Vertical Divider

|

Is Small/Medium OLED Display Capacity Headed for Massive Oversupply?

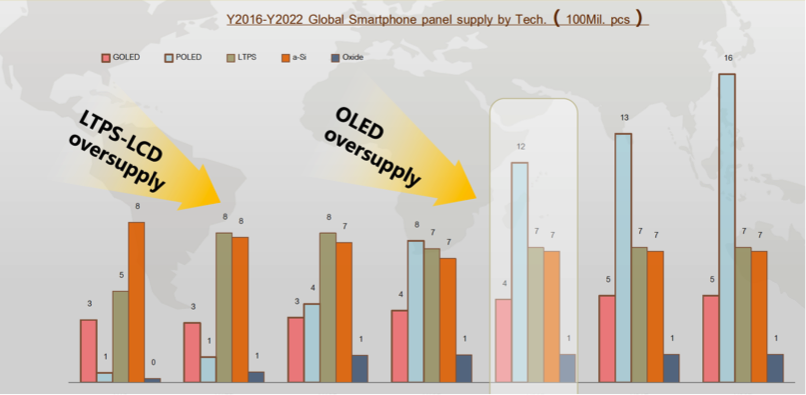

October 23, 2017 Both Display Supply Chain Consultants (DSCC) and Sigmaintell are forecasting that by 2019, OLED panel production will grow to the point where OLED panel prices will start to drop. Samsung is currently the only OLED supplier for the iPhone X, but LG Display has ramped up production and production investments to join the supply party. With EverDisplay, Tianma, BOE and Truly shipping small volumes of rigid OLED displays, could Samsung’s ability to charge premium prices for its flexible panels be in jeopardy? Samsung’s OLED plants are operating at around 90% capacity and that’s expected to continue in 2018. Sigmaintell as shown the following figure is forecasting an OLED glut in 2020. Figure 1: Global Smartphone Panel Supply by Technology Source: Sigmaintell

