Vertical Divider

Musing Commentary on September 05, 2021

IDC Forecasts Low Single Digit Y/Y Growth for Smartphones

IDC announced their 5-year outlook for smartphones with a projected CAGR of 2.3%. The highly saturated market with an estimated installed base of over 5b is unlikely to grow any faster. The major adjustment is the shift from LTPS LCD panels to OLED panels, which are expected to reach 670m phones in 2021 and could grow to 1b by 2026. a-Si panels, which are used in low end smartphones are expected to maintain their share as new phone buyers in emerging economies will purchase low-priced phones in the $100 cost range. The small/medium OLED panel makers will be faced with a severe supply glut. There is already sufficient OLED panel capacity to meet the 2026 demand, if all fabs operated at yields in the 80%-90% level. The constraint is that most Chinese fabs operate at ~50% yield. Given the inevitable yield improvements, the excess supply will put pressure on prices, perhaps causing an even larger drop in LTPS panel shipments.

IDC Forecasts Low Single Digit Y/Y Growth for Smartphones

IDC announced their 5-year outlook for smartphones with a projected CAGR of 2.3%. The highly saturated market with an estimated installed base of over 5b is unlikely to grow any faster. The major adjustment is the shift from LTPS LCD panels to OLED panels, which are expected to reach 670m phones in 2021 and could grow to 1b by 2026. a-Si panels, which are used in low end smartphones are expected to maintain their share as new phone buyers in emerging economies will purchase low-priced phones in the $100 cost range. The small/medium OLED panel makers will be faced with a severe supply glut. There is already sufficient OLED panel capacity to meet the 2026 demand, if all fabs operated at yields in the 80%-90% level. The constraint is that most Chinese fabs operate at ~50% yield. Given the inevitable yield improvements, the excess supply will put pressure on prices, perhaps causing an even larger drop in LTPS panel shipments.

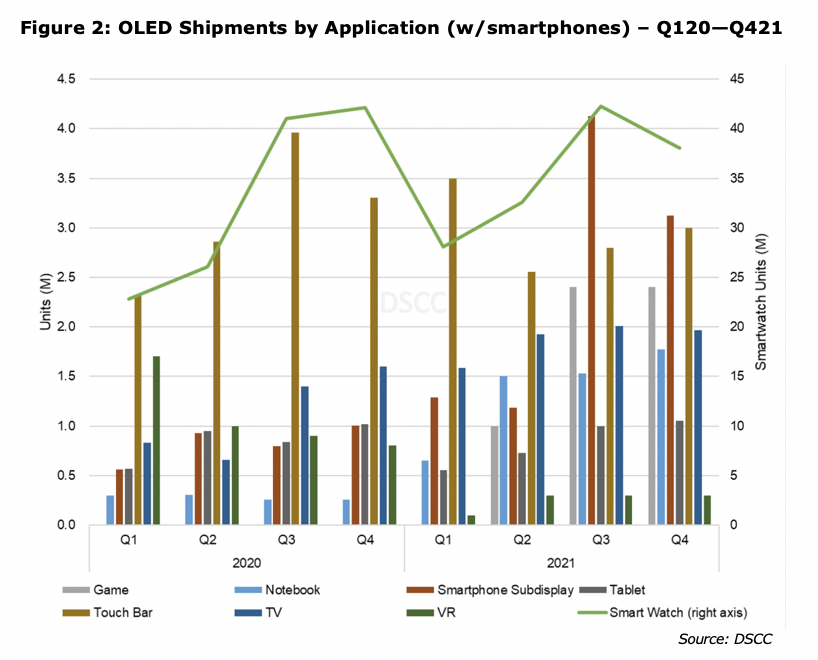

Expectations of new OLED demand from other applications appears minimal. DSCC puts shipments of games, notebooks and tablets at ~20m in 2021. These applications will grow but are unlikely to account for more than 10% of smartphone demand on an area basis. Moreover, Samsung is dedicating a Gen 8.5 fab to IT applications, which could consume most of the demand. Smart Watch volume is currently 100m per year and growing but at ~1.8” in diagonal doesn’t take up much in the way of sq. m. OLED panel makers have an opportunity with the 200m + automobile display market, where they have had only moderate success, due to the challenge of the extensive environments specs and the need for high luminous capability for bright sunlight conditions. LGD has taken the lead and has wins for very large OLED displays from Cadillac and Mercedes Benz.

|

OLED TVs have experienced a growth spurt as LGD’s Gen 8.5 fabs are now fully productive. The volume, although significant in the “Advanced TV” segment, is still <5% of overall TV set demand. Looking into 2022, LG will expand by adding 30,000 substrates/mo. and Samsung’s 30,000 sheet capacity QD-OLEDs will reach the market, but a major change in supply is still years away. |

|

Contact Us

|

Barry Young

|