Vertical Divider

Qualcomm’s New Snapdragon XR2 Increases Resolution Support by 6X

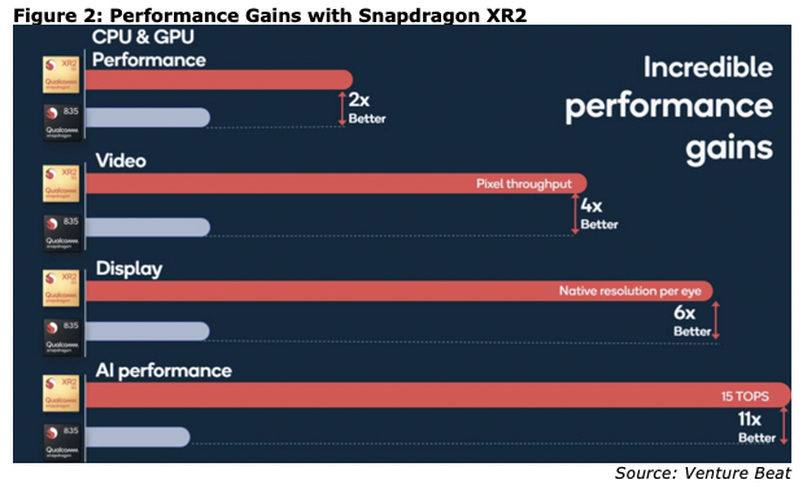

Last December, Qualcomm announced a new chipset for mixed reality devices called the Snapdragon XR2. Specifically built for standalone VR and AR headsets, XR2 appeared ready to smoke the smartphone-targeted Snapdragon 835 chips previously used in the consumer based Oculus Quest and enterprise HTC Vive Focus Plus,. A chart promised twice the CPU and GPU performance, four times the pixel throughput, six times the display resolution and 11 times the dedicated AI-TOPS. XR-2 based all-in-one VR headsets perform more light PCs than mobile phones. But Qualcomm didn’t have an actual product to announce with its super chip. Pokémon Go developer Niantic said it was planning XR2-powered AR glasses, but didn’t offer a timeline or imagery, and Qualcomm suggested that OEM announcements would follow on its partners’ schedules. Two months later, French startup Lynx promised a summer 2020 release for the first XR2-based headset, the $1,500 Lynx R-1. As of mid-September, however, the R-1 hasn’t shipped, and Lynx is still guaranteeing “products from the first batch” to people who pre-order today.

Last December, Qualcomm announced a new chipset for mixed reality devices called the Snapdragon XR2. Specifically built for standalone VR and AR headsets, XR2 appeared ready to smoke the smartphone-targeted Snapdragon 835 chips previously used in the consumer based Oculus Quest and enterprise HTC Vive Focus Plus,. A chart promised twice the CPU and GPU performance, four times the pixel throughput, six times the display resolution and 11 times the dedicated AI-TOPS. XR-2 based all-in-one VR headsets perform more light PCs than mobile phones. But Qualcomm didn’t have an actual product to announce with its super chip. Pokémon Go developer Niantic said it was planning XR2-powered AR glasses, but didn’t offer a timeline or imagery, and Qualcomm suggested that OEM announcements would follow on its partners’ schedules. Two months later, French startup Lynx promised a summer 2020 release for the first XR2-based headset, the $1,500 Lynx R-1. As of mid-September, however, the R-1 hasn’t shipped, and Lynx is still guaranteeing “products from the first batch” to people who pre-order today.

This week, Geekbench 5 results popped up with an unannounced HTC Vive Focus model with the XR2, and the specs matched what’s known about the new chipset’s likely configuration: an 8-core CPU running at 1.8GHz, paired with Android 10. The results include single- and multi-core scores of 924 and 3415, multiple times faster than numbers seen in Snapdragon 835-powered headsets such as the Oculus Quest (267/746). Memory details added credence to the results, matching up with expectations that the XR2 will generally be paired with 6GB of RAM, up from 4GB in prior-generation solutions. The new Focus Plus the only Snapdragon XR2 headsets available in the foreseeable future. XR2 is on the cusp of being adopted by consumer VR and AR headset makers, which means that standalone mixed reality will take the long-awaited big leap forward.

While Qualcomm provides both the chipset and reference platforms to developers, finished XR2-powered headsets will vary from company to company. For example, although the chipset can theoretically power displays with six times the resolution of prior VR screens, it does not mean that a Focus sequel will in fact deliver six times a given headset’s prior resolution. Historically, Qualcomm provides the chip-level capability and it’s up to each OEM to pick the parts that make sense for a particular audience, set of applications, and price point.

