact. Mizuho Securities, recently updated their smartphone forecast and dropped the 2021 volume by <3% or 40m phones to account for the shortage. Mizuho points to the following to justify their forecast:

Strains in the semiconductor supply chain have worsened in some areas as trends such as remote working combine with an industrial recovery from last year's pandemic slump to drive chip demand, the head of Germany's Infineon said.

The ability of chipmakers to add capacity is limited, while some in Asia face further production constraints as they seek to contain COVID-19 outbreaks in their workforces, CEO Reinhard Ploss told Reuters.

Infineon, the leading supplier of power semiconductors to the automotive industry, relies heavily on contract chip manufacturers such as TSMC with which it is in a "deep dialogue" on meeting customer needs, said Ploss. The chip supply crunch has provoked debate in Europe about whether to invest in new production capacity to reduce its dependence on imports from the Asian manufacturers that dominate the industry. Ploss questioned the goal set by Brussels of building a state-of-the-art 2 nanometer plant. Ploss points to the dearth of computer and smartphone producers in Europe to explain why Europe doesn’t need a 2nm semiconductor fab. The same argument could be made for the US as Apple, HP, Dell and others assemble their products in Asia.

Even the highly publicized shortages in the smartphone market are having only a minor impact. Mizuho Securities, recently updated their smartphone forecast and dropped the 2021 volume by <3% or 40m phones to account for the shortage. Mizuho points to the following to justify their forecast:

- Continued growth in 5G device uptake from 40% to 41% for 2021 and from 55% to 56% for 2022, and we estimate a 65% weighting in 2023. 5G devices to account for over half the market in 2022.

- 78m units of iPhone 13 in 2022 (although Apple plans roughly 85m units), with over half featuring AiP. Apple is expected to also roll out mmW models in countries besides the US (Japan, S. Korea, and possibly some parts of Europe). The issue is whether telecom carriers will embrace mmW.

- Samsung’s commitment to volume and therefore an emphasis on the mid-range puts their 5G weighting slightly below the overall market weighting through 2023, as they limit mmW to flagship models (its main markets are the US and South Korea, but its flagship models will likely feature mmW globally).

- Risk of deceleration in China’s infrastructure development is not imminent as 2021 annual disclosures, inventory levels appears high

- Huawei:

- For Honor (established as an independent business with base operations in Beijing and parts of former operations in Xi’an), expect total shipments of 35m units in 2021 and 85m units in 2022, including 5G device shipments of 24m and 70m units, respectively (revised down on development delays, shortage of application processors (AP), etc.).

- Given the status quo for Huawei regarding US sanctions, total shipments, expect 40m units in 2021 and 40m in 2022, including 5G device shipments of 11m and 4m units, respectively (AP from HiSilicon:Kirin inventory). There is little exodus of talent from Huawei, which boasts a large stock of preeminent Chinese talent, and a settlement with the US or a spin-off of consumer operations as an independent unit, Huawei could recover.

- Huawei’s situation significantly impacts the strategies of other Chinese brands

- Smartphone market is forecasted at 5% Y/Y growth to 1,360m units in 2021, and 7% growth to 1,455m units in 2022. Compared to 2019, (per-covid), volume is down 6%.Because these products have a relatively short replacement/upgrade cycle (3–4 years), assuming the pandemic gradually winds down, pent-up demand in emerging markets could drive market growth from 2022 onward The shortage of semiconductors generally—and AP in particular— are likely to continue into 2022, but the effect on smartphone volume will be kept to a minimum.

|

Contact Us

|

Barry Young

|