Vertical Divider

LCD Capex Gets a Reprieve

As DSCC recently reported, Q320 display equipment revenues rose 58% sequentially and 24% Y/Y to $2.8B, the highest since Q418, breaking a streak of 6 consecutive quarters with a Y/Y decline. Momentum appears to have recovered, at least in the short term, with a surprising focus on the LCD, but over the long run investment is expected to shift to OLEDs.

Figure 1: Display Equipment Revenues (36 Companies)

As DSCC recently reported, Q320 display equipment revenues rose 58% sequentially and 24% Y/Y to $2.8B, the highest since Q418, breaking a streak of 6 consecutive quarters with a Y/Y decline. Momentum appears to have recovered, at least in the short term, with a surprising focus on the LCD, but over the long run investment is expected to shift to OLEDs.

Figure 1: Display Equipment Revenues (36 Companies)

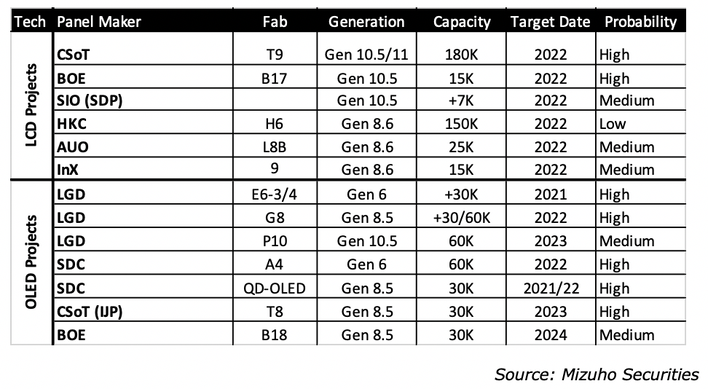

By panel maker, the planned expenditures are shown in the next table by panel maker and technology.

Table 1: Planned Fabs by Technology

Table 1: Planned Fabs by Technology

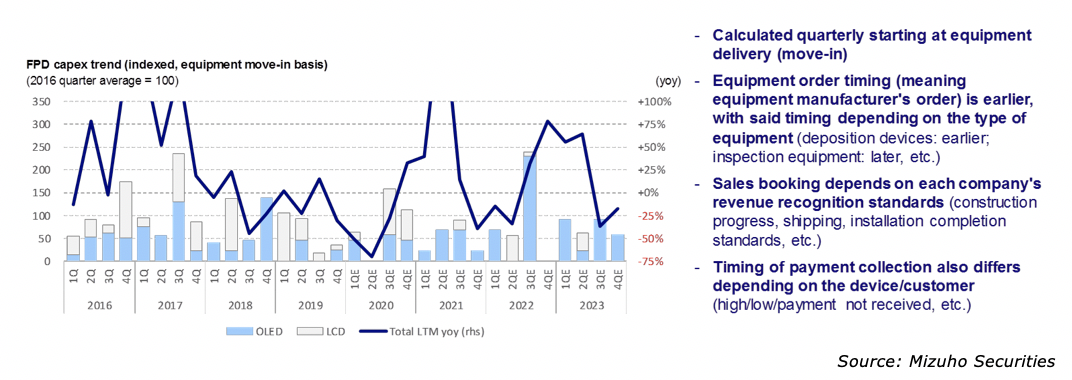

Figure 2: FPD Capex on a Move-In Basis indexed to 2016

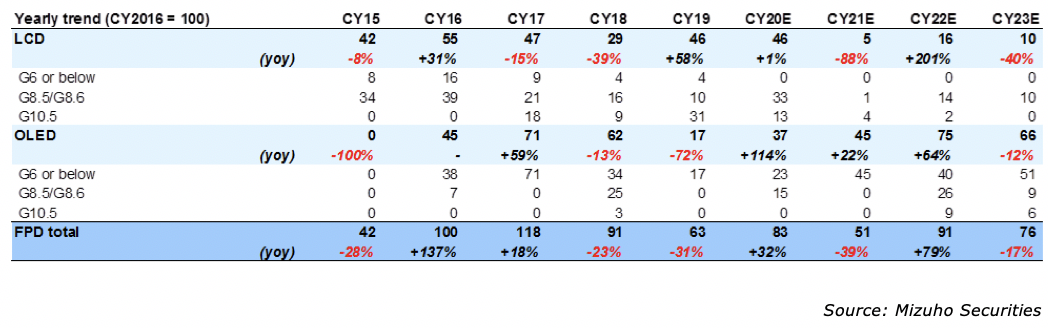

Table 2: Yearly Capex Trends

|

Contact Us

|

Barry Young

|