Vertical Divider

January Display Revenue Down 16.5% Y/Y

March 02, 2020

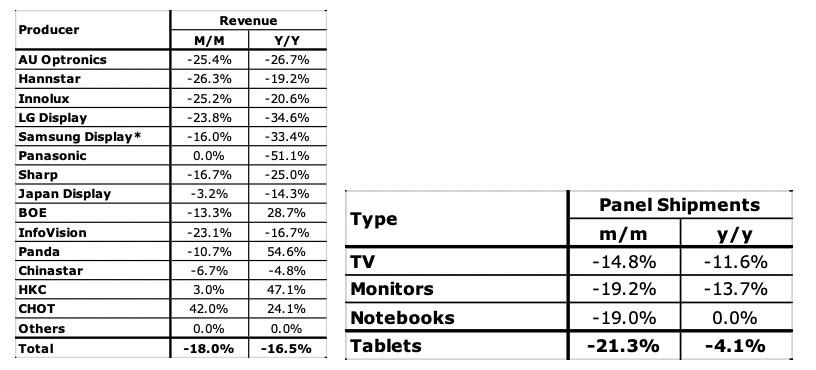

January display industry revenue was down 18.0% sequentially and down16.5% Y/Y. January typically averages (5 yr.) up 1.4% sequentially. HKC, CHOT, BOE, Panda, which were either new or had expansions countered the trend and the Samsung results do not include small panel OLED sales. Adding a bit of granularity, Display industry large panel sales were ↓15.7% sequentially and ↓16.5% Y/Y in January, while small panel sales were ↓26.3% m/m and also ↓16.5% Y/Y.

Figure 1: January Display Revenue Changes by Panel Maker and Application

March 02, 2020

January display industry revenue was down 18.0% sequentially and down16.5% Y/Y. January typically averages (5 yr.) up 1.4% sequentially. HKC, CHOT, BOE, Panda, which were either new or had expansions countered the trend and the Samsung results do not include small panel OLED sales. Adding a bit of granularity, Display industry large panel sales were ↓15.7% sequentially and ↓16.5% Y/Y in January, while small panel sales were ↓26.3% m/m and also ↓16.5% Y/Y.

Figure 1: January Display Revenue Changes by Panel Maker and Application

Source: SCMR, LLC

February should experience panel price increases, as travel bans work against the industry, both from a returning staffing perspective and from a material or finished goods transport viewpoint, while fabs further from Hubei Province and Wuhan specifically, should, in theory, be affected less. On a longer-term basis, early estimations by companies expect their business to be down 10% to 15% for the year, but much will depend on how quickly COVID-19’s infection rate is reduced. Most companies have indicated that their impact estimates assume all travel restrictions will be lifted by the end of 1Q, and assume that demand will return to ‘normal’ soon after, but there are concerns that it might take much or all of 2Q for the CE supply chain to be rebalanced. Many panel producers, even after panel price increases in January and February, are still operating at cash cost or lower. Panel producers have been on the defensive for about 7 months and panel buyers took advantage of the oversupply situation until the end of the year. Now, the industry seems to be in the throes of offsetting conditions, whereby demand in China is down and the supply is down confusing the behavior of panel buyers.

|

Contact Us

|

Barry Young

|