Vertical Divider

Q121 Global Semiconductor Demand Up 20% Y/Y, 30% Greater than Supply

Semiconductors are front and center in terms of both product availability and political diatribe, as demand grew significantly faster than supply. A report from TrendForce, spotted by AnandTech reveals that demand is 30% above supply right now, with 20% year-on-year growth for foundries that are fully loaded, and able to charge more. Lead times for an ordered batch of ICs is >14 weeks and longer for advanced nodes.

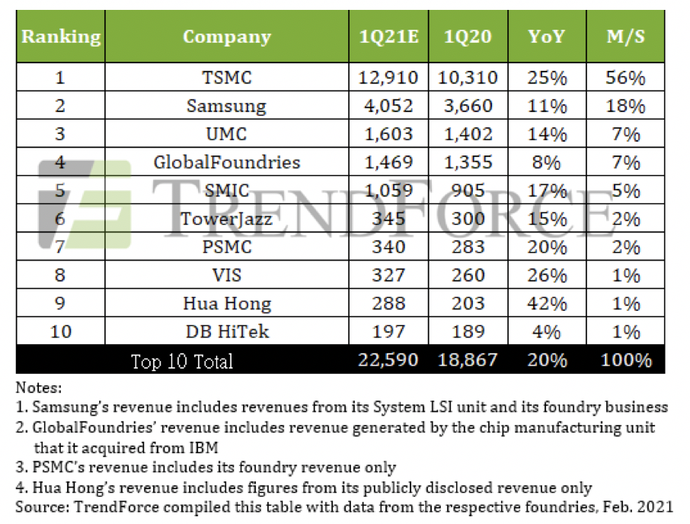

Anandtech shows TSMC leading the market with 56% of revenue, followed by Samsung (18%), UMC (7%), and GlobalFoundries (7%), with five of the top 10 global foundries banking more than $1B per quarter.

The cause of the shortage was attributed to increased demand for things like laptops, consoles and tablets, and caused supply constraints and shipping issues. Reporting from AP over the past 12 months indicated factories scaled back, expecting falling demand through the initial pandemic and thinking economies would be crushed. Yet after the initial shocks, remote learning, working, and need for leisure activities drove demand for all kinds of products.

Table 1: Q121 Top 10 Foundries in Revenue ($M)

Semiconductors are front and center in terms of both product availability and political diatribe, as demand grew significantly faster than supply. A report from TrendForce, spotted by AnandTech reveals that demand is 30% above supply right now, with 20% year-on-year growth for foundries that are fully loaded, and able to charge more. Lead times for an ordered batch of ICs is >14 weeks and longer for advanced nodes.

- TrendForce predicts that demand for chips is projected to continue to exceed supply “for several quarters,” with lead times stretching for 14 weeks for an order of fresh hardware.

- “Market observers predict that manufacturers will be busy for a long time, and beyond this, will take a long time to catch up.”

- With foundries running at maximum capacity, there are warnings that equipment may wear out faster with less maintenance operations, which increases the risk of small disruptions becoming major problems.

Anandtech shows TSMC leading the market with 56% of revenue, followed by Samsung (18%), UMC (7%), and GlobalFoundries (7%), with five of the top 10 global foundries banking more than $1B per quarter.

- TSMC’s lead continued despite the downturn by former top customer Huawei, with any excess wafers quickly snapped up by the likes of Apple, Qualcomm, Nvidia, and AMD.

- Samsung is behind TSMC on capacity and adoption of leading-edge processes but is expanding.

The cause of the shortage was attributed to increased demand for things like laptops, consoles and tablets, and caused supply constraints and shipping issues. Reporting from AP over the past 12 months indicated factories scaled back, expecting falling demand through the initial pandemic and thinking economies would be crushed. Yet after the initial shocks, remote learning, working, and need for leisure activities drove demand for all kinds of products.

Table 1: Q121 Top 10 Foundries in Revenue ($M)

|

Contact Us

|

Barry Young

|