Vertical Divider

LG to Miss Forecasts for 2020 OLED TV Panel Shipments

May 24, 2020

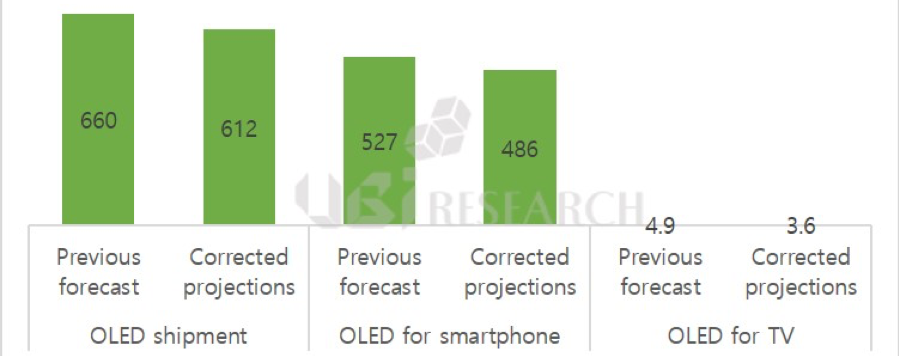

UBI Research modified forecast for the 2020 OLED market is $ 36.7 billion in sales and 612 million units, a decrease of 4.8% and 7.6%, respectively from their previous forecast. They expect the global smartphone market to drop by 20% and the TV market is to decrease by 15%. However, the impact on the overall OLED industry was judged to be only 5-8%. OLED panels for smartphones, TVs and watches are expected to decrease, but the small market for OLEDs for monitors is expected to increase. OLED shipments for smartphones was 527 million units at the beginning of the year, but the forecast was lowered to 486 million units, a decrease of only 7.8%. Chinese smartphone makers are expected to reduce LCD smartphones and increase production of OLED smartphones significantly as they adopt the Apple business direction. Flagship models of Chinese smartphone makers have used Pro and Pro Plus. Pro is the model grade name used by Apple and Plus is the model grade name used by Samsung. However, flagship models of Chinese smartphone makers that are launching this year are using both Pro and Pro Max as well as Apple. All of these models, like Apple, use flexible OLEDs.

The OLED TV market has been greatly affected by coronavirus. Estimated annual shipments at the beginning of the year were 4.9 million units, but the forecast was reduced to 3.6 million units down 26.5%, but 300,000 units more than 2019 shipments. The production schedule of the Guangzhou factory has been postponed since the third quarter due to the coronavirus, and TV sales are plunging in Japan and Europe, the main markets for OLED TV. Japan’s TV shipments in the second quarter was below 50% in 2019. Samsung Display is expected to ship up to 22.9 million LCD screens for monitors, which would reflect a 38.8% increase from 2019 and slashing production of LCD panels for TVs by 43.4% to 18.3 million units.

Demand for OLED monitors that Samsung Display has been promoting since the second half of last year is expected to increase due to the game industry, telecommuting, telemedicine, and remote classes due to the aftermath of the coronavirus.

Figure 15: Revised 2020 OLED Panel Shipments

May 24, 2020

UBI Research modified forecast for the 2020 OLED market is $ 36.7 billion in sales and 612 million units, a decrease of 4.8% and 7.6%, respectively from their previous forecast. They expect the global smartphone market to drop by 20% and the TV market is to decrease by 15%. However, the impact on the overall OLED industry was judged to be only 5-8%. OLED panels for smartphones, TVs and watches are expected to decrease, but the small market for OLEDs for monitors is expected to increase. OLED shipments for smartphones was 527 million units at the beginning of the year, but the forecast was lowered to 486 million units, a decrease of only 7.8%. Chinese smartphone makers are expected to reduce LCD smartphones and increase production of OLED smartphones significantly as they adopt the Apple business direction. Flagship models of Chinese smartphone makers have used Pro and Pro Plus. Pro is the model grade name used by Apple and Plus is the model grade name used by Samsung. However, flagship models of Chinese smartphone makers that are launching this year are using both Pro and Pro Max as well as Apple. All of these models, like Apple, use flexible OLEDs.

The OLED TV market has been greatly affected by coronavirus. Estimated annual shipments at the beginning of the year were 4.9 million units, but the forecast was reduced to 3.6 million units down 26.5%, but 300,000 units more than 2019 shipments. The production schedule of the Guangzhou factory has been postponed since the third quarter due to the coronavirus, and TV sales are plunging in Japan and Europe, the main markets for OLED TV. Japan’s TV shipments in the second quarter was below 50% in 2019. Samsung Display is expected to ship up to 22.9 million LCD screens for monitors, which would reflect a 38.8% increase from 2019 and slashing production of LCD panels for TVs by 43.4% to 18.3 million units.

Demand for OLED monitors that Samsung Display has been promoting since the second half of last year is expected to increase due to the game industry, telecommuting, telemedicine, and remote classes due to the aftermath of the coronavirus.

Figure 15: Revised 2020 OLED Panel Shipments

Source: UBI Research

LG recently released the following in its 20-F, “We plan to finalize our preparations for the commencement of operation at our CO fabrication facility, located in Guangzhou, China, within the first half of 2020, while the expected timing for commencing mass production of large-sized OLED panels at such facility remains subject to the state of the ongoing global COVID-19 pandemic, among other factors.” Given the previous statements that MP at Guangzhou would begin in Q319, Q419, Q120 and Q220, there is little credibility to the most recent statement.

Even with the slowdown in OLED TV panel shipments, LG Display continues its program to install Gen 10.5 equipment in Paju. The most recent report from Etnews is that the company will install two new exposure tools from Nikon to P10 in Paju. In March of this year, Nikon delivered 3-exposure tools to LGD, giving them a total of 5. Etnews also reported that LGD is expected to install one more exposure equipment from Canon in 2020. If Cano delivers, it will be their first Gen 10.5 tool.

LG recently released the following in its 20-F, “We plan to finalize our preparations for the commencement of operation at our CO fabrication facility, located in Guangzhou, China, within the first half of 2020, while the expected timing for commencing mass production of large-sized OLED panels at such facility remains subject to the state of the ongoing global COVID-19 pandemic, among other factors.” Given the previous statements that MP at Guangzhou would begin in Q319, Q419, Q120 and Q220, there is little credibility to the most recent statement.

Even with the slowdown in OLED TV panel shipments, LG Display continues its program to install Gen 10.5 equipment in Paju. The most recent report from Etnews is that the company will install two new exposure tools from Nikon to P10 in Paju. In March of this year, Nikon delivered 3-exposure tools to LGD, giving them a total of 5. Etnews also reported that LGD is expected to install one more exposure equipment from Canon in 2020. If Cano delivers, it will be their first Gen 10.5 tool.

|

Contact Us

|

Barry Young

|