Vertical Divider

Monitor Retail Prices Under Intense Pressure

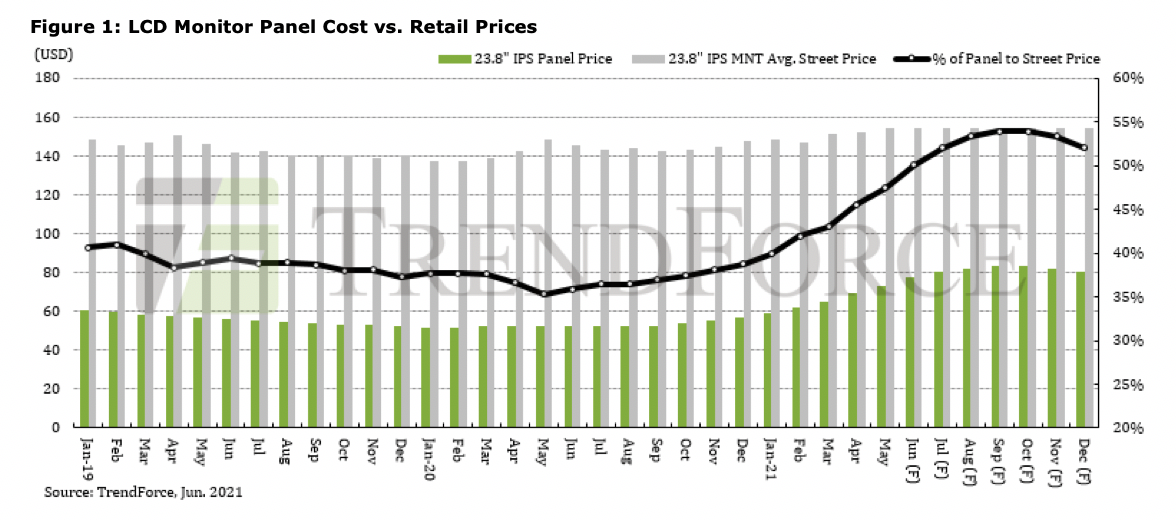

Trend Force’s reports the cost of the LCD panel typically accounts for about 40-50% of a monitor’s retail prices, while accounting for about 30-40% of monitor retail at the high end, due to the inclusion of industrial design and premium components and higher margins. Monitor brands face multiple sources of pricing pressure.

Trend Force’s reports the cost of the LCD panel typically accounts for about 40-50% of a monitor’s retail prices, while accounting for about 30-40% of monitor retail at the high end, due to the inclusion of industrial design and premium components and higher margins. Monitor brands face multiple sources of pricing pressure.

- 27-inch IPS FHD are relatively well-equipped to deal with panel price increase, which account for less than 50% of the retail prices in 2021

- 23.8-inch IPS products, where panels account for more than 40% of monitor retail prices since February, could rise to r 50-55% in Q321, the breakeven point for most monitor brands.

- 21.5-inch TN products panel prices have been rising since 2Q20, intensifying since 2H20.

Entering October 2020, panel costs began accounting for a considerable part of retail prices, in turn surpassing 50% in January 2021 and 60% in June 2021. Since panel manufacturers are disinclined to continue supplying 21.5-inch TN panels, the gap between supply and demand will persist, resulting in either an upward trajectory or bullish outlook for panel prices. In other words, the relative high costs of these panels will not only remain unresolved, but also likely worsen going forward.

TrendForce therefore believes that monitor brands may need to package their 21.5-inch TN monitors within bundle sales in order to offset the rising costs of panels. Alternatively, brands may also raise the retail prices of these products by about US$20-30 in order ensure that panel costs account for only about 50% of the monitors’ retail prices.

On the whole, the magnitude of financial losses incurred by monitor brands through price hikes, panel shortages, or the continued sale of 21.5-inch TN monitors will become the key determinant to how monitor brands adjust the volume of other mid-sized and large-sized products within their total monitor shipments.

TrendForce therefore believes that monitor brands may need to package their 21.5-inch TN monitors within bundle sales in order to offset the rising costs of panels. Alternatively, brands may also raise the retail prices of these products by about US$20-30 in order ensure that panel costs account for only about 50% of the monitors’ retail prices.

On the whole, the magnitude of financial losses incurred by monitor brands through price hikes, panel shortages, or the continued sale of 21.5-inch TN monitors will become the key determinant to how monitor brands adjust the volume of other mid-sized and large-sized products within their total monitor shipments.

|

Contact Us

|

Barry Young

|