Vertical Divider

|

LCD TV Panel Prices Down 21.3% Y/Y

November 26, 2018 By November, much of the holiday panel build is over, at least for North America and Europe. Given that panels would have to be shipped to assemblers, followed by container shipping (sea) which typically takes between 22 days and 32 days (depending on the point of origin) to San Diego, another 10 days (if the port is not busy) to cross the US, and another few days to be distributed to local stores, by mid-In November the display business begins to slow as production for the holiday rush is over. In dire situations, some companies ship by air, which shortens the travel time, but could cost between 5x and 10x the cost of sea transport depending on the product, and that tends to happen only in years where there is demand exceeds supply, which does not exist this year. Typically November sees an average TV panel price decline of 0.8% as shown in the next figure and while 2018 has experienced some extremes, the general pattern is typical of 5-year sequential averages. Looking at volatility data for 32” TV panels the number of ‘up’ months is decreasing and the ‘down’ months are increasing with each new cycle. While this is a quantitative observation and a bit specific to a particular panel size, it shows the difficult times for TV panel producers in subsequent years. Table 1: November Panel Price Growth by Application |

|

Source: SCMR LLC, IHS, WitsView

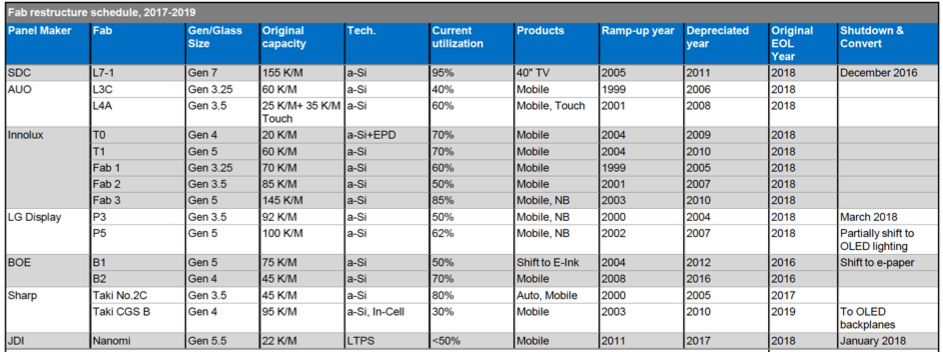

On a general basis, November saw weakness in all panel pricing categories, with TV and mobile the most pronounced. There was little incremental smartphone demand, with the next potential pivot point for smartphones after the Mobile World Congress in late February, early March. Monitor panel producers should continue to switch between small TV panels and monitor panels to try to smooth out results, but the only areas that seem to have growth in the monitor space are gaming monitors and 4K monitors, both of which are relatively small niches. Notebooks have experienced the least ASP reduction driven by components in somewhat short supply (not displays), which has kept the notebook supply chain relatively tight. The only mid-term positive for the LCD displays is the potential closing of older fabs, either as a way to improve the overall efficiency of a producer’s panel production, or their conversion to another display modality, such as OLED. The next figure shows planned closings/conversions for the LCD fabs. In addition to the L-1 fab listed for SDC, they are also converting L-8a to produce OLED/QD hybrid and perhaps L-8b.

Table 2: Display Fab Closures and Restructures

Table 2: Display Fab Closures and Restructures

Source: IHS

|

Contact Us

|

Barry Young

|