|

Bernstein Concludes China A Major Force in OLED Capex

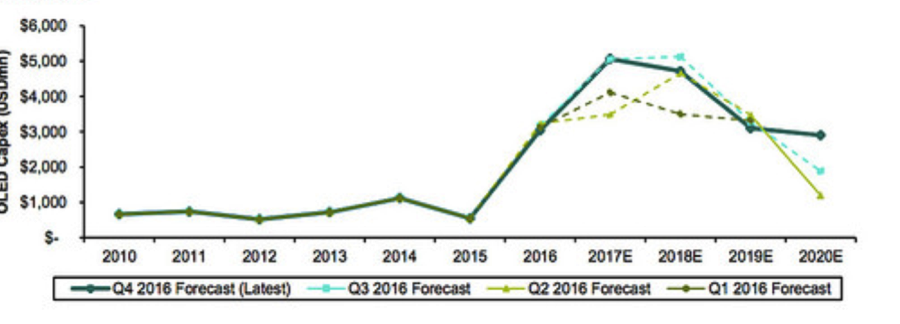

March 27, 2017 Bernstein analysts issued a report from what they call an “exhaustive and exhausting” trip to Asia, last month, to uncover the secrets of the electronics supply chain, with implications for Samsung Electronics, Corning, Micron Technology and LG Display among others. Their “industry experts” in Tokyo, Seoul, Shanghai, and San Francisco conclude that China is a big force in a rise in spending for display technologies, particularly, OLED, which is taking over from LCD, and also for spending on semiconductors, with the move to so-called 3-D NAND chips. The authors are Alberto Moel, Mark Li, Mark Newman, and Stacy Rasgon. The authors summarize the “China Syndrome” as they refer to it: OLED capacity ramp-ups from the Chinese players are even more aggressive than we thought, and hence equipment and material players are benefiting from this “OLED capex cycle”. A big concern, despite those upbeat notes, is a potential over-supply situation in display glass, as China slams on the gas for OLED capacity: We downgraded the display names two weeks ago as we believe we are in the middle of an aggressive G10 TFT-LCD and OLED capex cycle, which spells (big) trouble starting 2H 2017 and into 2018. Our conversations with industry participants during the trip further reinforced our view that panel makers (in particular the Chinese ones), are aggressively ramping up OLED capacity. During the tour we met with (working backwards in the supply chain) LG Display, Samsung, Japan Display, Toppan, ULVAC, Tokyo Electron, Applied Materials, Kateeva, Idemitsu Kosan, Hitachi Chemical, and Nanosys, as shown below. Figure 1: Bernstein’s OLED Capex Projection Suppliers of equipment and materials will be beneficiaries of the big ramp in spend, the authors note. They include suppliers of “OLED emissive materials” such as Universal Display, Duksan Neolux, Merck, Dow Chemical and also Samsung SDI: and “flexible substrate makers” such as Ube Kosan and Cheil Industries. Then there are the equipment makers such as Canon Tokki and Ulvac. The authors gleaned some things about what the production outlook looks like for the iPhone at Samsung, which has the sole contract to produce OLED displays for Apple, though it’s not entirely clear if the comments are derived from conversation with Samsung themselves, or another party: With strong memory pricing, OLED ramp-up and upcoming Galaxy S8, we see further upside to Samsung Electronics this year. Increased cash returns and restructuring are options. The company expects to ship 80 million smartphone OLED for Apple in 2H 2017 although, in our view, Apple may be double ordering as a safety measure. OLED profitability also appears better than expected with operating margins increasing from 20% to 25% area, but their target margin is 20%. We note that Chinese smartphone OEMs haven’t been able to access OLED supply in spite of their willingness to pay double the LCD price given the OLED supply concentration between Samsung Electronics and Apple. The Apple contract is take-or-pay, and ASPs for the flexible display are in the $75-80 range, well above the rigid OLED ASPs in the $30 range. Expected production for Apple is 50-80 million units this year. Samsung expects two Apple models to have flexible OLED this year. Samsung doesn’t believe there will a credible competitor for Apple’s OLED business this year or next.

|

Vertical Divider

|

|

Contact Us

|

Barry Young

|