Vertical Divider

|

Samsung and Xiaomi Take the Led in Smartphone Sales in India

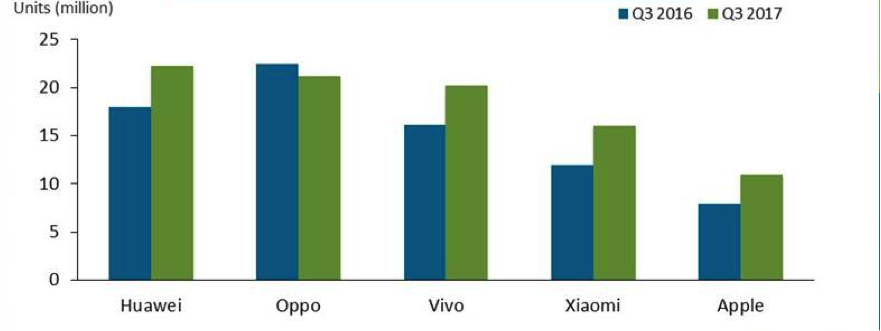

November 06, 2017 According to Strategy Analytics, Samsung Electronics and Xiaomi posted a market share of 26% and 25% in the Indian smartphone market in the third quarter of this year, respectively. The former’s market share increased 26% from a year ago while the latter’s skyrocketed by 300% during the same period. They were followed by Vivo (10%), Oppo (9%) and Lenovo (7%). In the second quarter, the market shares of Samsung Electronics, Xiaomi, Vivo and Oppo had been 21.2%, 15.6%, 11.9% and 9.6%, respectively. Strategy Analytics reported that the combined market share of Chinese smartphone manufacturers in the Indian market rose from 1% to 57% between the third quarter of 2012 and the third quarter of this year. According to data of Counterpoint Research, Samsung Electronics’ and Xiaomi’s shares in the Indian smartphone market were 23% and 22% in the third quarter of this year while Vivo, Oppo and Lenovo followed them with 9%, 8% and 7%, respectively. According to the market research firm, Xiaomi’s Redmi Note 4, Redmi 4 and Redmi 4A were the top three best sellers in the market during the period while the Samsung Galaxy J2 came in fourth. The Indian smartphone market remains one of the fastest-growing markets in the world. Strategy Analytics reported that the annual sales volume of the market reached 36 million units, up 7% from a year ago. Apple is on a run up over the past 12 months, rising 43% compared to the Dow’s 29%. Looking longer term, however, since its July 2015 high, there is a much more modest gain of just 30% over the more than two years, just slightly over the Dow’s 26%. On of the drags on the electronic company’s growth has been sliding iPhone market share in China. China growth fueled a lot of Apple’s earlier growth, and concerns over falling share and sales have held it back for two years. A new report from Canalys states that Apple sales for Q3 2017 have grown 40% year over year, from roughly 8 million units to 11 million. Figure 1: China Smartphone Shipments Q316 vs. Q317 Source: Canalys

Clearly this will come as good news to investors, adding to the announcement from Apple that pre-orders for the iPhone X were “over the top.” During Tim Cook’s prepared remarks at the Apple quarterly earnings call, he said, “As we expected, we returned to growth in greater China, with unit growth and market share gains for iPhone, iPad, and Mac. In fact, it was an all-time record quarter for Mac sales in Mainland China as well as an all-time high for Services revenue. And revenue from emerging markets outside of greater China was up 40%, with great momentum in India, where revenue doubled year over year. We also had great results in enterprise and education with double digit growth in worldwide customer purchases of iPad and Mac in both markets.” Analysis 1 – Apple position in China Apple only competes in the high-end market, particularly in developing markets, where a large portion of the population does not have the resources to buy the iPhone. If competitors dominate in overall numbers it is not an issue for Apple, the way it would be for Samsung. The majority of these sales are not in Apple's league. For example, in the March quarter of 2016, Apple's China iPhone sales fell 7% Y/Y in constant dollars, yet it still grew just shy of 1% in high-end market share according to The Nielsen Device Share report. This illustrates that the market there is complex. Yet the current report is for sales, so an increase of three million units will no doubt boost this quarter’s revenue and profits that will be announced on November 1. Analysis 2 – In the future Canalys gives an interesting take on the future of iPhone growth in China. They state:

