Vertical Divider

LGD Engaging in Vertical Deposition of Side-by-side OLED Production for TVs

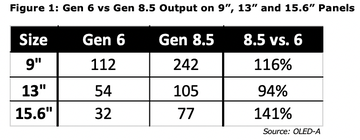

LG Display said it will spend 3.3 trillion won ($2.8b) to expand its small- to mid-sized OLED production capacity. The company will expand its Gen 6 (1500x1850mm) Paju OLED plant from 30,000 substrates/ month to 60,000 substrates per month by 2024. The funds will likely be used for new lines E6-3 and E6-4, each with a capacity of 15,000 substrates/month, at the Paju plant as well as maintaining capacity while E6-3 will likely be a flexible OLED line like E6-1 and E6-2. E6-4, and to adding lithography tools to make up for the additional masks in producing LTPO displays. Apple is planning to launch a new iPad with a OLED panel; LG Display will start supplying OLED panels for the series a year later in 2023. The first OLED panels on the tablets will be rigid OLED panels. LG Display has already placed orders for equipment that it will use in E6-3, sources told TheElec. The company is expected to ship around 50 million OLED panels to Apple this year, which will be double the 25 million units it supplied last year. However, LG’s panels from its Gen 6 fab will be at a severe disadvantage competing with Samsung’s Gen 8.5.

LG Display said it will spend 3.3 trillion won ($2.8b) to expand its small- to mid-sized OLED production capacity. The company will expand its Gen 6 (1500x1850mm) Paju OLED plant from 30,000 substrates/ month to 60,000 substrates per month by 2024. The funds will likely be used for new lines E6-3 and E6-4, each with a capacity of 15,000 substrates/month, at the Paju plant as well as maintaining capacity while E6-3 will likely be a flexible OLED line like E6-1 and E6-2. E6-4, and to adding lithography tools to make up for the additional masks in producing LTPO displays. Apple is planning to launch a new iPad with a OLED panel; LG Display will start supplying OLED panels for the series a year later in 2023. The first OLED panels on the tablets will be rigid OLED panels. LG Display has already placed orders for equipment that it will use in E6-3, sources told TheElec. The company is expected to ship around 50 million OLED panels to Apple this year, which will be double the 25 million units it supplied last year. However, LG’s panels from its Gen 6 fab will be at a severe disadvantage competing with Samsung’s Gen 8.5.

Samsung Display is developing an alternative method for OLED material deposition that would allow the production of RGB OLED displays on Gen 8 production lines. The Samsung project has been in partnership with Ulvac (6728.JP) in terms of the deposition tool itself, essentially the heart of the process, but other tool vendors have also been developing equipment that for Gen 8 RGB OLED process and Samsung Display is not alone in trying to develop a Gen 8 RGB process deposition tool. LG Display has also been working toward a similar goal of vertically held substrates, working with Sunic Systems and Dai Nippon Printing(DNP), the largest supplier of the FMMs. OLEDON, a South Korean company has been developing the technology along with a process that transfers the materials from a donor film that is pulled into the chamber via a belt. However that process is only applicable to ‘open mask’ displays.

Samsung Display’s OLED etcher suppliers have begun the development of their new dry etchers for Gen 8.5 OLED panels, TheElec has learned. Wonik IPS, ICD and Tokyo Electron are competing for orders from Samsung Display’s fab that will initially produce tablets, notebooks and monitors. Dry etchers are used during the thin-film transistor process for circuits such as gate, source and drain. Wonik IPS, ICD and Tokyo Electron have supplied their dry etchers for Samsung Display’s Gen 6 OLED panels. The initial order will undoubtedly result in future orders as Samsung reaches MP and then expands its Gen 8.5 capacity.

Dai Nippon Printing during Q221 began developing the fine metal masks (FMM) used in Gen 8.5 OLED panels. Hims will produce the tensioner for the new FMMs, a knowledgeable person said. Production is expected to begin in late 2022 to be used in iPads launching in 2022 and 2023. Apple is also expected to use OLED panels in the MacBook. Samsung Electronics’ mobile business is also planning to ship more 6m tablets and notebooks with OLED panels in 202q and 10m in 2022.

Samsung Display’s OLED etcher suppliers have begun the development of their new dry etchers for Gen 8.5 OLED panels, TheElec has learned. Wonik IPS, ICD and Tokyo Electron are competing for orders from Samsung Display’s fab that will initially produce tablets, notebooks and monitors. Dry etchers are used during the thin-film transistor process for circuits such as gate, source and drain. Wonik IPS, ICD and Tokyo Electron have supplied their dry etchers for Samsung Display’s Gen 6 OLED panels. The initial order will undoubtedly result in future orders as Samsung reaches MP and then expands its Gen 8.5 capacity.

Dai Nippon Printing during Q221 began developing the fine metal masks (FMM) used in Gen 8.5 OLED panels. Hims will produce the tensioner for the new FMMs, a knowledgeable person said. Production is expected to begin in late 2022 to be used in iPads launching in 2022 and 2023. Apple is also expected to use OLED panels in the MacBook. Samsung Electronics’ mobile business is also planning to ship more 6m tablets and notebooks with OLED panels in 202q and 10m in 2022.

|

Contact Us

|

Barry Young

|