While Qualcomm provides both the chipset and reference platforms to developers, finished XR2-powered headsets will vary from company to company. For example, although the chipset can theoretically power displays with six times the resolution of prior VR screens, it does not mean that a Focus sequel will in fact deliver six times a given headset’s prior resolution. Historically, Qualcomm provides the chip-level capability and it’s up to each OEM to pick the parts that make sense for a particular audience, set of applications, and price point.

The general trend will be towards higher resolution VR displays, but with multiples in the 1.5-2X range rather than 6X. The difference in visual clarity offered by Pico’s Neo 2, which offers 1,920 by 2,160 resolution per eye, is nearly twice the detail delivered by Oculus Quest’s dual 1,440 by 1,600 screens. Under the right circumstances, screens at that resolution will be free of the “screen door effect” putting the onus on GPUs to deliver enough polygon and texture detail to wow users.

Since the Neo 2 is powered by a Snapdragon 845 — a chip that’s roughly halfway between the 835 and XR2 in performance, expect XR2 headsets to surpass Pico’s offering. The Neo 2’s graphics look like higher-resolution versions of Quest visuals, at an imperceptibly faster refresh rate (75Hz versus Quest’s 72Hz). Based on what Qualcomm has said about XR2, and what Lynx has shown for the Lynx-R1, the new crop of headsets should use 90Hz refresh rates. That means PC-class display speeds, with a lower likelihood of nausea.

Facebook surprised everyone with the Quest’s performance this generation, wringing more complex visuals out of the Snapdragon 835 than anyone (save perhaps a 3D graphics wizard of John Carmack’s caliber) could have imagined. Qualcomm suggested the XR2 has twice as much CPU and GPU power as the 835, but if the early benchmarks can be believed, that’s underselling the new chipset’s abilities. Since the Quest was able to approximate — not match — the graphics in PlayStation VR titles, it’s fair to expect that XR2-powered titles will rival current-generation console VR, if not entry-level PC VR. Beyond games, this means that social applications such as Facebook Horizon and productivity/streaming apps like Virtual Desktop could look roughly as detailed, complex, and smooth on an XR2-powered headset as on the Oculus Rift. One caveat: “current-generation” and “entry-level” are moving targets. Today, we’re only two months away from a console generation transition, and even basic PCs continue to improve in graphics performance every day. There’s no way in the world that mobile-class XR2 headsets will fully eliminate the need for high-spec dedicated machines, but if the Quest’s trend continues, the visual delta between tethered and tetherless headsets will matter to fewer people.

While the raw numbers were revealed last December, Snapdragon XR2’s AI processing capabilities are underappreciated, and could be a major factor in improving mixed reality headset performance. Here, the gap between Snapdragon 835 and XR2 is an 11X improvement — 15 trillion operations per second (TOPS) versus roughly 1.3 TOPS in the 835. That’s two-thirds more than Qualcomm includes in the laptop-class Snapdragon 8cx Gen 2, and equivalent to what’s in the flagship-class Snapdragon 865 smartphone chipset. However, the raw number of instructions doesn’t necessarily tell the whole story of AI performance; quantity matters, but so do quality and system-level engineering and software considerations to make use of the capabilities. In the early days of the Oculus Quest, the limited computer vision system magically delivered room-scale SLAM scanning and 6DoF controller tracking, which Facebook subsequently software updated to add impressively smooth hand tracking. Imagine what a headset with 10 extra times the AI horsepower could do with tracking and cameras — then assume that offloading some AI-related tasks from the CPU will also free it up for better general purpose performance. There are other ways AI capabilities can impact the performance of mixed reality headsets, including empowering smarter computer opponents and generating solutions for semi-novel problems. They’ll also enable richer voice controls and — for augmented reality headsets — help with segmenting live visuals so that they can be seamlessly blended with digital content.

In 2020, Magic Leap imploded, HTC’s CEO resigned, Facebook renamed Oculus Connect and moved it entirely online, and multiple VR developers pivoted, sold themselves off, and/or shut down. Lynx might plausibly have been expected in February, but to hit its promised summer date for R-1, it’s not exactly surprising that it didn’t. Nothing’s certain at this point, but Snapdragon XR2 headsets should soon be in stores — notably, early ones without 5G connectivity, rather than more deluxe models that will combine robust CPU/GPU/AI horsepower with the freedom of a cellular connection. But it won’t be until 2021 at the earliest, and even then, only in territories with more robust 5G infrastructures than we currently have in the United States. When that happens —VR and AR could rapidly evolve. From: VentureBeat

For OLED micro display companies 4K x 4k resolution with high luminance performance seems to be the next resolution standard and microLEDs will likely be the competition.

