Vertical Divider

Samsung Display To Begin Mass Production Of Quantum-Dot

(OLED) Panels From 2021

July 05, 2020

The company held a celebratory event at its facility in Asan, South Chungcheong Province, where CEO Lee Dong-hoon oversaw the delivery of the first batch of QD manufacturing equipment. “Despite the COVID-19 pandemic, our close collaborative ecosystem with global partners enabled us to carry out our QD investments according to plan,” said Choi Joo-sun, chief of large-size display unit. “We will strive to produce unparalleled QD displays based on our advanced technology and 20-year-long experience in large-size liquid-crystal displays,” Choi said.

Since announcing its plan to invest in QD technology in October 2019, Samsung Display has partially removed L8 manufacturing line for LCD screens for TVs and recently completed construction of clean rooms for QD lines. With the installation of 8.5-generation vapor deposition machinery as a start, Samsung Display plans to complete the QD manufacturing line within this year and kick in commercial production next year.

The transition from LCD to QD is a strategic decision by Samsung Display to tackle the premium TV market in the coming years. The LCD market is now inundated with cost-effective Chinese products that erode business profitability, whereas QD is rising as the next-generation technology for high-definition TVs. Samsung Display said that it is currently honing the final-stage technologies that will add to its products’ quality and quantity.

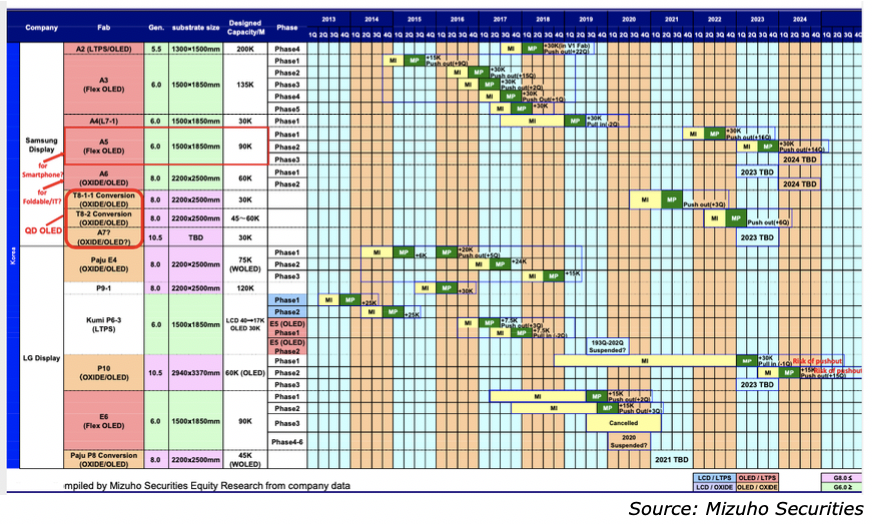

The QD process includes three fluorescent blue OLED (Tandem) structure, which are deposited using the standard VTE process together with the common layers and then covered by IJP red and green QD color converters and some type of color filter. The T8-1 Gen 8.5 conversion is expected to have a capacity of 30K substrates/month, and it was to be followed by a 2nd Generation T8-2 Gen 8.5 conversion with 45-60K substrates/month, in 2022, where the blue OLEDs would be replaced by IJP GaN nano rods. The last element in the plan is a Gen 10.5 fab with 30K/month capacity and a TBD target date.

Table 1: Korea’s Display Fab Activities

(OLED) Panels From 2021

July 05, 2020

The company held a celebratory event at its facility in Asan, South Chungcheong Province, where CEO Lee Dong-hoon oversaw the delivery of the first batch of QD manufacturing equipment. “Despite the COVID-19 pandemic, our close collaborative ecosystem with global partners enabled us to carry out our QD investments according to plan,” said Choi Joo-sun, chief of large-size display unit. “We will strive to produce unparalleled QD displays based on our advanced technology and 20-year-long experience in large-size liquid-crystal displays,” Choi said.

Since announcing its plan to invest in QD technology in October 2019, Samsung Display has partially removed L8 manufacturing line for LCD screens for TVs and recently completed construction of clean rooms for QD lines. With the installation of 8.5-generation vapor deposition machinery as a start, Samsung Display plans to complete the QD manufacturing line within this year and kick in commercial production next year.

The transition from LCD to QD is a strategic decision by Samsung Display to tackle the premium TV market in the coming years. The LCD market is now inundated with cost-effective Chinese products that erode business profitability, whereas QD is rising as the next-generation technology for high-definition TVs. Samsung Display said that it is currently honing the final-stage technologies that will add to its products’ quality and quantity.

The QD process includes three fluorescent blue OLED (Tandem) structure, which are deposited using the standard VTE process together with the common layers and then covered by IJP red and green QD color converters and some type of color filter. The T8-1 Gen 8.5 conversion is expected to have a capacity of 30K substrates/month, and it was to be followed by a 2nd Generation T8-2 Gen 8.5 conversion with 45-60K substrates/month, in 2022, where the blue OLEDs would be replaced by IJP GaN nano rods. The last element in the plan is a Gen 10.5 fab with 30K/month capacity and a TBD target date.

Table 1: Korea’s Display Fab Activities

Musing’s take: Rumblings in Asan indicated that the 2nd Generation decision has been delayed by at least a year. The reason is not clear as it might be that expectations for the blue OLEDs have improved, or the nano rod technology is taking longer to develop or perhaps, Covid-19 is causing the high end TV market growth to slow. Another aspect of the Samsung first generation QD plan is the cost.

- IGZO backplane – similar to LG, although LG’s expertise allows then to use 3 or 4 less masks than Samsung

- Three OLED emitting layers, comparable to LG’s RGBW design

- Plus, Samsung’s use of IJP QD color converters

- Plus, Color Filter, comparable to LG’s RGBW design, although LG uses a CFOA, which is less expensive than Samsung’s believed to be color filter on glass

- Samsung’s advantage is the bottom emission structure, which enables higher aperture ratio’s and is therefore a better fit for 65” 8K panels. As the panel size gets larger, it is less of an advantage

|

Contact Us

|

Barry Young

|