Vertical Divider

June Large Area LCD Shipments Down 2.7% Y/Y, But ASPs Rise

June was the first month that had negative Y/Y large panel shipment comparisons since March of 2020. June display industry sales came in at $7.47B up 42.6% Y/Y, and while large panel ASP’s have been rising since last May, June was the first month where ASPs declined, albeit just down 0.1% sequentially. The average large panel ASP monthly increase being 3.6% this year and 3.2% over the last 12 months.

June was the first month that had negative Y/Y large panel shipment comparisons since March of 2020. June display industry sales came in at $7.47B up 42.6% Y/Y, and while large panel ASP’s have been rising since last May, June was the first month where ASPs declined, albeit just down 0.1% sequentially. The average large panel ASP monthly increase being 3.6% this year and 3.2% over the last 12 months.

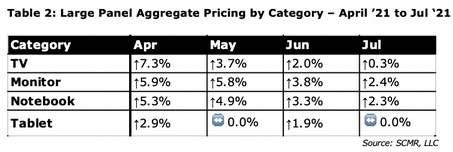

Panel prices rose in June, but are expected to see taper off in July, with TV prices almost flat. Large panel shipments are forecast flat to down in July, which will put additional pressure on panel producer results, particularly TV panels. The expected growth notebooks and monitors demand in August should result in modest price increases but TVs are expected to have lower ASPs, which would keep large panel display sales flat for many panel makers.

In June AUO, ChinaStar, HKC and CHOT the exceptions were the only panel makers with large area shipment increase. CSoT comparisons include the addition of Samsung’s Suzhou LCD fab, so the additional production is not an organic sequential comparison. HKC and CHOT are expanding capacity, while BOE had negative sequential growth in sales.

In June AUO, ChinaStar, HKC and CHOT the exceptions were the only panel makers with large area shipment increase. CSoT comparisons include the addition of Samsung’s Suzhou LCD fab, so the additional production is not an organic sequential comparison. HKC and CHOT are expanding capacity, while BOE had negative sequential growth in sales.

|

Contact Us

|

Barry Young

|