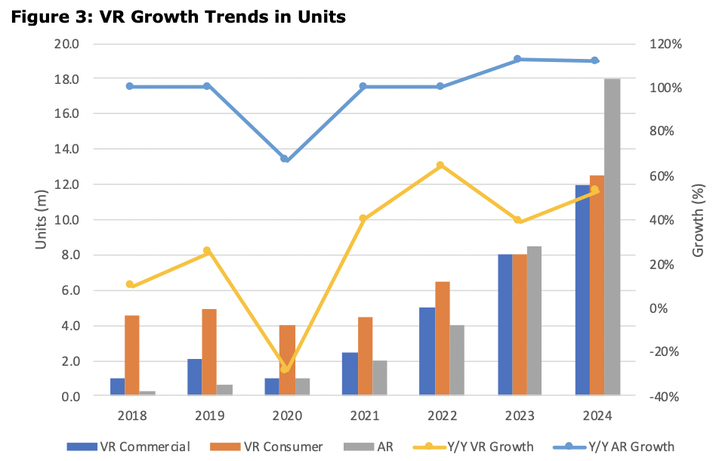

The market has faced a temporary setback this year as supply chain disruptions impacted volumes in the early months and expected product transitions have slowed the market mid-year. However, IDC expects shipments of VR headsets to grow rapidly with a compound annual growth rate (CAGR) of 48% from 2020 to 2024 as consumer and enterprise audiences continue to invest in the technology.

Virtual reality is starting to mature and reach a broader audience. "While gaming remains at the forefront of consumer VR, other use cases such as virtual concerts and virtual workouts are also starting to resonate with buyers," said Jitesh Ubrani, research manager for IDC's Mobile Device Trackers. "Meanwhile, many enterprises continue to ramp up their use of VR with training, collaboration, design, and manufacturing use cases driving momentum. We expect the commercial segment to grow from 38% of the worldwide market in 2020 to 53% by 2024."

Standalone VR declined as a category in the second quarter of 2020 (2Q20) despite growing awareness and high demand for headsets such as the Oculus Quest. Facebook finds itself in a precarious position. As the leader in the standalone category, the company's share far exceeds that of every other player combined, though the recent discontinuation of the Oculus Go will likely lead to Facebook ceding some share at the entry level of standalone VR. Meanwhile, companies such as Pico, Lenovo, and others continue to court the enterprise market.

Tethered VR headsets also declined during the quarter although this was largely driven by the slowdown in PlayStation as consumers look forward to the next-generation PlayStation console and a possible refresh of Sony's popular VR headset. Other popular tethered headsets such as the Rift S and the HTC Vive family continued to see volume declines as both consumer and commercial buyers allocate spend in other areas this year. That said, there's still a place in the market for tethered VR, which tends to drive a higher-quality visual experience than standalone products. Upcoming product launches such as HP's new Reverb G2 should help drive a rebound in 2021.

Screenless Viewers have continued to decline in popularity and are mainly sold in emerging markets where local vendors try to attract first-time VR users with basic headsets that leverage the screen of their smartphone. However, the lack of content and toy-like experience prevents the category from achieving further success, and we expect volumes to continue to wind down through the forecast period.

Since the Neo 2 is powered by a Snapdragon 845 — a chip that’s roughly halfway between the 835 and XR2 in performance, expect XR2 headsets to surpass Pico’s offering. The Neo 2’s graphics look like higher-resolution versions of Quest visuals, at an imperceptibly faster refresh rate (75Hz versus Quest’s 72Hz). Based on what Qualcomm has said about XR2, and what Lynx has shown for the Lynx-R1, the new crop of headsets should use 90Hz refresh rates. That means PC-class display speeds, with a lower likelihood of nausea.

Facebook surprised everyone with the Quest’s performance this generation, wringing more complex visuals out of the Snapdragon 835 than anyone (save perhaps a 3D graphics wizard of John Carmack’s caliber) could have imagined. Qualcomm suggested the XR2 has twice as much CPU and GPU power as the 835, but if the early benchmarks can be believed, that’s underselling the new chipset’s abilities. Since the Quest was able to approximate — not match — the graphics in PlayStation VR titles, it’s fair to expect that XR2-powered titles will rival current-generation console VR, if not entry-level PC VR. Beyond games, this means that social applications such as Facebook Horizon and productivity/streaming apps like Virtual Desktop could look roughly as detailed, complex, and smooth on an XR2-powered headset as on the Oculus Rift. One caveat: “current-generation” and “entry-level” are moving targets. Today, we’re only two months away from a console generation transition, and even basic PCs continue to improve in graphics performance every day. There’s no way in the world that mobile-class XR2 headsets will fully eliminate the need for high-spec dedicated machines, but if the Quest’s trend continues, the visual delta between tethered and tetherless headsets will matter to fewer people.

