Vertical Divider

Roundup of Smartphone News-iPhone

December 08, 2019

iPhone production volume is expected to fall short of 200m for the first time since 2014, however, robust sales of the iPhone 11 (among new 2019 models) and legacy models like the XR and iPhone 8, expect a 20% Y/Y increase in 1Q 2020 to 45m units. Add to that significant changes in new 2020 models, in terms of both specs and appearance, and production of new models in 2020 could total 94m, topping the 2019 level. For overall 2020 production volume is expected to be ~205m units (up 9% Y/Y). From a display perspective, the migration of smartphone displays from LCD to OLED will accelerate, and the medium/ long-term (2020–2023) implications are negative for the LCD value chain but positive for the OLED value chain. In the short term, however, sales of the iPhone and legacy LCD models are relatively solid, so in terms of Apple-related demand, the short-term implications are positive for the LCD value chain and negative for the OLED value chain.

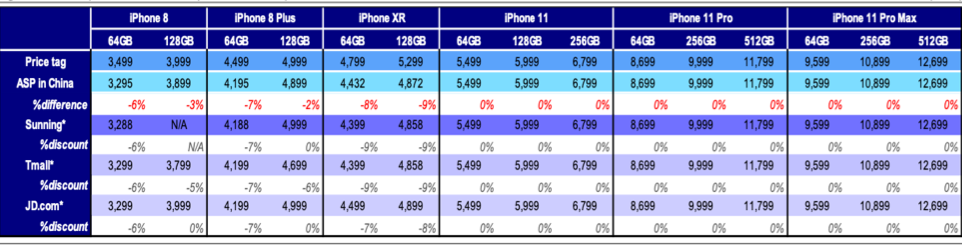

Table 1: iPhone Price Trends in China. (RMB)

Roundup of Smartphone News-iPhone

December 08, 2019

iPhone production volume is expected to fall short of 200m for the first time since 2014, however, robust sales of the iPhone 11 (among new 2019 models) and legacy models like the XR and iPhone 8, expect a 20% Y/Y increase in 1Q 2020 to 45m units. Add to that significant changes in new 2020 models, in terms of both specs and appearance, and production of new models in 2020 could total 94m, topping the 2019 level. For overall 2020 production volume is expected to be ~205m units (up 9% Y/Y). From a display perspective, the migration of smartphone displays from LCD to OLED will accelerate, and the medium/ long-term (2020–2023) implications are negative for the LCD value chain but positive for the OLED value chain. In the short term, however, sales of the iPhone and legacy LCD models are relatively solid, so in terms of Apple-related demand, the short-term implications are positive for the LCD value chain and negative for the OLED value chain.

Table 1: iPhone Price Trends in China. (RMB)

