Vertical Divider

Musing on Displays

Large Area Display Unit Shipment Forecast

March 29, 2020

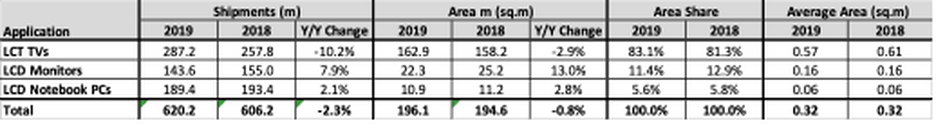

Omedia (formally IHS) took a look at production and revised their forecast for display production in 2020. The forecast projects a decrease in TV panels but an increase in monitors and notebook PCs, even as production in the first quarter of 2020 will be down at least 50% Y/Y and may not fully recover until Q320. Moreover, demand is also likely to be restricted as unemployment has be showing exponential growth.

Table 1: LCD Panel Shipment and Area Forecast

Large Area Display Unit Shipment Forecast

March 29, 2020

Omedia (formally IHS) took a look at production and revised their forecast for display production in 2020. The forecast projects a decrease in TV panels but an increase in monitors and notebook PCs, even as production in the first quarter of 2020 will be down at least 50% Y/Y and may not fully recover until Q320. Moreover, demand is also likely to be restricted as unemployment has be showing exponential growth.

Table 1: LCD Panel Shipment and Area Forecast

Source: Omedia

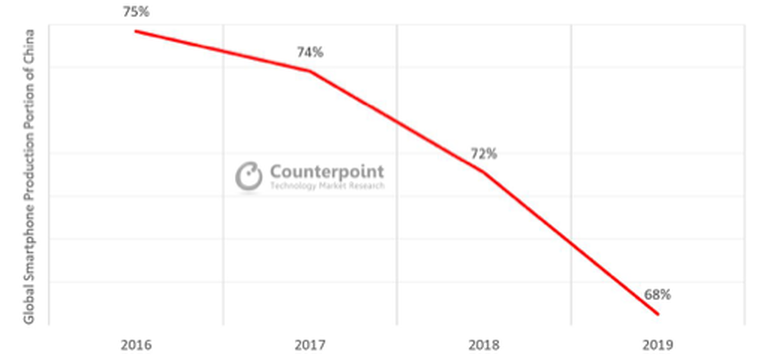

Even before the pandemic, China was losing its position as the world’s smartphone factory as recent dynamics within the supply chain and production ecosystem, shifted away due to rising costs, trade tensions with the US, and a re-prioritization of other consumer markets make China less attractive as a production base. Vendors have been shifting production to India and Vietnam. India with its ‘Make in India’ policy enticing many vendors to expand there. And with the country now the world’s second largest smartphone market, manufacturers could be swayed into moving production onto the sub-continent. The pandemic has put a crimp into these plans as Samsung and others announced a postponement of production in India.

Figure 1: Share of Global Smartphone Production in China

- Samsung Electronics shuttered all China smartphone production at end-2019 when it closed its Huizhou location – a plant which in 2017 produced 63m handsets. Rising labor costs and shrinking domestic market share were the key reasons for closure. Average monthly salaries at the plant tripled, from US$274 to US$832 in 2008 and 2018, while Samsung’s domestic market share fell below 1% in 2019 after peaking at 19.7% in 2013. The company plans to replace its in-house Chinese production line by expanding existing facilities in Vietnam and India. Although some production remains in China, this will only be through Chinese ODMs.

Figure 1: Share of Global Smartphone Production in China

Source: Counterpoint Research

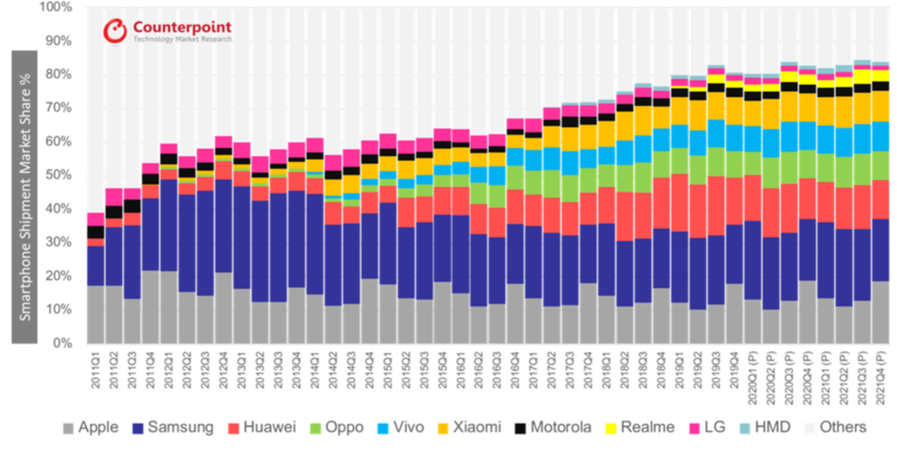

- Apple, which outsources production through EMS firms such as Foxconn and Pegatron, is also diversifying outside of China. Starting with the iPhone SE in 2017, the 6S in 2018, and the X last year, Apple moved some production to India to take advantage of tariff benefits under the ‘Make in India’ policy, and to better target the underpenetrated Indian market. It now plans to move up to 30% of current production outside China in response to protracted trade conflicts between China and the US; India, Vietnam and other SE Asian countries have been brought up as possible alternatives.

- OPPO continues to expand India production, growing from 15m units in 2018 to 50m in 2019. The company plans to further increase the number to 100m in 2020, attracted by the government’s ‘Make in India’ tariff benefits. This would mean well over half OPPO’s devices will be ‘Made in India’, making the country a strategic location from which to expand into SE Asia and Africa.

- vivo is also increasing production in India, where all smartphones currently being sold are made. It announced last August it planned to double production volume to 50m in 2020, meaning more than half the company’s production this year will come from India.

- Xiaomi, which has maintained the top spot since 2018 in India smartphone shipments, announced last year the construction of its seventh Indian factory, which would increase current production numbers by 50%. The company’s India facilities produced 40m units last year, 95% of which were Made in India; for 2020, the numbers are expected to reach 60m and 99%.

Figure 2: A Decade of Transition in Smartphone War

Source: Counterpoint

|

Contact Us

|

Barry Young

|