While the raw numbers were revealed last December, Snapdragon XR2’s AI processing capabilities are underappreciated, and could be a major factor in improving mixed reality headset performance. Here, the gap between Snapdragon 835 and XR2 is an 11X improvement — 15 trillion operations per second (TOPS) versus roughly 1.3 TOPS in the 835. That’s two-thirds more than Qualcomm includes in the laptop-class Snapdragon 8cx Gen 2, and equivalent to what’s in the flagship-class Snapdragon 865 smartphone chipset. However, the raw number of instructions doesn’t necessarily tell the whole story of AI performance; quantity matters, but so do quality and system-level engineering and software considerations to make use of the capabilities. In the early days of the Oculus Quest, the limited computer vision system magically delivered room-scale SLAM scanning and 6DoF controller tracking, which Facebook subsequently software updated to add impressively smooth hand tracking. Imagine what a headset with 10 extra times the AI horsepower could do with tracking and cameras — then assume that offloading some AI-related tasks from the CPU will also free it up for better general purpose performance. There are other ways AI capabilities can impact the performance of mixed reality headsets, including empowering smarter computer opponents and generating solutions for semi-novel problems. They’ll also enable richer voice controls and — for augmented reality headsets — help with segmenting live visuals so that they can be seamlessly blended with digital content.

In 2020, Magic Leap imploded, HTC’s CEO resigned, Facebook renamed Oculus Connect and moved it entirely online, and multiple VR developers pivoted, sold themselves off, and/or shut down. Lynx might plausibly have been expected in February, but to hit its promised summer date for R-1, it’s not exactly surprising that it didn’t. Nothing’s certain at this point, but Snapdragon XR2 headsets should soon be in stores — notably, early ones without 5G connectivity, rather than more deluxe models that will combine robust CPU/GPU/AI horsepower with the freedom of a cellular connection. But it won’t be until 2021 at the earliest, and even then, only in territories with more robust 5G infrastructures than we currently have in the United States. When that happens —VR and AR could rapidly evolve. From: VentureBeat

For OLED micro display companies 4K x 4k resolution with high luminance performance seems to be the next resolution standard and microLEDs will likely be the competition.

The market has faced a temporary setback this year as supply chain disruptions impacted volumes in the early months and expected product transitions have slowed the market mid-year. However, IDC expects shipments of VR headsets to grow rapidly with a compound annual growth rate (CAGR) of 48% from 2020 to 2024 as consumer and enterprise audiences continue to invest in the technology.

Virtual reality is starting to mature and reach a broader audience. "While gaming remains at the forefront of consumer VR, other use cases such as virtual concerts and virtual workouts are also starting to resonate with buyers," said Jitesh Ubrani, research manager for IDC's Mobile Device Trackers. "Meanwhile, many enterprises continue to ramp up their use of VR with training, collaboration, design, and manufacturing use cases driving momentum. We expect the commercial segment to grow from 38% of the worldwide market in 2020 to 53% by 2024."

Standalone VR declined as a category in the second quarter of 2020 (2Q20) despite growing awareness and high demand for headsets such as the Oculus Quest. Facebook finds itself in a precarious position. As the leader in the standalone category, the company's share far exceeds that of every other player combined, though the recent discontinuation of the Oculus Go will likely lead to Facebook ceding some share at the entry level of standalone VR. Meanwhile, companies such as Pico, Lenovo, and others continue to court the enterprise market.

Tethered VR headsets also declined during the quarter although this was largely driven by the slowdown in PlayStation as consumers look forward to the next-generation PlayStation console and a possible refresh of Sony's popular VR headset. Other popular tethered headsets such as the Rift S and the HTC Vive family continued to see volume declines as both consumer and commercial buyers allocate spend in other areas this year. That said, there's still a place in the market for tethered VR, which tends to drive a higher-quality visual experience than standalone products. Upcoming product launches such as HP's new Reverb G2 should help drive a rebound in 2021.

Screenless Viewers have continued to decline in popularity and are mainly sold in emerging markets where local vendors try to attract first-time VR users with basic headsets that leverage the screen of their smartphone. However, the lack of content and toy-like experience prevents the category from achieving further success, and we expect volumes to continue to wind down through the forecast period.

|

Contact Us

|

Barry Young

|