Vertical Divider

Smartphones

Market Research

February 23, 2020

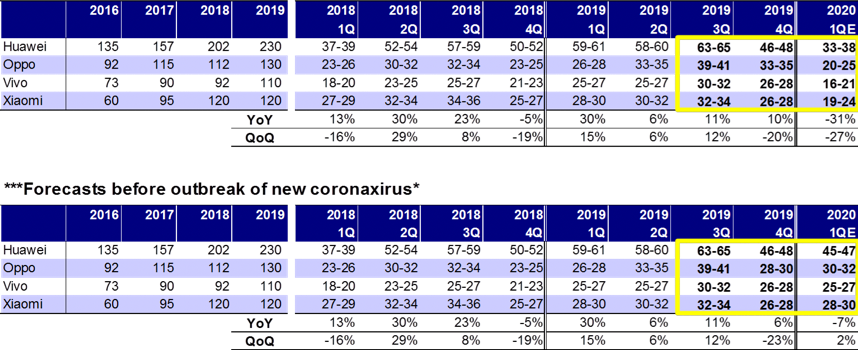

As we reported last week, there seems to be over-reaction to the effects of the Covid-19. DigiTimes Research revised forecast puts 2020 global smartphone shipments at 1.278b units, including less than 200 million units of 5G models. Mizuho Securities, a more reliable source, dropped their 2020 forecast form 1.5b to 1.45b. Given the 2019, shipments of 1.44b, the effect is expected to minor and concentrated in Huawei, down 35m, OPPO down 8m, vivo down 7m Coolpad down 4 and Xiaomi down 3m Y/Y .

Table 1: Smartphone Shipment Forecast Before and After COVID 19

Market Research

February 23, 2020

As we reported last week, there seems to be over-reaction to the effects of the Covid-19. DigiTimes Research revised forecast puts 2020 global smartphone shipments at 1.278b units, including less than 200 million units of 5G models. Mizuho Securities, a more reliable source, dropped their 2020 forecast form 1.5b to 1.45b. Given the 2019, shipments of 1.44b, the effect is expected to minor and concentrated in Huawei, down 35m, OPPO down 8m, vivo down 7m Coolpad down 4 and Xiaomi down 3m Y/Y .

Table 1: Smartphone Shipment Forecast Before and After COVID 19

Source: Mizuho Securities

Table 2: Smartphone Production Forecast for Major Chinese Brands Before and After COVID 19

Source: Mizuho Securities

DigiTimes by way of contrast says, in the best-case scenario under which the virus is under control by the end of February and factory resumption rates keep rising, China's top-four handset brands are expected to see their smartphone shipments experience an annual fall of 19.5% in the first quarter of 2020 compared to 11% projected in January. Capacity utilization rates of some key Chinese component makers for camera lenses, chassis and touch modules currently reach about 20-40%, with a few at 50%. Since only large-scale supply chain makers are currently running at lower capacities and a large number of small makers are awaiting approvals from local governments to restart facilities, the handset industry faces the mounting risks of supply chain disruption in March should any kind of components or materials run out of the stock. DigiTimes Research believes the downside to be even worse.

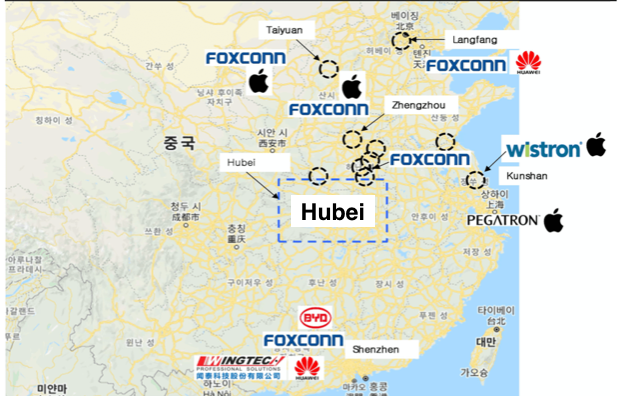

Samsung Electronics stopped producing smartphones in China by shutting down its Huizhou plant in 2019. Although Samsung Display still runs LCD and VD plants in Suzhou and Tianjin, their impact on the company’s consolidated earnings is minimal. While China is the world's top consumer market, it is also the biggest production base for Apple (AAPL) and Huawei, Samsung’s key rivals. Apple mostly produces iPhones, iPads and MacBooks at the Chinese plants of Foxconn, Pegatron and Wistron

Foxconn Zhengzhou (90%) and Taiyuan (10%) are responsible for 70% of total iPhone production while Pegatron’s Shanghai plant is responsible for 28% of production and Wistron’s Kunshan plant 2%. As for Huawei, more than 70% of production is done in Shenzhen, 15% in Foxconn Langfang, and a smaller portion in the Flextronics plant in Singapore. In terms of production and logistics, uncertainties are high for Apple and Chinese companies, but some shock in the short term is inevitable for Korean players as they supply semiconductors and OLEDs.

