Vertical Divider

LG Continues Divesting LCD Assets – Sells Polarizer Business

June 14, 2020

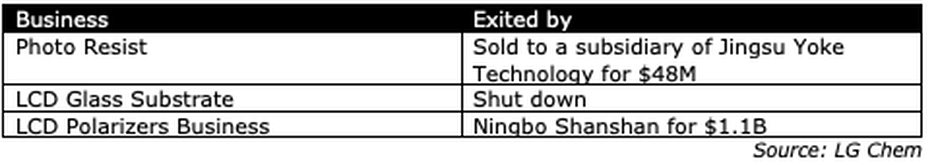

LG Chem (announced it has signed a conditional contract to sell most of its polarizer business for $1.1b to Ningbo Shanshan Co., Ltd, a chemical company based in Zhejiang Province and a provider of battery materials. LG Chem will retain its automotive polarizer business and focus on its OLED materials business, which includes circular polarizers for OLEDs. The deal is contingent on board approval and Ningbo Shanshan has stated that it plans to offer shares up to ~$438m to fund the acquisition. Initially the acquisition would be in the form of a JV with LG Chem retaining 30% of the new company, which it will eventually cede to Ningbo Shanshan, although final terms might differ from what has been announced thus far.

This sale is consistent actions of South Korean panel producers Samsung Display and LG Display as they decrease LCD capacity and convert capacity to OLEDs SDC, the leader in small panel OLED, and LGD, the leader in large panel OLED have set the trend in South Korea and those in the South Korean display supply chain will see their local LCD business disappear or be severely reduced. Getting out in front of that change is key to their survival, especially as China tries to develop its own ‘Made-in-China’ display supply chain. OLED’s circular polarizer films will represent between 25% and 30% of the overall polarizer market this year with Sumitomo and Nitto Denko being the leading suppliers.

LG Chem’s Exiting LCD Business

June 14, 2020

LG Chem (announced it has signed a conditional contract to sell most of its polarizer business for $1.1b to Ningbo Shanshan Co., Ltd, a chemical company based in Zhejiang Province and a provider of battery materials. LG Chem will retain its automotive polarizer business and focus on its OLED materials business, which includes circular polarizers for OLEDs. The deal is contingent on board approval and Ningbo Shanshan has stated that it plans to offer shares up to ~$438m to fund the acquisition. Initially the acquisition would be in the form of a JV with LG Chem retaining 30% of the new company, which it will eventually cede to Ningbo Shanshan, although final terms might differ from what has been announced thus far.

This sale is consistent actions of South Korean panel producers Samsung Display and LG Display as they decrease LCD capacity and convert capacity to OLEDs SDC, the leader in small panel OLED, and LGD, the leader in large panel OLED have set the trend in South Korea and those in the South Korean display supply chain will see their local LCD business disappear or be severely reduced. Getting out in front of that change is key to their survival, especially as China tries to develop its own ‘Made-in-China’ display supply chain. OLED’s circular polarizer films will represent between 25% and 30% of the overall polarizer market this year with Sumitomo and Nitto Denko being the leading suppliers.

LG Chem’s Exiting LCD Business

|

Contact Us

|

Barry Young

|