|

LCD TV Panel Pricing Due for Readjustment Down

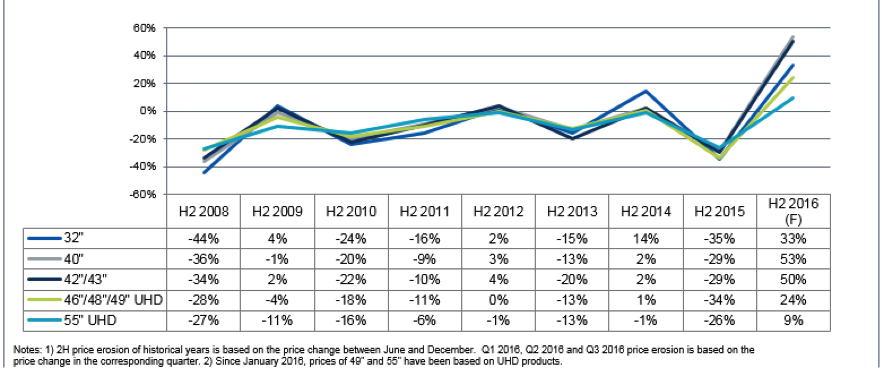

February 20, 2017 As we have reported over the past 6 months, the ASP of LCD TV panels has increased in 2016 after being depressed since the second half of 2015. Panel prices usually rise and fall in a one-year cycle, so the recovery this time in less than a year is unusual. Pricing remained low until the first half of 2016, causing most panel makers to post losses. But since the second half of this year, pricing has bounced back rapidly, driven mainly by hikes in the price of 32-inch panels from Chinese panel makers and also by fast migration to larger TV sizes. Overall, TV panel sizes are estimated to have increased by nearly three inches in 2016 from last year, much faster than the one-inch gain a year on average usually recorded. While the fast growth in panel size has increased area capacity consumption by TV brands, causing an imbalance in panel supply and demand. The following graph shows the quick rebound in panel prices over the last year. Figure 1: TV Panel Price Changes (H/H); HD/FHD, Open Cell Source: IHS, OLED-A

Korean TV panel makers have been reducing output of 32-inch to boost production of larger-sized panels and generate higher profitability while Chinese panel makers initially intending to increase TV panel production by annual double-digit rates are now shifting strategies, expanding instead the production of IT displays in 2017 to diversify portfolios away from focusing on TV screens alone toward more panels for notebook PCs and monitors, moves could further tighten TV panel supply next year.

However, Samsung Display’s decision to shut down its L7-1 line, which is responsible for a majority of the global supply of 40-inch thin-film transistor (TFT) LCDs remains the major cause of tight supply. The L7-1 is a Gen 7 TFT LCD fab turning out glass substrates measuring 1870 x 2200 millimeters for 40-inch TV panels. The shut down of the L7-1 fab was a surprise and their latest decision may seem hard to understand in the wake of higher demand. But the company’s decision comes as the L-1 has proven to be unprofitable and the use of the facility for the growing OLED demand was calculated to throw off greater free cash. So Samsung decided to repurpose the older and non-profitable TFT LCD fabs, which accounted for 3-4% of global capacity to OLED production. Now there are possible shutdowns involving other larger-sized panel-making fabs, including Samsung Display’s L7-2 line. New panel fabs in China slated to start MP in the latter half of 2017, allayed jitters and indicating that an imbalance in the supply and demand of 40-inch TFT-LCD panels could be easing.. But if Samsung Display decides to also shutter its L7-2 line, the resulting misalignment in supply and demand would then last much longer, extending until 2018. Together the L7-1 and L7-2 fabs can be considered as twin fabs in South Korea, so speculation is understandable that Samsung Display might restructure L7-2 after shutting down the L7-1 line. IHS cites three reasons why Samsung Display will not close the L7-2 fab:

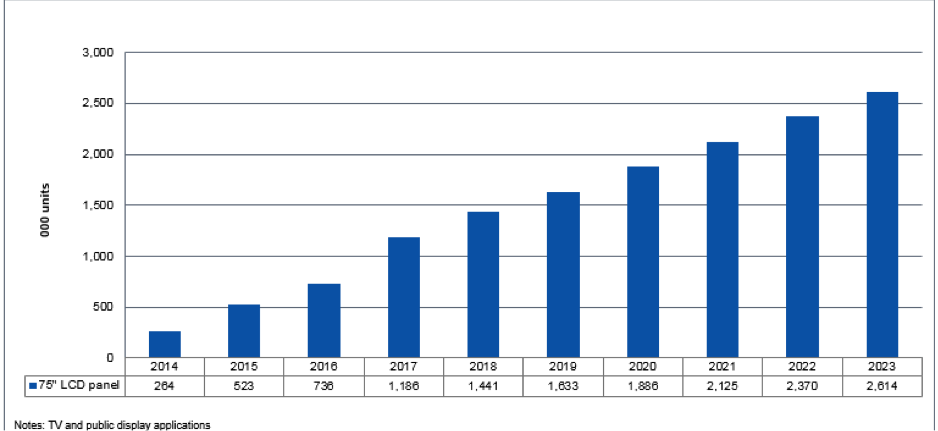

Figure 2: 75” TFT LCD Panel Forecast Source: IHS

Compared to the closure of the L7-1 dedicated to the production of 40-inch TFT LCDs, shutting down the L7-2 would have a bigger impact on both Samsung Display and the panel market. HIS believes Samsung Display will not risk losing its leading position in the market by closing down its L7-2 line. Instead of shutting down the L7-2, the company could utilize the fab more actively to reform its panel line-up and business portfolio—all part of an effort for Samsung Display to further improve competitiveness in the panel industry.

The counter argument is that given an increasing supply of large panels from highly efficient Gen 8.5 and Gen 10.6 fabs in China, Samsung would be fighting an uphill battle by competing with a Gen 7 fab that has such high maintenance costs it is unprofitable as was the L-1 fab. If Samsung has demand for a more profitable product, such as smartphone displays, why wouldn’t they re-purpose the fab to a technology where they have a competitive advantage. The issue is not whether they want to risk a leadership position in LCD TV panels, because that position is effectively gone, but do they have sufficient OLED demand to justify the conversion. As to 75”demand, the 7 (according to the CEO of Applied Materials) Gen 10.5 fabs should handle that easily. Samsung’s TV strategy is quite obvious, they want to dominate the 50” and over segment with near QLED TVs until they can make QLEDs work or figure out how to print OLED TV panels. They will be in a position to buy as many LCD TV panels at low ASPs from the Chinese as there is a glut coming in the next 2-4 years. Much of the information in this article was adopted from a blog by our old friend and former colleague, David Hsieh of IHS. |

Vertical Divider

|

|

Contact Us

|

Barry Young

|