|

May Panel Revenue Up 4.5% M/M & 31.7% Y/Y

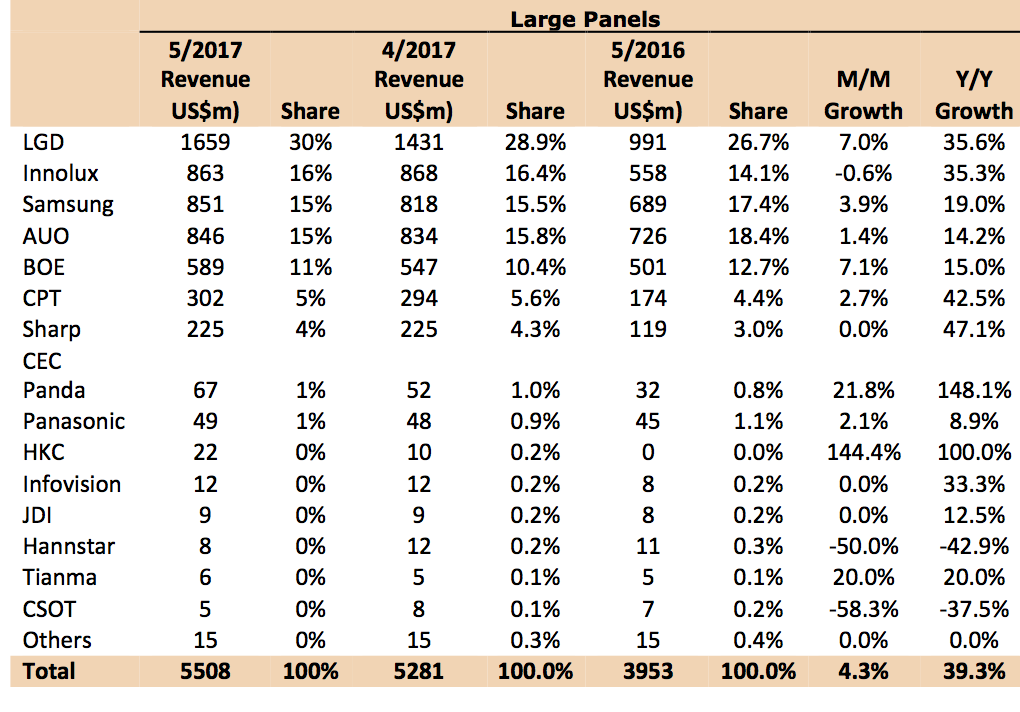

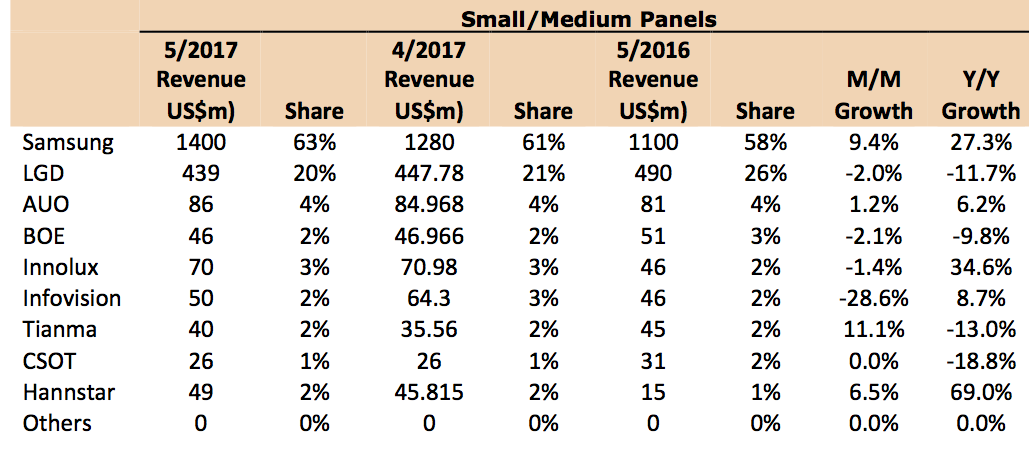

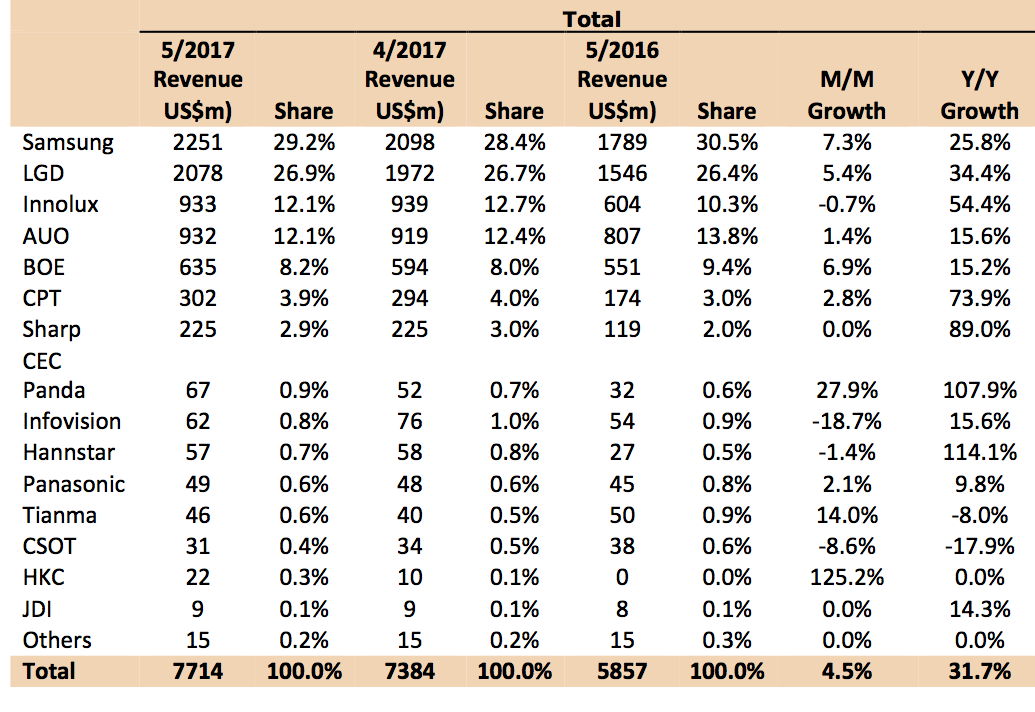

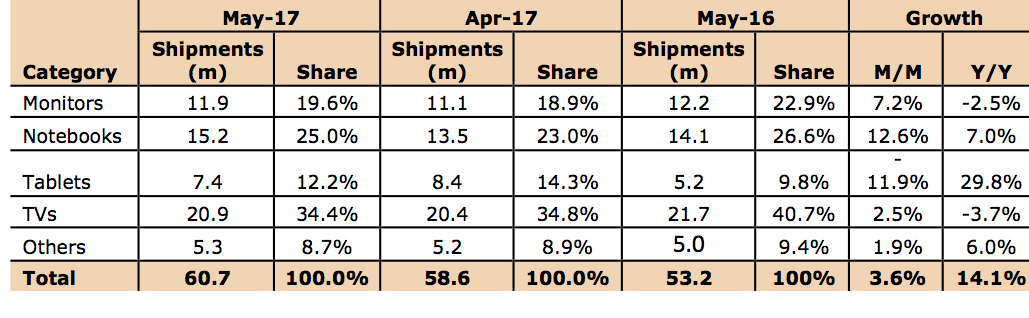

July 3, 2017 Panel makers experienced a 4.5% (M/M) increase in panel sales in May, while Y/Y comparisons remained strong against a very poor 1H 2016. Those with significant improvements in M/M panel sales were Chinese producers Panda and Tianma up 21.8% and 12.2%, respectively while CPT and Infovision were down 18.4% and 24.4%, respectively. The industry had $6.25b in revenue, the average for the last four months. Panel shipments were up in all categories except tablets (-11.9% M/M) while notebooks led the group with a 12.6% gain in shipments, offsetting the 13.5% decline in the previous month. TV panel shipments grew 2.5% M/M, but continue to decline annually, which leaves ASP growth as the revenue driver. The recent accident at the P8-1 LCD plant at LG Display has the potential to keep at least some TV panel prices from declining although the trend, which has been positive for a number of months, began to show weakness over the last month. Panel prices should decline slowly through August, with TV panel pricing showing the smallest declines. But the decline will be affected by the length of time the LG Gen 8.5 remains closed. Table 1: May 2017 Display Sales & Growth Summary (Large Area) Small/Medium Area

Total Panel Revenue

Source: SCMR LLC

Note the original source material from WitsView ignored the OLED shipments and had to be added by OLED-A Table 2: Large Area Panel Volume by Product Source: SCMR LLC

|

Vertical Divider

|

|

Contact Us

|

Barry Young

|