Vertical Divider

Leftovers

Sharp Considerations in Bidding for JDI’s Hakusan’s D3 LTPS LCD Fab

January 20, 2020

We recently reported that Sharp, the Hon Hai Group were looking at buying an interest in JDI’s Hakusan’s D3 LTPS LCD Gen 6 fab. Japan Display has invested about ¥170b to build the D3 factory, which is dedicated to iPhones applications for Apple (mass manufacturing started in 3Q 2016). The factory currently has a production capacity of 25,000/month for G6 and has the latest equipment (e.g., 1.5μm lithography equipment) for a LTPS liquid crystal factory. The production capacity is close to that of Sharp’s Kameyama No. 1 (K1) factory (22,000) but the factory has enough space to increase production to 50,000. Due to a lack of demand, the D3 factory has stopped running, and Japan Display has subsequently booked an impairment loss on the factory. Currently, the factory’s book value is about ¥50b, which makes it look like a good deal. In light of Sharp’s fixed cost burden and Japan Display's financial position, the acquisition is unlikely to be a bad purchase for Sharp since Sharp would push for even lower prices. The potential acquisition could generate about ¥150b in operating cashflow. The media has been stating that the factory’s price tag is ¥80b–¥90b, which does not seem a very reasonable basis for buying the factory.

Sharp LCD business strategy: To raise profitability by consolidating

sites into Kameyama 1/2 & Sakai. Sharp appears to be concentrating production sites for its LCD panel operations into K1 (G6 LTPS: from iPhone to auto), Kameyama No. 2 (K2; G8 IGZO: tablets, notebooks, monitors) and Sakai (G4.5 OLED), while gradually shuttering existing domestic plants (G2, G4, and G4.5). Annual depreciation expenses of about ¥20b are very low compared to sales of over ¥750b. It is essential that it builds a structure capable of generating stable earnings (OPM of at least 5%), by achieving sales growth per square meter through a focus on high-end applications, while also limiting fixed production costs via plant closures and site consolidation. In that sense, the D3 acquisition does offer a lot of upside in terms of generating sales, but also presents risks such as increased fixed costs, the need to capture more demand, and the downside of scattered site locations. Sharp would need “guaranteed demand” from a major client which is where Apple comes in as they still have an outstanding credit of ~$800m with JDI.

For 2020, Apple is planning to release an LCD based SE2 (which will utilize the iPhone 8 platform) and 4 OLED iPhones. There are some issues: 1) there is a price difference between OLEDs and LCDs; 2) it will take time for suppliers other than Samsung Display to emerge; and 3) worsening profitability at key LCD suppliers JDI and LG Display raises doubts about the continuation of these operations. Therefore, expect one new line of LCD models (5.5” or 6.06”) may be introduced for 2021 releases. Apple decided upon a strategy of OLED adoption, so the launch of more LCD models is likely to represent a temporary phenomenon. At present, iPhone LCD panel demand are estimated to be 160m units in 2019, 110m units in 2020, and about 100m in 2021 (assuming the launch of a new model using LCD). Necessary 2019 LCD production capacity was offered by Sharp’s K1 (22,000/month). JDI’s Mobara J1 (20,000/month from its overall total capacity) and LG Display’s AP3 (20,000/month from its overall total capacity). With demand set to decrease, there would be little reason for Sharp to proactively pursue acquiring D3. Such a move would require the launch of a new LCD iPhone model by Apple every year from 2021 onward (with the guarantee of a significant share for Sharp), or increased usage of IGZO(K2) panels in such products as the iPad and MacBook. If Sharp does decide to acquire D3, it would indicate a long-term continuation of LCD models from Apple’s LTPS-LCD value chain.

Another, consideration is based on the assumption that LG Display will withdraw from LCD production (to specialize in OLED). Acquiring D3 would roughly double Sharp’s panel supply capacity for the iPhone from estimated 2019 volume of 54m units, therefore suggesting the generation of sales of about ¥300b.