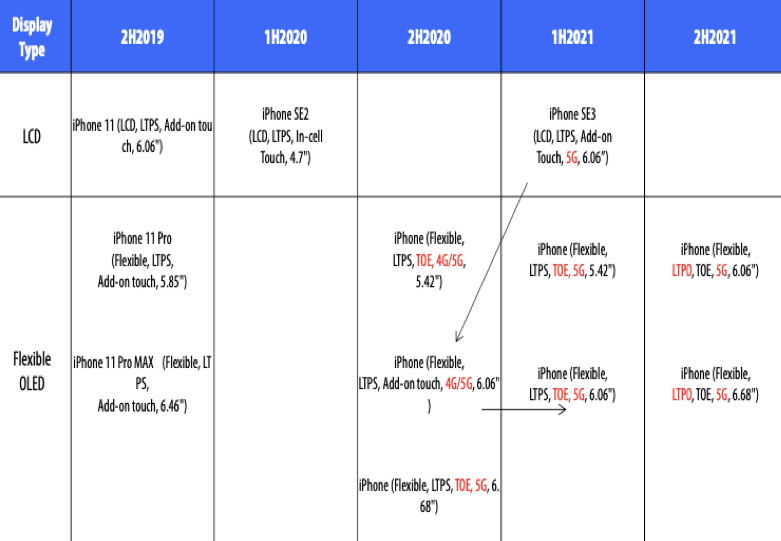

Source: Mizuho Securities

iPhone sales strength is reflected by Sharp, which supplies most of the dual cameras for the iPhone 11, and expects camera module sales in 4Q19 to be up more than twofold sequentially, and Apple's orders have been more than 10% higher than expected. Currently, 90% of the dual cameras for the iPhone 11 are supplied by Sharp and 10% by OFilm. The iPhone 11 series' production volume in 2H19, confirmed by Taiwanese EMS companies is estimated to be 77.6mn units, with LCD models making up close to 50%. Apple is expected to release the iPhone SE2, a 4.7-inch LCD model in 1H20. Since Huawei is bound to take a hit in the overseas market due to the lack of Google's Android OS, Apple will likely accelerate efforts to expand its market share. Apple's original plan for 2H20 was to discontinue LCD models and have all three differently sized models (5.42-, 6.06- and 6.68-inch) in OLED. However, as LCD models are selling better than expected, Apple will likely release the 6.06-inch SE3 in 2H20, which was initially planned for a 1H21 release, and could delay the launch of its 6.06-inch OLED model, which would result in Samsung Display's flexible OLED shipments to Apple to be flat Y/Y in 2020. BOE is struggling with the Y-OCTA technology, and will not supply OLED panels to Apple even in 2H20.

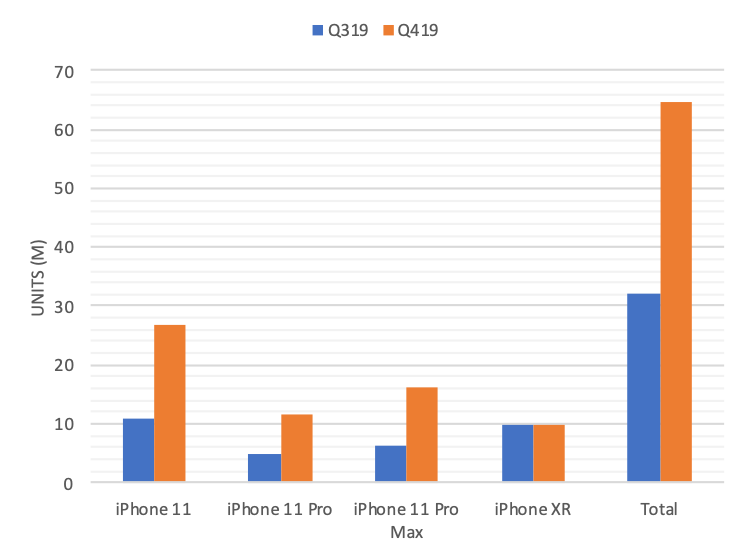

Figure 1: 2H19 New iPhone Shipments

Source: Hyundai Securities

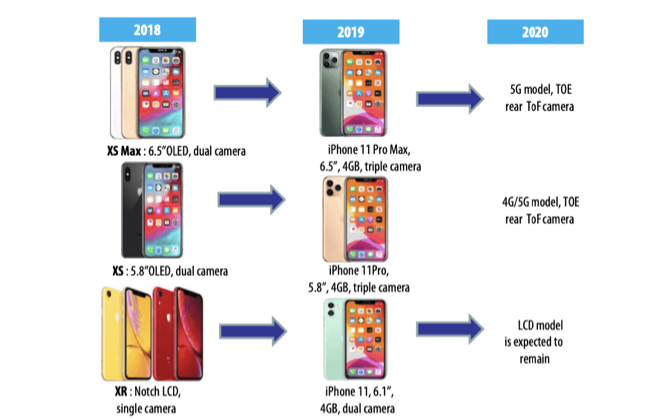

Figure 2: iPhone Transitions 2018 -2020 (1)

Source: Hyundai Securities

Figure 4: iPhone Transitions 2019-2021

Source: Hyundai Securities

|

Contact Us

|

Barry Young

|