Vertical Divider

|

LG Display to supply OLED Displays for Sony Smartphones

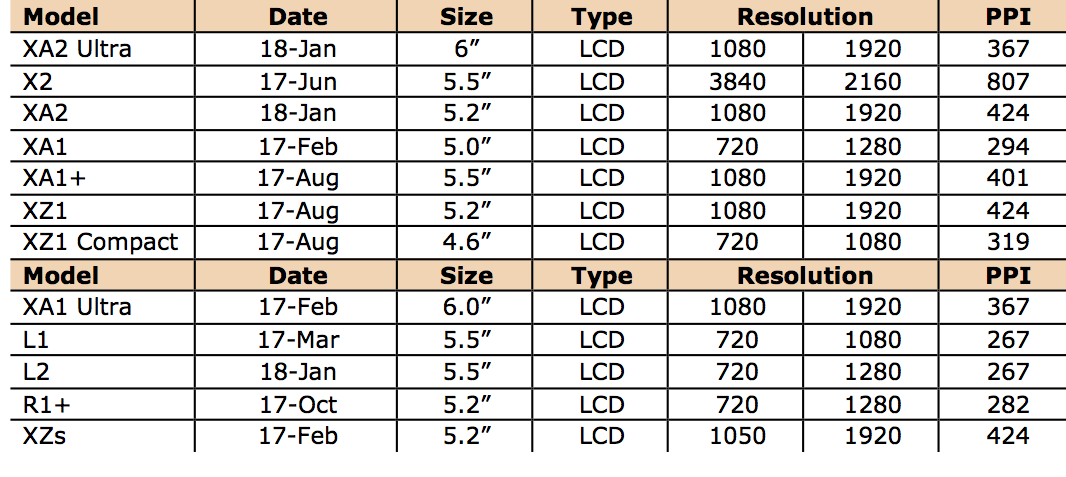

February 03, 2018 Sony is not known as a worldwide leader in the smartphone space, although they did achieve a 5% share back in 2011/2012, but by 2013 Sony was out of the top rankings and have remained so since. However, in Japan, they command a lead ahead of all other brands except for Apple (AAPL) and likely shipped ~5.6m units, in Japan which has a 2% share compared to China’s 30% share. Sony has a rather unremarkable current line-up of smartphones and would seem to need something to set it apart from the myriad of other smartphones outside of its home turf in Japan. They have used small volumes of Samsung’s OLED displays, although they are an LG Display customer for OLED TV panels, and other than releasing a 4K smartphone last year (X2) there products lack differentiation. LG Display and Sony would seem however to be the perfect fit for OLED displays, as LGD would be able to supply the smaller quantities needed for Sony, but would show larger potential customers that it can supply high quality, flexible OLED displays to a well-known brand. Sony gains the cache of adding OLED smartphone offerings and depending on the extent of the flexibility (likely conformed) can directly compete with their Chinese rivals. Table 1: Sony Current Smartphone Offerings Source: GSMarena