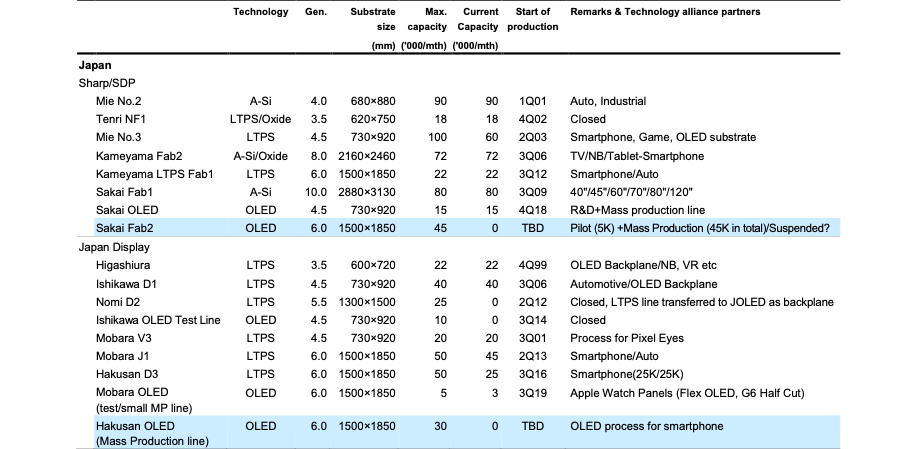

Figure 1: Sharp and JDI Display Capacity

Sharp Considerations in Bidding for JDI’s Hakusan’s D3 LTPS LCD Fab

January 20, 2020

We recently reported that Sharp, the Hon Hai Group were looking at buying an interest in JDI’s Hakusan’s D3 LTPS LCD Gen 6 fab. Japan Display has invested about ¥170b to build the D3 factory, which is dedicated to iPhones applications for Apple (mass manufacturing started in 3Q 2016). The factory currently has a production capacity of 25,000/month for G6 and has the latest equipment (e.g., 1.5μm lithography equipment) for a LTPS liquid crystal factory. The production capacity is close to that of Sharp’s Kameyama No. 1 (K1) factory (22,000) but the factory has enough space to increase production to 50,000. Due to a lack of demand, the D3 factory has stopped running, and Japan Display has subsequently booked an impairment loss on the factory. Currently, the factory’s book value is about ¥50b, which makes it look like a good deal. In light of Sharp’s fixed cost burden and Japan Display's financial position, the acquisition is unlikely to be a bad purchase for Sharp since Sharp would push for even lower prices. The potential acquisition could generate about ¥150b in operating cashflow. The media has been stating that the factory’s price tag is ¥80b–¥90b, which does not seem a very reasonable basis for buying the factory.

Sharp LCD business strategy: To raise profitability by consolidating

sites into Kameyama 1/2 & Sakai. Sharp appears to be concentrating production sites for its LCD panel operations into K1 (G6 LTPS: from iPhone to auto), Kameyama No. 2 (K2; G8 IGZO: tablets, notebooks, monitors) and Sakai (G4.5 OLED), while gradually shuttering existing domestic plants (G2, G4, and G4.5). Annual depreciation expenses of about ¥20b are very low compared to sales of over ¥750b. It is essential that it builds a structure capable of generating stable earnings (OPM of at least 5%), by achieving sales growth per square meter through a focus on high-end applications, while also limiting fixed production costs via plant closures and site consolidation. In that sense, the D3 acquisition does offer a lot of upside in terms of generating sales, but also presents risks such as increased fixed costs, the need to capture more demand, and the downside of scattered site locations. Sharp would need “guaranteed demand” from a major client which is where Apple comes in as they still have an outstanding credit of ~$800m with JDI.

For 2020, Apple is planning to release an LCD based SE2 (which will utilize the iPhone 8 platform) and 4 OLED iPhones. There are some issues: 1) there is a price difference between OLEDs and LCDs; 2) it will take time for suppliers other than Samsung Display to emerge; and 3) worsening profitability at key LCD suppliers JDI and LG Display raises doubts about the continuation of these operations. Therefore, expect one new line of LCD models (5.5” or 6.06”) may be introduced for 2021 releases. Apple decided upon a strategy of OLED adoption, so the launch of more LCD models is likely to represent a temporary phenomenon. At present, iPhone LCD panel demand are estimated to be 160m units in 2019, 110m units in 2020, and about 100m in 2021 (assuming the launch of a new model using LCD). Necessary 2019 LCD production capacity was offered by Sharp’s K1 (22,000/month). JDI’s Mobara J1 (20,000/month from its overall total capacity) and LG Display’s AP3 (20,000/month from its overall total capacity). With demand set to decrease, there would be little reason for Sharp to proactively pursue acquiring D3. Such a move would require the launch of a new LCD iPhone model by Apple every year from 2021 onward (with the guarantee of a significant share for Sharp), or increased usage of IGZO(K2) panels in such products as the iPad and MacBook. If Sharp does decide to acquire D3, it would indicate a long-term continuation of LCD models from Apple’s LTPS-LCD value chain.

Another, consideration is based on the assumption that LG Display will withdraw from LCD production (to specialize in OLED). Acquiring D3 would roughly double Sharp’s panel supply capacity for the iPhone from estimated 2019 volume of 54m units, therefore suggesting the generation of sales of about ¥300b.

Figure 1: Sharp and JDI Display Capacity

Source: Mizuho

Yet another view is that Sharp could convert D3 into an OLED production site. It could use the D3 LTPS line in its current state for producing TFT substrates (for OLED backplanes) and introduce OLED deposition lines where there is available space, thereby turning the plant into an OLED panel production site. Sharp would have to make a separate investment in module processing, but capex for OLED processing alone would be less than ¥100b for 30,000/month. This approach would offer the benefit of inexpensively obtaining buildings, infrastructure, and LTPS substrate processes. From the perspective of Hon Hai Group, which owns non-Sharp LCD manufacturers such as Innolux and Century Display, it would also be preferable for Sharp to take the initiative with OLED development. However, a number of manufacturers such as Samsung Display, LG Display, and BOE already possess a lot of production capacity in this area. Apple probably requires Sharp’s substrate technologies such as LTPS and LTPO, but it is not clear if it also needs their OLED panels.

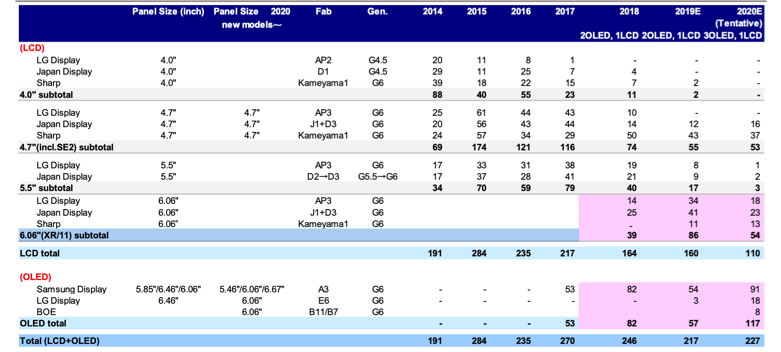

Figure 2: iPhone Panel Supply Forecast (m of panels)

Source: Mizuho

|

Contact Us

|

Barry Young

|