Vertical Divider

OLED L/A Fabs Could Have a 17m Panel Capacity by 2025

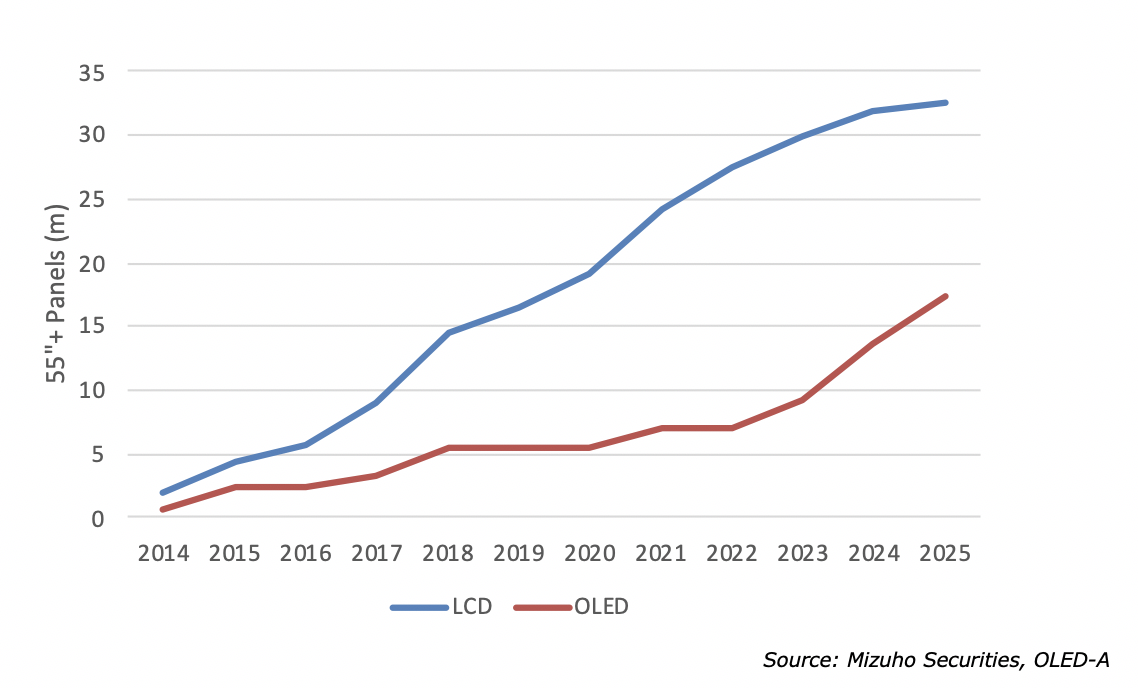

The following chart compares the growth in 55”+ yielded panel capability for Gen 8.5, Gen 8.6 and Gen 10/11 fabs, based on the current capacity plans for OLED and LCD fabs. It shows that by 2025 OLEDs will have ½ the production capacity of LCDs, which would enable them to dominate the very high end. But the caveat is that the capacity growth starting in 2023 is based on unconfirmed fabs:

If these plans don’t come to fruition, OLED capacity will be woefully short and could face a fate similar to what happened to the plasma industry.

Figure 1: Large Area Panel Capacity Growth OLEDs vs. LCDs

The following chart compares the growth in 55”+ yielded panel capability for Gen 8.5, Gen 8.6 and Gen 10/11 fabs, based on the current capacity plans for OLED and LCD fabs. It shows that by 2025 OLEDs will have ½ the production capacity of LCDs, which would enable them to dominate the very high end. But the caveat is that the capacity growth starting in 2023 is based on unconfirmed fabs:

- LG’s Gen 10.5 in Paju

- Samsung’s 2nd Phase of its QD-OLED program

- BOE’s Gen 8.5 and 10.5 WOLED fabs

- TCL’s Gen 8.5 IJP Fab

If these plans don’t come to fruition, OLED capacity will be woefully short and could face a fate similar to what happened to the plasma industry.

Figure 1: Large Area Panel Capacity Growth OLEDs vs. LCDs

|

Contact Us

|

Barry Young

|