Vertical Divider

Musing on Production

OLED Equipment Spending to Exceed $44b From 2020-2024

May 24, 2020

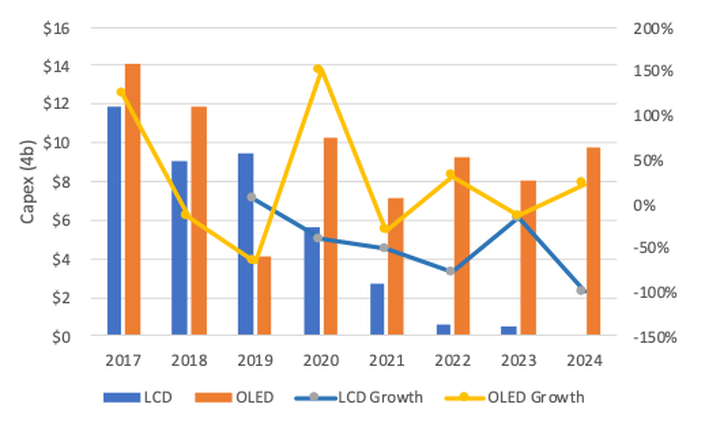

The display and the semiconductor industries typically use forward capex as a measure of their health. The standard for reporting capex has been Omdia but recently DSCC has been much more descriptive on the tool makers and their individual contribution to total display capex. DSCC released the Q2’20 edition of its Quarterly Display Capex and Equipment Market Share Report, which shows cumulative capex (2020 -2024) of $9.4b for LCDs and $44.5b for OLEDs

Figure 1: Display Equipment Spending by Technology

OLED Equipment Spending to Exceed $44b From 2020-2024

May 24, 2020

The display and the semiconductor industries typically use forward capex as a measure of their health. The standard for reporting capex has been Omdia but recently DSCC has been much more descriptive on the tool makers and their individual contribution to total display capex. DSCC released the Q2’20 edition of its Quarterly Display Capex and Equipment Market Share Report, which shows cumulative capex (2020 -2024) of $9.4b for LCDs and $44.5b for OLEDs

Figure 1: Display Equipment Spending by Technology

Source: DSCC

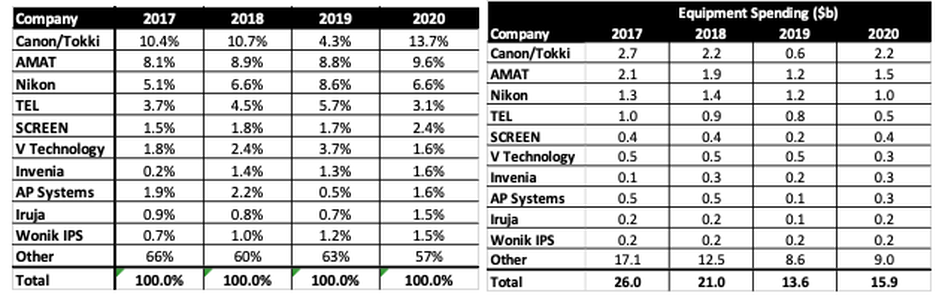

Canon/Tokki led the industry in 2017 and 2018, but in 2019, their share dropped to 4.3% as they trailed AMAT and Nikon, a function of a slowdown in Gen 6 OLED fab installs. But in 2020, DSCC puts Nikon/Tokki back in the #1 position.

Table 1: Display Equipment Spending and Share

Table 1: Display Equipment Spending and Share

Source: DSCC

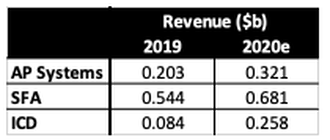

Last week, we published display equipment revenue for AP Systems, SFA, ICD and The 2019 revenue came from the company’s official disclosures.

Table 2: Company Revenue from Equipment

Source: Company data

There is a substantial difference in the display equipment revenues as reported by AP Systems in 2019 and those listed as equipment spending by DSCC. The difference can be attributed to other equipment not tracked by DSCC and the revenue recognition policies. For example, they don’t track AP Systems module assembly equipment, mask making equipment, UV curing equipment or ICD’s chamber parts business. DSCC’s equipment company’s financials are provided in their Health Report, where companies are ranked on their financial disclosures. Comparisons of company revenue vs. equipment spending is also ambiguous due to:

- Percentage completion

- Factory acceptance test at own factory

- Move-in

- Install (Sign-off)

DSCC says it is quite futile to match companies revenue recognition approaches with panel maker equipment spending especially when the timing differs by the type of tool.

|

Contact Us

|

Barry Young

|