|

The Vagaries of LCD Panel Pricing

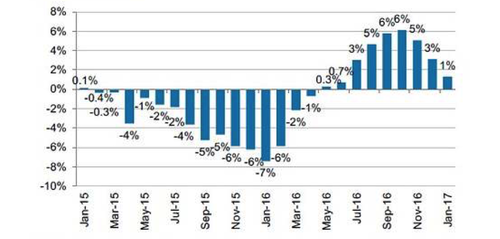

February 07, 2017 LG Display was double downgraded from Buy to Sell by Morgan Stanley amid signs of a sharp slowdown in demand for LCD panels. The display panel maker has soared over 20% since last June on strong LCD TV sales. The market for TV display panels started to look less crowded after Samsung Display closed repurposed Gen 7 TV factories to focus on making OLED smartphone screens. LCD panel prices have risen sharply in the last six months, with the 50-inch panel prices rising 36%. Since last November, prices for 40 to 43 inch panels have surpassed their previous peak seen in April 2015. However, LCD price growth is slowing, a sign that the market has peaked, according to Morgan Stanley. LCD panel prices grew only 1% in January, a sharp slowdown from October’s 6% growth. Figure 1 Blended LCD TV Panel Price M/M Change Source: Morgan Stanley

Growth in LCD panel prices saw a sharp slowdown in January. As we have predicted, the industry landscape is set to change again, as Chinese manufacturers ramp up production of 8 Gen 8.5 fabs this year and 5 Gee 10.6 fabs in 2018 and beyond. Supply is unlikely to tighten for large size >40-inch TV panels following aggressive customer inventory restocking after LCD capacity closure and elevated panel prices impacting demand elasticity. Morgan Stanley’s new price target of 26,000 won implies 0.6 times the bank’s forward book estimate and another 12% downside. J.P. Morgan analyst Narci Chang, estimated LCD display capacity supply growth at 3%, 6% and 11%, respectively, for 2017, 2018 and 2019 compared to demand growth of 4% for each year, and down graded AUO from neutral to underweight. |

Vertical Divider

|

|

Contact Us

|

Barry Young

|