Vertical Divider

OLED Smartphone Panel Shipments in 2021 Expected Reach 597m

Stone Partners forecasts 2021 smartphone shipments of 1.390b up 10% Y/Y. They forecast LCD, and OLED smartphone shipments to be 793m, and 597m respectively. Stone says close to 316m smartphones will use flexible OLED panels and 281m will be rigid. Apple is expected to ship 160 million OLED iPhones in 2021 up 80% 2020’s estimated 90 million. They forecast that Huawei will ship only 90m, of which 8m will use flexible OLED displays. The gap of 50m to 60m of Huawei’s flexible OLED shipments is forecast to be absorbed by Xiaomi, OPPO, and vivo. Xiaomi and OPPO will reportedly churn out 18 million flexible OLED smartphones, vivo will ship about 12 million units in 2021.

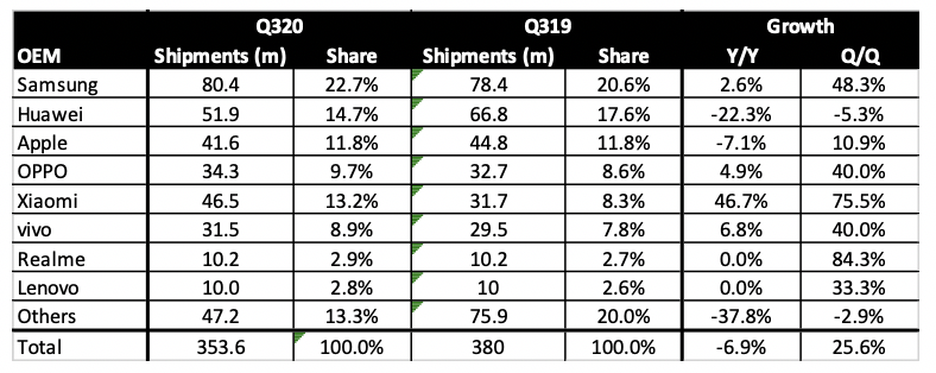

In Q320, IDC reported a changing of the guard sequentially, with Samsung regaining rising from #4 to #3. Overall, the global sales were 353.6m, up 25.6% sequentially but down 6.9% Y/Y. Samsung had a blowout quarter with 80.4m shipments up 2.6% Y/Y and 48.3% sequentially, Xiaomi, was up 46.7% Y?Y and 75.5% sequentially. Apple late with the iPhone 12 dropped 7.1% Y/Y but still was up 10.9% sequentially. In Q420, we expect Samsung to maintain its lead, Huawei to drop substantially and Apple to pick up the delayed iPhone orders.

Table 1: Q320 Smartphone Shipments, Share, Growth

Stone Partners forecasts 2021 smartphone shipments of 1.390b up 10% Y/Y. They forecast LCD, and OLED smartphone shipments to be 793m, and 597m respectively. Stone says close to 316m smartphones will use flexible OLED panels and 281m will be rigid. Apple is expected to ship 160 million OLED iPhones in 2021 up 80% 2020’s estimated 90 million. They forecast that Huawei will ship only 90m, of which 8m will use flexible OLED displays. The gap of 50m to 60m of Huawei’s flexible OLED shipments is forecast to be absorbed by Xiaomi, OPPO, and vivo. Xiaomi and OPPO will reportedly churn out 18 million flexible OLED smartphones, vivo will ship about 12 million units in 2021.

In Q320, IDC reported a changing of the guard sequentially, with Samsung regaining rising from #4 to #3. Overall, the global sales were 353.6m, up 25.6% sequentially but down 6.9% Y/Y. Samsung had a blowout quarter with 80.4m shipments up 2.6% Y/Y and 48.3% sequentially, Xiaomi, was up 46.7% Y?Y and 75.5% sequentially. Apple late with the iPhone 12 dropped 7.1% Y/Y but still was up 10.9% sequentially. In Q420, we expect Samsung to maintain its lead, Huawei to drop substantially and Apple to pick up the delayed iPhone orders.

Table 1: Q320 Smartphone Shipments, Share, Growth

Source: IDC Quarterly Mobile Phone Tracker, 10/29/20

Samsung passed Xiaomi in the Indian market to become the leading smartphone brand. Counterpoint and IDC disagreed on Huawei’s shipments, 66.8m vs. 51.9m, respectively. IDC expects smartphone shipments to reach 1.35b in 2021 and 1.4b in 2022.

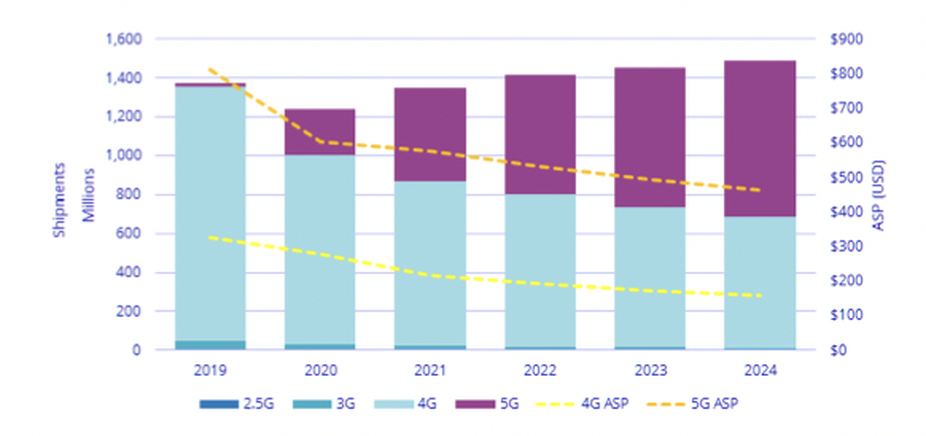

Figure 1: Smartphone Shipments and ASPs

Source: IDC

|

Contact Us

|

Barry Young

|