Vertical Divider

Rigid OLED Panel Sales Outpace Flexible in 2019

December 15, 2019

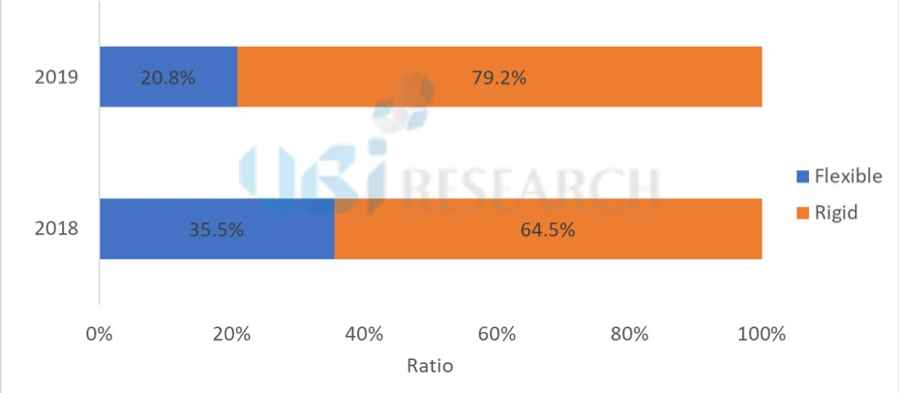

UBI Research says that rigid OLED shipments (237 million) command a 79.2% market share of the entire OLED smartphone market, up from 64.5% in 2018.

Figure 1: S/M OLED Panel Area by Substrate

December 15, 2019

UBI Research says that rigid OLED shipments (237 million) command a 79.2% market share of the entire OLED smartphone market, up from 64.5% in 2018.

Figure 1: S/M OLED Panel Area by Substrate

Source: OLEDNet

Figure 2: S/M OLED Panel Shipment Share by Substrate

Source: OLEDNet

At the OLED Summit, DSCC proffered that that flexible OLED panel makers could use their fabs to produce rigid display with a few changes:

All rigid OLED lines are currently operating at full capacity and UBI suggests that we may see some companies converting flexible OLED lines to rigid OLED production - or that there will be new investments in rigid OLED production. The main producer of rigid OLEDs is Samsung Display but China's Visionox and EDO also produce such displays in lower volume.

Counter to this logic is that the cost of flexible displays is coming down as yields improve and more OEMs are looking to flexible displays for premium and mid-tier smartphones, driving utilization up. Samsung just committed to their A4 flexible line indicating their confidence in the growth of flexible OLEDs. Finally, rigid OLEDs compete with LTPS LCD fabs, which are fully depreciated so they have a significant cost advantage.

- Use a glass substrate instead of PI, which would lower costs, since a glass carrier is already built into the cost of flexible displays.

- Eliminate the yield impact of laser lift off

- Retain the use of TFE

All rigid OLED lines are currently operating at full capacity and UBI suggests that we may see some companies converting flexible OLED lines to rigid OLED production - or that there will be new investments in rigid OLED production. The main producer of rigid OLEDs is Samsung Display but China's Visionox and EDO also produce such displays in lower volume.

Counter to this logic is that the cost of flexible displays is coming down as yields improve and more OEMs are looking to flexible displays for premium and mid-tier smartphones, driving utilization up. Samsung just committed to their A4 flexible line indicating their confidence in the growth of flexible OLEDs. Finally, rigid OLEDs compete with LTPS LCD fabs, which are fully depreciated so they have a significant cost advantage.

|

Contact Us

|

Barry Young

|