Analysis 3 – The definitive driving factor The model X shares a lot of features with the two 8 models, including the processor, advanced Augmented Reality and AI processing, etc. But as we have discussed in the past, three things really define the iPhone X:

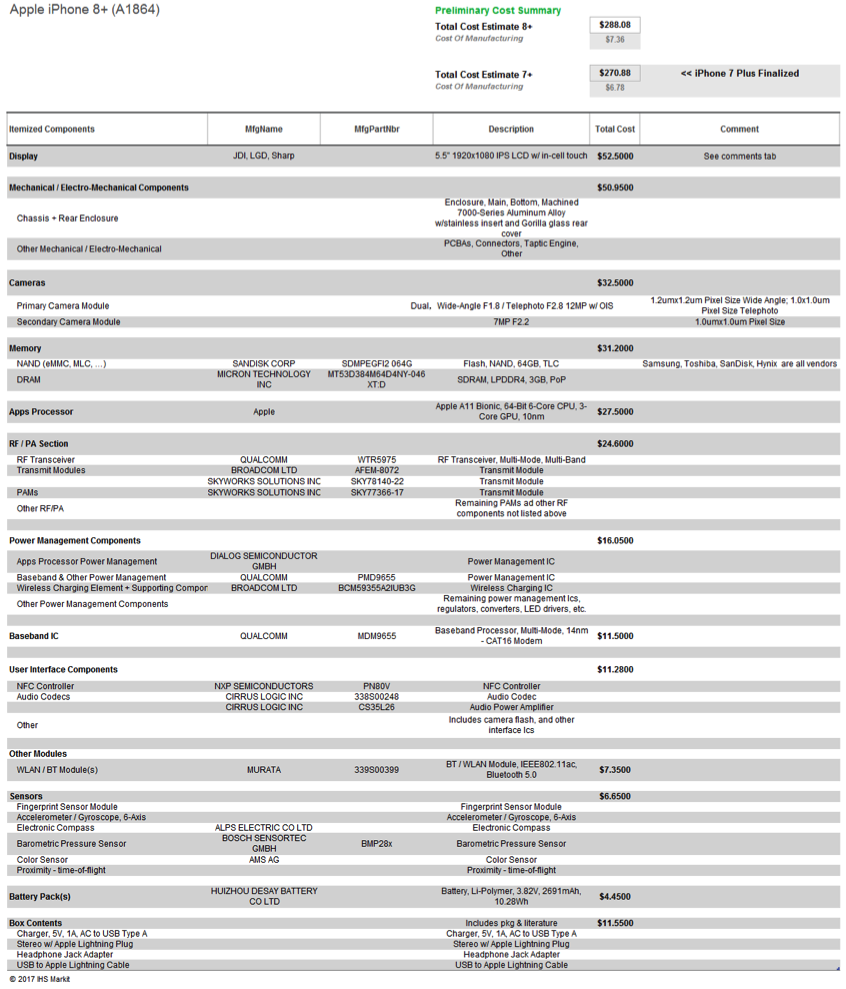

Face ID will likely be revolutionary in its appeal. Assuming it functions as advertised, it will allow the user to unlock his phone merely by glancing at it – which is precisely what one does when one wants to use it. Even Touch ID is cumbersome in comparison. This is why, if Face ID works well, the iPhone X will dominant the high-end category both in China and elsewhere. Clearly, Face ID will be an exceptionally desirable feature. Samsung tried to skunk Apple with their face recognition, but what they implemented was merely a photo-recognition feature that can be fooled by a simple photo – NOT an acceptable solution. It should be noted that Face ID depends on what Apple calls the TrueDepth camera, and this also drives the Animoji and the ground breaking Studio Lighting features, both of which should be very popular. IHI published a breakdown of the component costs of Apple iPhone 8. The LCD IPS panel supplied by Sharp, JDI and LGD comes at a price of US$52.50. Table 1: IHS Apple iPhone 8 Component Cost Breakdown Source: IHS

|

|

|

Contact Us

|

Barry Young

|