|

Samsung Expanding OLED and Reducing LCD Capacity

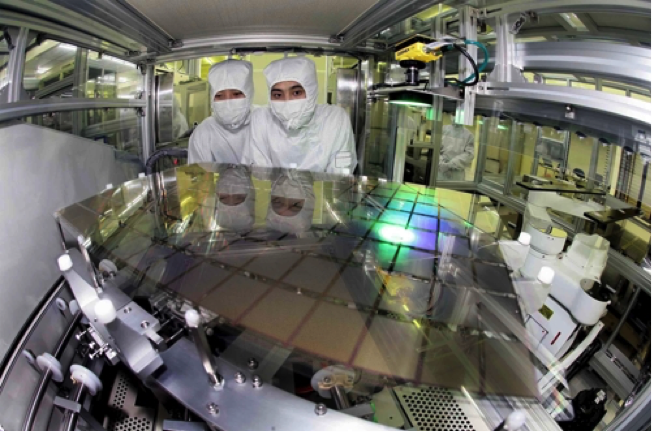

March 27, 2017 Samsung Display is expected to convert at least a portion of its L6 LCD production line from a-Si to Oxide backplane production and OLED display lines. The L6 fab had a raw capacity of 268,125 m2 as of November 2016, which represented 7.5% of Samsung Display’s overall capacity, and 1.3% of worldwide capacity. Samsung has begun to reduce production on at least one of the three L6 lines at the end of last year, which will be closed by May and converted to Oxide and OLEDs. We expect phase 1 of the oxide conversion to be fully ramped by April/May 2018, with lower output levels beginning this summer, and the ramp down of L6 phase 2 starting in July of this year, completed by year-end, and the conversion of L6 phase 2 to be completed by July/August 2018. The L6 phase 3 ramp down will begin at the end of this year, with the conversion completed by 1Q 2019. Samsung Display has yet to signal whether the L6 conversion will change the substrate size from Gen 5 but it is likely to be increased to a Gen 6 similar to the A3 lines. Samsung is expected to shift its LCD tablet and notebook production to its L8 Gen 5.5 lines, albeit at a reduced rate, as it continues to supply Apple with panels for the iPad, along with Sharp and LG Display. While expectations are that Samsung will release the Galaxy Tab S3 this month, there have been rumors that they will also release a Win 10 tablet line this year. Samsung has reportedly supplied OLED displays to HP and Lenovo) for their Spectre and Yoga ThinkPad laptops. Samsung Display and parent Samsung Electronics, continue to push OLED displays further into their mobile lines, and reduce their exposure to LCD in small panel devices. Samsung Display should also be able to produce the equivalent of 2.6m 13.5” OLED laptop screens/quarter at the completely converted facility. Apple has been averaging about 11.5m iPad units/quarter for the last two years, so only a portion of the iPad line could be converted to OLED over the next few years, as Samsung Display will also use the new capacity for its captive customer, but even the possibility that Apple might use OLED for its iPad line keeps a fire burning under the OLED space, and will continue to drive Samsung Display and others to add capacity. Samsung Display is anticipated to allocate 5 trillion won (US$4.4 billion) or more this year in line with its switch to the OLED industry, while LG Display also announced it will invest more than 5 trillion won in 2017 to expand its facilities. The Institute for Information & Communications Technology Promotion expects the world's OLED market to grow 32 percent on-year to reach $19.2 billion this year. Figure 1: Samsung’s 6th Gen Substrate Source: Yonhap

|

Vertical Divider

|

|

Contact Us

|

Barry Young

|