Vertical Divider

|

Mizuho Forecasts 2022 Forecast TVs and PCs Down, Smartphones up 7% Y/Y

Mizuho Security analysts defined the opportunities and risks for consumer electronic product demand heading into 2022

|

|

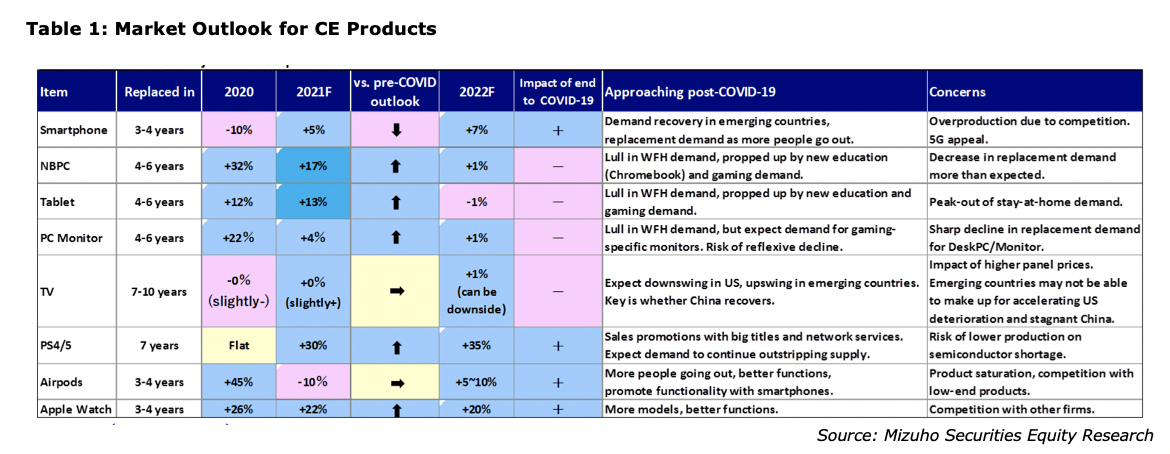

- PCs: Demand for notebook PCs and tablets is strong, supported by stay-at-home, WFH (work from home), and educational demand, and to an acceleration in the shift from desktop PCs to notebook PCs. After rising 32% in 2020, notebook PC sales are expected to grow 17% in 2021. Tablets sales are expected to continue growing at a double-digit pace for the second straight year, with 13% growth in 2021, after rising 12% in 2020. However, growth rates for notebook PCs and tablets are peaking and could be flat in 2022 at 252m. Desktop PC shipments, are expected to fall. Chromebooks for educational use represents new rather than replacement demand, it should support overall demand ahead. Shipments of notebook PCs and tablets are unlikely to return to 2019 levels, but the demand base has increased a notch, a positive trend viewed as positive.

- Wrist watches: Demand for wrist watches stagnated in 2020 in response to the pandemic-induced lock-downs. While smartwatches posted a slight increase, due to Apple, ordinary wrist watches registered negative growth, with the Japanese market shrinking by 38% Y/Y to 20m units by volume and by 30% to ¥622.7b by value, according to the Japan Clock and Watch Association. Watch sales in the Apr–Jun quarter at Casio Computer, recovered to more than 90% of the level of the same quarter of 2019, reflecting ongoing sales strength from 2Q 2020 in China, where the COVID-19 impact had long been modest, as well as a recovery trend for demand in Europe and North America as economies steadily reopened in tandem with the progress in vaccination. Demand in Japan and in emerging markets in Asia, though, remains sluggish. This illustrates the close correlation between demand and economic reopening, leading us to conclude that demand will stay on a recovery path into 2022. Smartwatches should also show the same basic trend.

- Smartphones: The market is relatively weak because of COVID-19. 2020 ended with sales of 1,290m, while 2021 units are projected at 1,350m (downwardly revised from 1,360m units to reflect the impact of chip shortages and the pandemic on Southeast Asia and other emerging economies), which amounts to a shortfall of 380m units over a two-year period. Although demand has been recovering since the start of 2021, the bounce-back has been sluggish in areas with renewed COVID-19 spread, such as India, Asian emerging markets, and South America. Consequently, there is a downside risk for the duration of 2021. Looking ahead to 2022, the situation will depend on the pandemic, but the release of pent-up demand (the timing of which, though, hinges on COVID-19) leading to demand recovery. For Western countries, increased demand is expected from model upgrading and increased mobility, although there are also risks, such as a lack of 5G appeal and potential lengthening of the replacement period caused by users replacing batteries instead. The outlook is especially clouded is China, where 2020 Chinese smartphone sales were down by 11% even though the pandemic impact was modest there, and with a 7% gain in 1H 2021, the pace of recovery is slow. This appears to reflect the fact that, in principle, China did not make cash disbursements to its citizens as the US and other countries did, and the substantial impact of the dramatic drop in production volume caused by US sanctions on Huawei, which is the dominant high-end model brand in China (the Huawei loss). There is also a dearth of catalysts moving into 2022 now that 5G diffusion is already well advanced. Salvation for the Chinese market is coming in the form of brisk iPhone sales in the high-end market and the release of high-end models by Honor, a spinoff from Huawei. An increase of 7% is forecasted for the market overall in 2022.

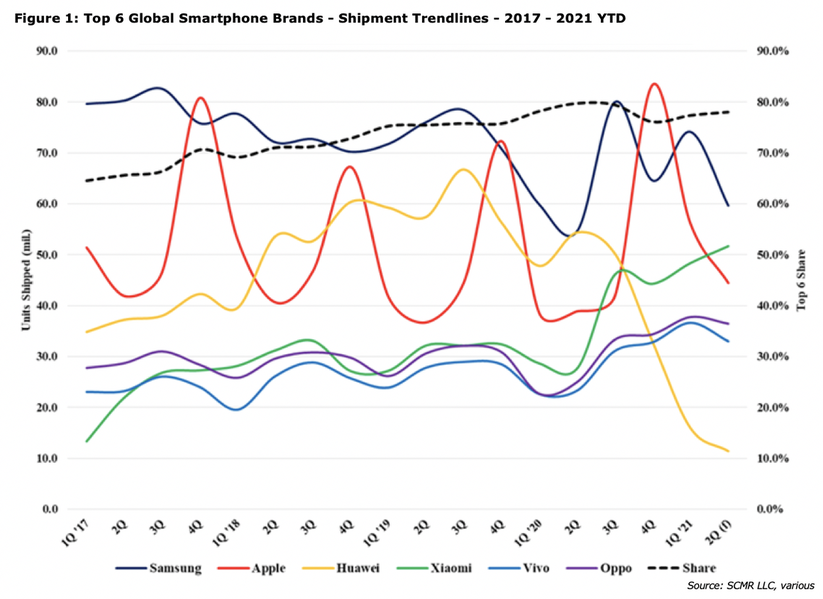

The next figure shows only the trend lines for each brand, making directional changes a bit more obvious. The trend lines for Oppo and Vivo are so close that they completely overlap.

|

Contact Us

|

Barry Young

|