Figure 1: EMS Plants in China

Samsung Electronics stopped producing smartphones in China by shutting down its Huizhou plant in 2019. Although Samsung Display still runs LCD and VD plants in Suzhou and Tianjin, their impact on the company’s consolidated earnings is minimal. While China is the world's top consumer market, it is also the biggest production base for Apple (AAPL) and Huawei, Samsung’s key rivals. Apple mostly produces iPhones, iPads and MacBooks at the Chinese plants of Foxconn, Pegatron and Wistron

Foxconn Zhengzhou (90%) and Taiyuan (10%) are responsible for 70% of total iPhone production while Pegatron’s Shanghai plant is responsible for 28% of production and Wistron’s Kunshan plant 2%. As for Huawei, more than 70% of production is done in Shenzhen, 15% in Foxconn Langfang, and a smaller portion in the Flextronics plant in Singapore. In terms of production and logistics, uncertainties are high for Apple and Chinese companies, but some shock in the short term is inevitable for Korean players as they supply semiconductors and OLEDs.

Figure 1: EMS Plants in China

Source: Hyundai Securities

Apple has warned that it may not meet the revenue guidance it provided last month, as the coronavirus outbreak is expected to result in iPhone supply shortages and weak sales of its products in China. It noted that it is "experiencing a slower return to normal conditions" than expected, and that "we do not expect to meet the revenue guidance we provided for the March quarter and worldwide iPhone supply will be temporarily constrained." Apple added “its iPhone manufacturing partner sites are located outside the Hubei province - the epicenter of the epidemic and while they have all reopened, they are ramping up more slowly than we had anticipated. These iPhone supply shortages will temporarily affect revenues worldwide. It noted that demand for its products within China has been affected by the outbreak. All of our stores in China and many of our partner stores have been closed. Additionally, stores that are open have been operating at reduced hours and with very low customer traffic. We are gradually reopening our retail stores and will continue to do so as steadily and safely as we can. Our corporate offices and contact centers in China are open, and our online stores have remained open throughout. But the vendor maintained that customer demand for its products and services outside of China has been strong so far and in line with its expectations.”

Apple on January 28, 2020 provided guidance for its fiscal 2020 second quarter, expecting revenues to come between US$63.0 billion and US$67.0 billion; gross margin between 38.0% and 39.0%; operating expenses between US$9.6 billion and US$9.7 billion; and other income/(expense) of US$250 million. Apple will likely miss its schedule for mass producing the lower-cost iPhones due to the COVID-19 impact, according to Nikkei Asian Review sources. Inventories of existing iPhone models could remain low through April or longer. Mass production of the iPhone SE successor was supposed to start by the end of this month, but the start date could now be pushed back into March.

In other responses to COVID-19, the People’s Bank of China (PBoC) lowered the one-year LPR to 4.05 percent from 4.15 percent in a bid to boost the economy, as it battles the economic fallout of the new coronavirus outbreak. The reduction in the loan prime rate (LPR), one of the preferential rates commercial banks impose on their best customers and which serves as a reference for other lending rates, is the latest measure to help companies struggling through the epidemic.

Apple on January 28, 2020 provided guidance for its fiscal 2020 second quarter, expecting revenues to come between US$63.0 billion and US$67.0 billion; gross margin between 38.0% and 39.0%; operating expenses between US$9.6 billion and US$9.7 billion; and other income/(expense) of US$250 million. Apple will likely miss its schedule for mass producing the lower-cost iPhones due to the COVID-19 impact, according to Nikkei Asian Review sources. Inventories of existing iPhone models could remain low through April or longer. Mass production of the iPhone SE successor was supposed to start by the end of this month, but the start date could now be pushed back into March.

In other responses to COVID-19, the People’s Bank of China (PBoC) lowered the one-year LPR to 4.05 percent from 4.15 percent in a bid to boost the economy, as it battles the economic fallout of the new coronavirus outbreak. The reduction in the loan prime rate (LPR), one of the preferential rates commercial banks impose on their best customers and which serves as a reference for other lending rates, is the latest measure to help companies struggling through the epidemic.

|

Contact Us

|

Barry Young

|