Vertical Divider

Q221 Advanced TV Shipments jumped 70% Y/Y to 4.0M units

DSCC released its Quarterly Advanced TV Shipment and Forecast Report with

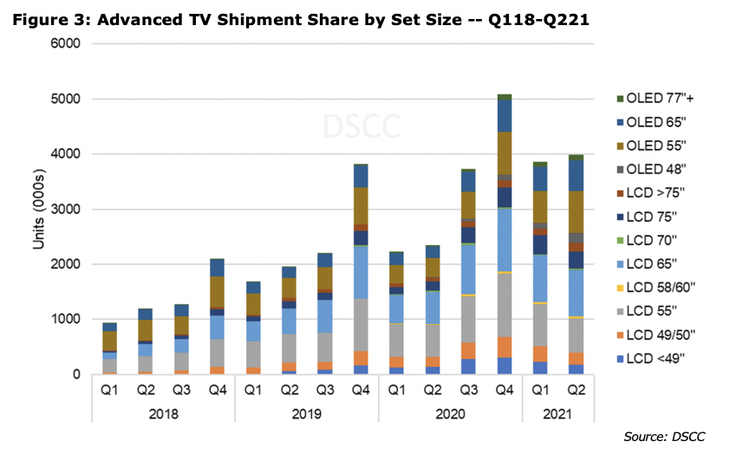

Advanced LCD TV revenues increased by 51% Y/Y as the overall TV mix shifted to large sizes and set makers did not pass along panel price increases, which continued rising during the quarter. OLED TV revenue share of Advanced TV increased from 36% in Q220 to 51% in Q221, as OLED took a majority of Advanced TV revenues for the first time since 2018.

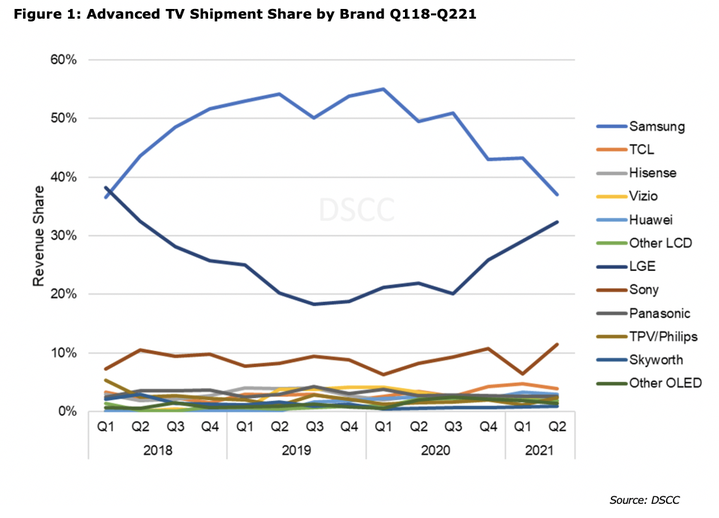

Samsung maintained its #1 position, but its lead over #2 LGE dropped from 16% at the end of 2020 to 5% in Q221. Samsung overall share was 38%, its lowest since DSCC began reporting on the category in Q118.

DSCC released its Quarterly Advanced TV Shipment and Forecast Report with

Advanced LCD TV revenues increased by 51% Y/Y as the overall TV mix shifted to large sizes and set makers did not pass along panel price increases, which continued rising during the quarter. OLED TV revenue share of Advanced TV increased from 36% in Q220 to 51% in Q221, as OLED took a majority of Advanced TV revenues for the first time since 2018.

- Advanced LCD TVs of 75” increased 88% Y/Y to 317K, and Advanced LCD TVs larger than 75” increased 121% to 150K, while OLED TVs 77” and larger increased by 308% to 113K, more than the total cumulative volume of this category for all years up to the end of 2019.

- Full operation at LG Display’s Guangzhou fab combined with rising LCD TV panel prices resulted in 169% Y/Y performance.

- Advanced LCD TV shipments increased by 36% Y/Y, and OLED TV share increased from 25% to 40% over the year.

- Advanced TV revenues increased by 97% Y/Y to $5.6B

- Revenues for 75” Advanced LCD TVs increased by 66%, those for >75” increased by 140% and revenues for 77”+ OLED TV increased by 251% as the sales volume increased dramatically with only modest price declines.

- Total OLED TV revenues increased by 176% Y/Y on the strength of increasing 77” OLED TV sales as well as sales of the 48” size introduced in Q220.

Samsung maintained its #1 position, but its lead over #2 LGE dropped from 16% at the end of 2020 to 5% in Q221. Samsung overall share was 38%, its lowest since DSCC began reporting on the category in Q118.

|

Contact Us

|

Barry Young

|