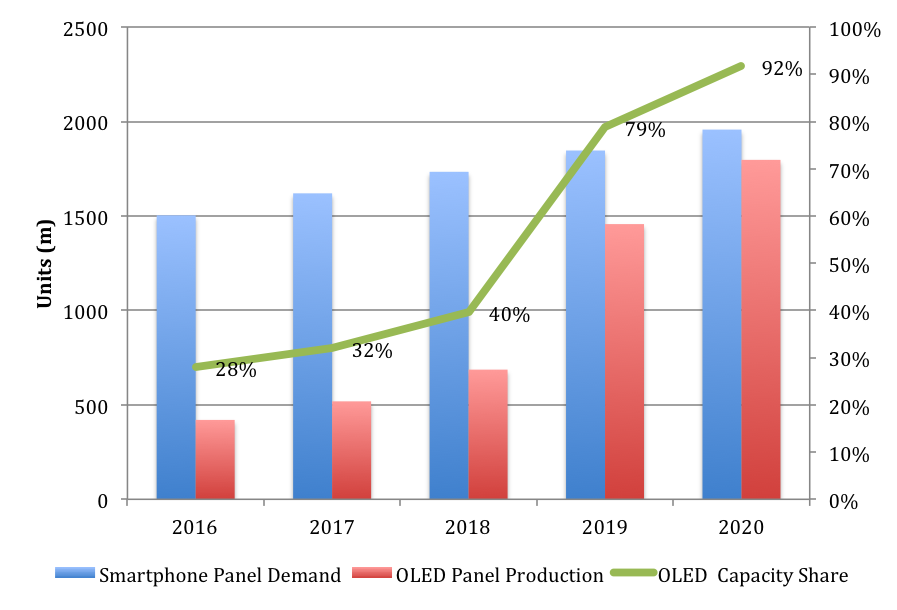

When calculating capacity, both market research firms are assuming that Samsung’s A5 fab will be built out. However, Samsung Display is mulling over whether the company will make investment for production of 30,000 or 60,000 substrates/month as the first facility investment in the new factory A5 in the Tangjeong Industrial Complex in Asan. Although the outline for the entire investment size was roughly decided in the first half of this year, the plan is being influenced by competitors’ success in reaching MP in the second half of 2017. Samsung Display is expected to make its first facility investment for A5 Factory in December. The display giant is likely to make its first investment for 30,000 substrates/month, but the production capacity may rise to 60,000 substrates/month depending on their competitor’s progress and the company’s own yield. Samsung informed pre-process equipment suppliers of equipment delivery schedules viva voice. But the size of the investment remains open. Although the company leans toward building a Super OLED factory its competitors' catch-up speed could be faster than expected and the yield of the existing A3 factory has not yet reached a satisfactory level. "If the A3 yield rises, we can naturally prune the size of the additional investment," an official said. “As the yield and the status of rivals should be monitored, it is highly likely that the final decision will be made next autumn." LG Display is the competitor most watched by Samsung Display. LG Display is supplying its mass-produced products from its first 6th-generation OLED E5 for the Google Pixel 2XL model. Although there is concern over E5 yields in the outset, LG Display's atmosphere is positive. Recently, the E5 line received a team to monitor and adjust the entire line for final mass production operation. "In the early period, the E5 yield was low, but the yield improved considerably in just a few months, so we are encouraged," another official said. "We have more anticipation for and stronger confidence in good performances considering the fact that the E5 factory just began production.” If LG Display secures a stable production system, Apple, which prefers multiple supply lines, is likely to reduce volume from Samsung Display. On Samsung Display’s part, the company can have an advantageous position when the company set its supply as tight as possible compared to demand. This is because Samsung Display can keep its price range high while minimizing the impact from volume reductions in the future. The fact that the A3 line producing panels for Apple, has not yet reached a stable yield is also a factor in delaying investment decisions. In the case of liquid crystal displays (LCDs) with mature technology, about 98% is the golden yield. However, 6th-generation flexible OLEDs have no clear standards on a golden yield yet. Since Samsung Display is a monopoly supplier to the world market, Samsung's standards become the world standards. Flexible OLEDs are more difficult to process than rigid OLEDs and materials are difficult to handle. Due to this fact, it will take a considerable amount of time to achieve LCD-level yields. Currently, the yield of the line that produces products for Apple is said to be less than 60%. The yield becomes lower after a post-treatment process. Apple typically has higher acceptance standards than Samsung Electronics or Chinese companies. Samsung Display has set a goal of stabilizing the entire A3 line by this month. This is because the confirmation of a final yield can pave the way to setting future production volume. Samsung Display will calculate the size of the additional facility investment by calculating demand quantity after raising the yield as high as possible by Q118. The next figure shows the smartphone forecast, the OLED panel production and the OLED penetration by year assuming Samsung’s original schedule for A5. By 2019, OLEDs would have enough capacity to satisfy 84% of smartphone panel demand a very unlikely situation and therefore emblematic of a glut. Figure 2: OLED Smartphone Panel Penetration Source: Canaccord, OLED-A

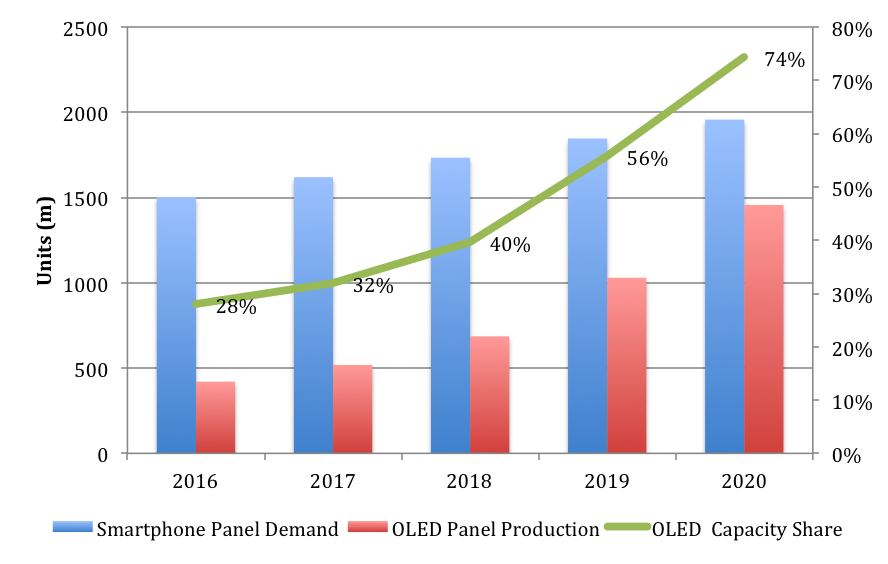

However, as shown in the next figure, if Samsung delayed the A5 investment by 12 – 18 months the OLED penetration would drop to 56% in 2019, a much more reasonable target. Figure 3: OLED Smartphone Panel Penetration, Modified* Source: Canaccord, OLED-A

* Samsung’s A5 Fab Delayed by 18 month |

|

|

Contact Us

|

Barry Young

|