LG Display began flexible OLED production at its E5 fab during 3Q 2017 (phase 1) and is expected to begin phase 2 production in 3Q this year. LGD however remains somewhat conservative on expanding their small panel OLED capacity unless they can see the development of a number of customers to support such an expansion and they are also expected to begin production of their E6 flexible OLED fab in 3Q 2018, which pushes them harder to develop such customers. LGD current product used in the V30 and the Google Pixel 2 XL have been fraught with issues (blue tint in off angles, mura, image sticking) and must prove to Apple that it can produce flexible OLED displays in high volume at the quality levels needed by Apple’s aggressive designs to qualify as a second source. LG Display reported disappointing bottom line results despite a modest beat over consensus revenue estimates as a rapid ramp in expenses for OLED R&D brought operating margins to under 1%. On a Y/Y basis revenue was up 11.3% while ASPs declines offset the increased shipment volume and generally higher profitability on OLED TV panels. The company did not elaborate on the increase in R&D spending, other than to specify “in preparation for future OLED growth” for an expanding customer base. Together with some one-off expenses and the impact of currency, the expenses took a serious bite out of profitability. The good news was that the company expects expenses to return to previous levels in 1Q and while they also expect ASPs to decline in 1Q, they believe the decline will be slower than in 4Q and will be stable by the end of the quarter. Using the per meter calculation (company) the company saw a 1.8% decline in panel pricing in 4Q, which would assume a lesser decline for 1Q. However, the company also expects a decline in shipment area in the high single digits for 1Q, which will likely bring shipments down to the same levels seen in Q217, coupled with a price decline of ~1.4%, would imply some gross margin improvement, but likely still less than 3Q 2017 levels (18%). The reduction in expenses in 1Q should help to boost net margin above the meager 0.6% seen in 4Q, but we don’t expect a return to net margins above mid-single digits in 1Q. As to the industry prospects for 1Q and 1H, the company expects to see better TV demand in 1Q, primarily coming from China, and says they have indications that inventory levels have improved slightly from 3Q, which we have not seen, other than adjustments made for seasonality. They take a conservative view of the TV supply/demand picture, calling the TV business ‘mature’ and indicating that the high single-digit increase in supply coming from new large format Chinese fabs could be troublesome from a panel perspective. LGD shipped 1.7m large OLED panel in 2017, on target with expectations and expects to ship between 2.5 and 2.7m units this year, which is in line with expectations. The size mix and the company’s capacity expansion timeline will influence the absolute number, and they indicated that they expect to see improving profitability in the large panel OLED business that was EBIDA positive as per the company. While the company had given broad plans for capex of 20twon between 2017 and 2020, split between large and small OLED capacity increases, they indicated that the spend for 2018 would be 9twon, after what we expect was between 6 and 7twon in 2017. This would imply ~5twon in 2019 and ~1twon in 2020, along with annual maintenance of under 1twon/year. A variable in the overall spending number would be negotiations between the company and the local Chinese government for financial incentives for LGD’s Guangzhou, China fab that is just beginning construction, although the company will still have to borrow to meet its capex spend this year. While the company indicated that it is a bit too early to discuss shipment levels from their new E5 Gen 6 flexible OLED fab, they did indicate that yields were improving and they were moving toward ‘stabilization’ at the fab. In the case of E5, the current run rate is ~4,000 sheets/month, against a potential for 15,000 sheets/month at full capacity. This current level, coupled with yields below 70%, would be in keeping with the company’s relatively cautious attitude toward building expectations for high volume shipments. The phase 2 ramp rom April to September this year, should have a ramp trajectory faster than that of the phase 1 line. The company also indicated that they expect to begin production in their E6 fab in September of this year, and while they believe the China fab will not see any real delay, despite the time lost to get Korean government approval, which they could begin the production ramp as early as October 2019. There was little mention of the company’s Gen 10.5 fab (P10A), which is going to be a massive undertaking for the company, given it is their first foray into a fab size over Gen 8.5, and will be based on oxide backplanes. This fab could be used for both LCD and OLED large panel production, but plans are still under development. LG may be holding up their decision process until they get a reading from the IJP pilot line in order to determine the deposition process. However, since LG is clearly moving to an OLED shop, the move to Gen 10.5 LCDs with oxide backplanes (IGZO) seems counterproductive. IGZO is 50% more expensive then a-Si, so they start with a extra cost for LCDs, then their R&D is focused on OLEDs so they will likely be behind in LCD TVs. This situation is clearly a dilemma for LG, which would be solved if they can print the OLEDs and compete with LCDs on price. Short of that solution, the company will be relegated to competing with all the Chinese Gen 10.5 fabs on price, not a good position to be in. Overall the quarter was a bit disappointing from an earnings perspective, but the cost increases if used to solve the small medium performance problems were a necessary evil and should help the small and large panel OLED production going forward. The necessity to compete with Samsung Display for major customers, particularly Apple is driving LG Display, and if successful, will establish them as a valid small panel flexible OLED supplier to the rest of the world. |

|

|

Contact Us

|

Barry Young

|