Vertical Divider

Musing Commentary on July 25, 2021

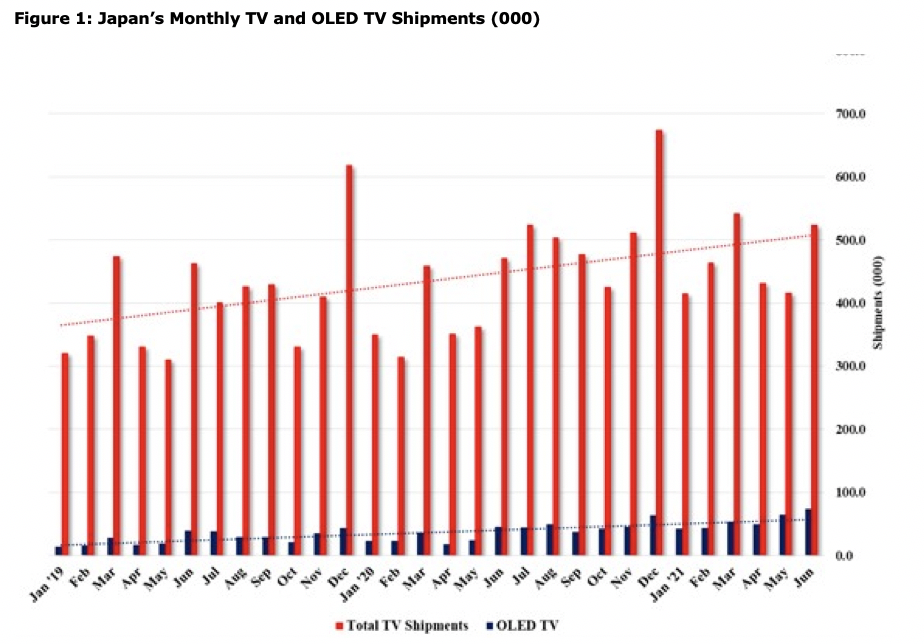

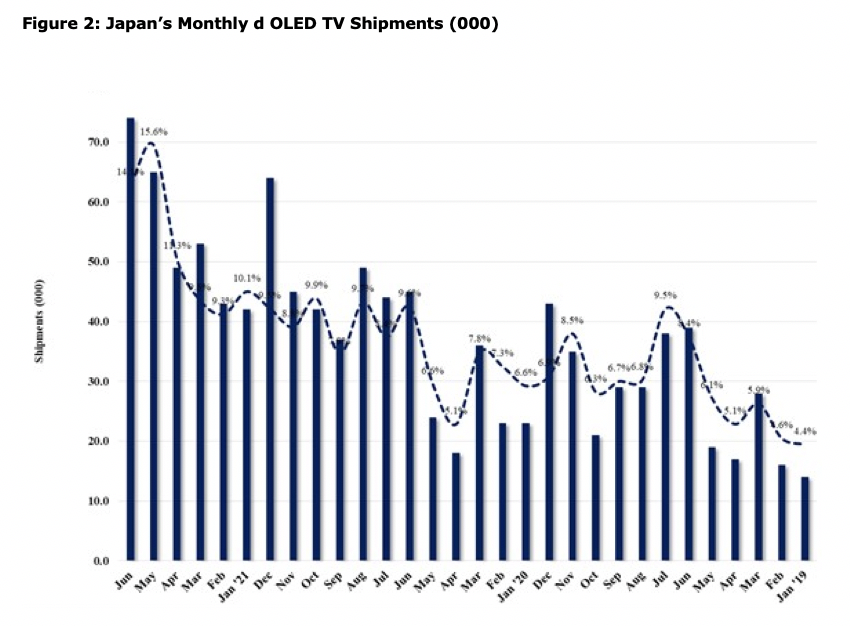

The rise of LCD panel prices and the fan ban at the 2020 Japan Olympics has resulting in an inexorable growth in OLED TV demand. Japan’s total TV shipments in June’21 were up slightly Y/Y, but OLED TV set sales were up 57% to 74K or 15% of total TV shipments. If OLEDs had a 15% share globally, it would result 33m in sales.

The rise of LCD panel prices and the fan ban at the 2020 Japan Olympics has resulting in an inexorable growth in OLED TV demand. Japan’s total TV shipments in June’21 were up slightly Y/Y, but OLED TV set sales were up 57% to 74K or 15% of total TV shipments. If OLEDs had a 15% share globally, it would result 33m in sales.

The price difference between an OLED panel and an LCD panel dropped from 383% to 155% over the last year, and current trends may take it to under 100% by the end of the year.

With the rapid change in demand, there is wide disagreement between researchers on the number of OLED TVs to be shipped in 2021. Omdia puts the volume at 5.8m and UBI forecasts 7.2m, while LGD says they will produce close to 8m panels.

UBI used the demand growth, plus the planned OLED TV panel capacity expansion to conduct a supply/demand analysis and projected there would be a supply shortage of 12% in 2024 and 35% in 2025.

UBI used the demand growth, plus the planned OLED TV panel capacity expansion to conduct a supply/demand analysis and projected there would be a supply shortage of 12% in 2024 and 35% in 2025.

Typically, market researchers. look at demand trends and project them into the future applying any known aberrations to increase or decrease demand. The difficulty of forecasting demand, this way is that it doesn’t take into consideration the real world competition. The price of OLED TVs over time has always been an attempt by LG Display to maximize revenue, while selling all the panels they could produce. OLED TV prices are compared with high-end LCD TVs, requiring consumers to pay more for the OLED. The difference between a comparably outfitted OLED and an LCD determined how many high end consumers would opt for OLED TVs. In the case, where OLED TV demand is higher than capacity, prices will rise. And consumers that don’t want to pay the premium will buy an LCD TV. In the 2024 timeframe, LCDs should be back to a typical price pattern where ASPs drop 8-10% per year, exaggerating the price difference with OLEDs and causing more LCD sales. It is therefore unlikely that there will ever be a large shortage of OLED TVs as long as the price difference with LCDs is extant.

|

Contact Us

|

Barry Young

|