Vertical Divider

Magnachip Focus on OLED Drivers ICs Points to Rapid Growth

Magnachip has become a major supplier of driver ICs and is #2 behind Samsung in the OLED smartphone market. The company recently changed its business plan to move away from production and to concentrate on DDIC design. IN Q320, MagnaChip Semiconductor Corporation’s revenue increased by 5% sequentially to $124.8M but was down by 16% Y/Y as the sale of the Foundry Services Group and Fab 4 was completed in September.

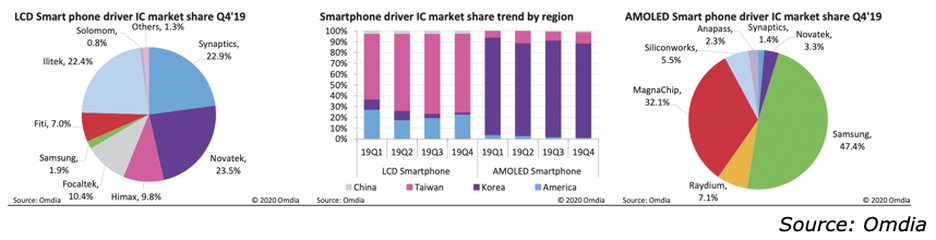

Figure 1: Magnachip in the Driver Market

Magnachip has become a major supplier of driver ICs and is #2 behind Samsung in the OLED smartphone market. The company recently changed its business plan to move away from production and to concentrate on DDIC design. IN Q320, MagnaChip Semiconductor Corporation’s revenue increased by 5% sequentially to $124.8M but was down by 16% Y/Y as the sale of the Foundry Services Group and Fab 4 was completed in September.

Figure 1: Magnachip in the Driver Market

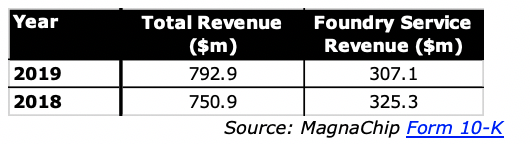

To put the sale impact on revenue in perspective, 2019 annual revenue was $792.2M with the foundry unit contributing $307.1M or 38.8%. The unit has been going down, however.

Table 1: Magnachip Total Revenue vs. Foundry Revenue

Table 1: Magnachip Total Revenue vs. Foundry Revenue

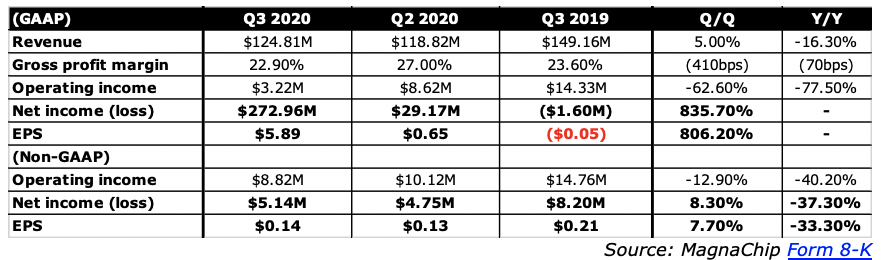

The unit was sold for $350.6M in cash with MagnaChip posting a gain of $287.1M from the sale, $264.5M after tax. The income from discontinued operations increased GAAP net income from $8.5M to $273M in Q3 as shown in the table below. EPS was $0.21 from continuing operations, but $5.89 thanks to the sale.

Table 2: Magna Chip Q320 Selected Financials and Growth

Table 2: Magna Chip Q320 Selected Financials and Growth

|

Contact Us

|

Barry Young

|