Vertical Divider

Q420 Wearables Up 27.2% Y/Y

Worldwide shipments of wearable devices reached 153.5 million in the fourth quarter of 2020 (4Q20), a year-over-year increase of 27.2% according to new data from the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker. Shipments for the full year grew 28.4% to 444.7 million units.

Samsung held the third position with growth coming from its hearables business as the company shipped 8.8 million units across its various brands. Samsung's low-cost wristbands also saw greater traction and were able to compete with the Chinese vendors in a few markets although overall volume for these devices was relatively low at 1.3 million units. Overall watch shipments declined to 2.9 million in 4Q20.

Huawei fell to fourth place in 4Q20 and continued to struggle with the sanctions imposed by the U.S. government. While its shipments within China grew 9.4% year over year, shipments declined in previously strong markets such as Asia/Pacific (excluding Japan and China), the Middle East and Africa, and Western Europe. The company has slowly started to move away from wristbands and towards watches as exhibited by the 18.2% growth in watch shipments and the 33.7% decline in wristbands. Watches also command a higher average selling price (ASP) and enabled the company to get closer to developers with its homegrown HarmonyOS, which is expected to tie in with smartwatches in the future.

BoAt rounded out the top five with 5.4 million units shipped in 4Q20. However, the company is solely operating in India and almost exclusively focuses on the hearables segment. As such, global expansion may prove challenging as the global wearables market remains dominated by multinational brands.

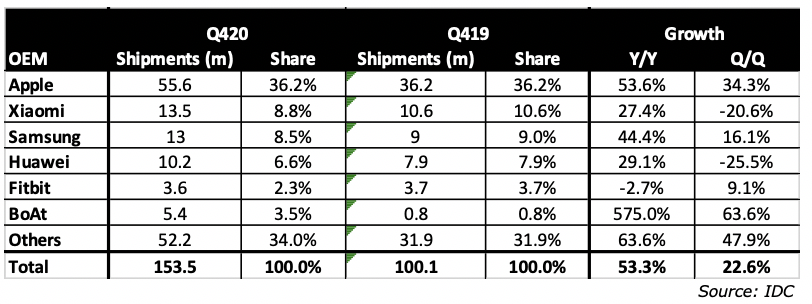

Table 1: Q420 Wearables Shipments, Share, Growth

Worldwide shipments of wearable devices reached 153.5 million in the fourth quarter of 2020 (4Q20), a year-over-year increase of 27.2% according to new data from the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker. Shipments for the full year grew 28.4% to 444.7 million units.

Samsung held the third position with growth coming from its hearables business as the company shipped 8.8 million units across its various brands. Samsung's low-cost wristbands also saw greater traction and were able to compete with the Chinese vendors in a few markets although overall volume for these devices was relatively low at 1.3 million units. Overall watch shipments declined to 2.9 million in 4Q20.

Huawei fell to fourth place in 4Q20 and continued to struggle with the sanctions imposed by the U.S. government. While its shipments within China grew 9.4% year over year, shipments declined in previously strong markets such as Asia/Pacific (excluding Japan and China), the Middle East and Africa, and Western Europe. The company has slowly started to move away from wristbands and towards watches as exhibited by the 18.2% growth in watch shipments and the 33.7% decline in wristbands. Watches also command a higher average selling price (ASP) and enabled the company to get closer to developers with its homegrown HarmonyOS, which is expected to tie in with smartwatches in the future.

BoAt rounded out the top five with 5.4 million units shipped in 4Q20. However, the company is solely operating in India and almost exclusively focuses on the hearables segment. As such, global expansion may prove challenging as the global wearables market remains dominated by multinational brands.

Table 1: Q420 Wearables Shipments, Share, Growth

|

Contact Us

|

Barry Young

|