Vertical Divider

Large Area LCD Supply/Demand to Remain in Glut Situation Through 2020

May 17, 2020

Omdia forecasts 2020 large area LCD demand to decline 10% Y/Y although notebooks and tablets are expected to increase due to working/learning at home trends. Omdia expects this surge in IT will be short-lived and will mainly pull in demand from the second half of the year. The rise in IT spending will not be sustainable as corporate IT and education systems’ budgets are curtailed due to slowing economic growth. Omdia forecasts unit demand could begin recovering from 2021 but will take two to three years to approach 2019 levels. However, on an area basis, 2021 large-panel demand is expected to exceed 2019’s level by 11% as the LCD TV weighted average panel size rises from 45.4-inch to 49.2-inch. Over the same 2019 to 2021 timeframe, capacity is forecast to grow by only 2 percent. AS we have explained previously, the Korean LCD TV panel fab shutdowns negate much of the capacity expansions and new factories now being built in China.

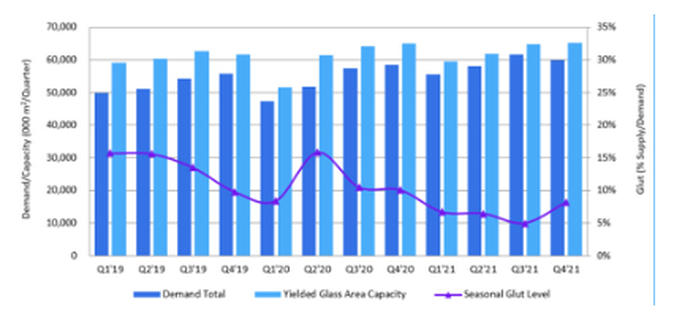

Figure 1: LCD Large Area Panel Supply/Demand and Glut Ratio

May 17, 2020

Omdia forecasts 2020 large area LCD demand to decline 10% Y/Y although notebooks and tablets are expected to increase due to working/learning at home trends. Omdia expects this surge in IT will be short-lived and will mainly pull in demand from the second half of the year. The rise in IT spending will not be sustainable as corporate IT and education systems’ budgets are curtailed due to slowing economic growth. Omdia forecasts unit demand could begin recovering from 2021 but will take two to three years to approach 2019 levels. However, on an area basis, 2021 large-panel demand is expected to exceed 2019’s level by 11% as the LCD TV weighted average panel size rises from 45.4-inch to 49.2-inch. Over the same 2019 to 2021 timeframe, capacity is forecast to grow by only 2 percent. AS we have explained previously, the Korean LCD TV panel fab shutdowns negate much of the capacity expansions and new factories now being built in China.

Figure 1: LCD Large Area Panel Supply/Demand and Glut Ratio

Source: Omdia

Ramp-up plans in the first half of 2020 for multiple new Chinese Gen 8.6 and Gen 10.5 LCD fabs were interrupted due to equipment set-up plans caused by travel restrictions on engineers. For some process-critical machines, such as photolithography tools, set-up is starting to fall behind previous plans by two to four months. Balance in supply demand is not expected to reach equilibrium (5% to 10% glut) until Q121 and is forecasted to remain that way throughout 2021.

From: Omdia analyst Charles Annis. The data is from the AMOLED and LCD Supply Demand & Equipment Intelligence Service.

|

Contact Us

|

Barry Young

|