|

Inventory Levels Rise Indicating Slowing Demand

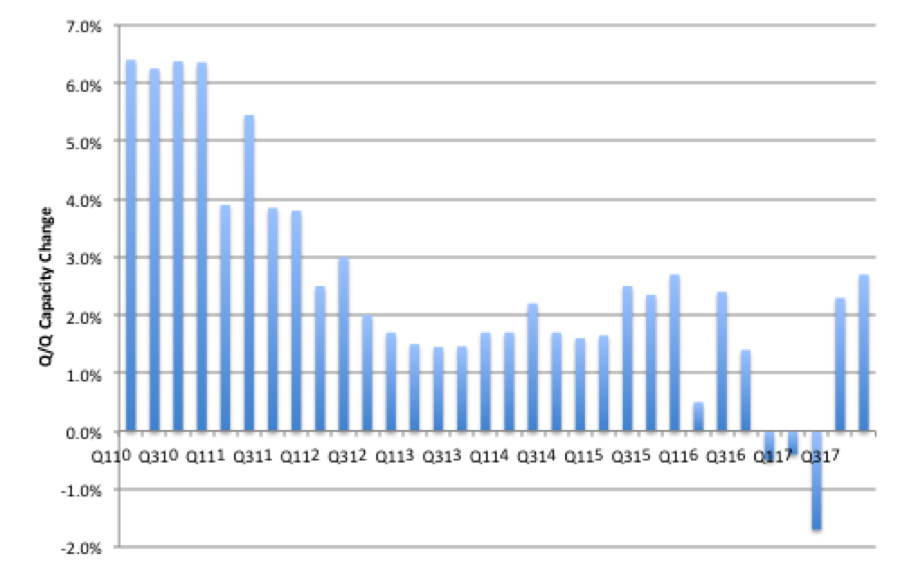

July 24, 2017 Over the last few months, TV inventory levels in China have risen as brands tried to maintain yearly targets against slowing demand. Typical TV set inventory levels in China are ~8 weeks for non-domestic brands, but have risen from that level in 4Q 2016 to 9.7 weeks in 1Q and 10.6 weeks in 2Q 2017, according to data from Chinese consulting firm Sigmaintell, and local set inventories, which are typically ~6 weeks, have moved to 6.4 weeks and 7.4 weeks respectively in 1Q and 2Q 2017. While TV panel prices have begun to decline modestly, they have risen significantly from year ago levels, which we believe has reduced TV brand margins, and made it difficult to offer discounts to buyers, who have become used to declining TV prices. It will be essential that the industry finds a way to reduce this excess, high cost TV inventory in 3Q, as the holiday build season begins in mid quarter, but our concern is that panel producers, who have been running fabs at high utilization rates, will try to continue relatively high production levels to maintain their margins, while TV set buyers slow orders to burn off inventory. In most cases panel producers have two choices in such a scenario. First, they can continue to produce at high levels, but will lower prices to attract hesitant buyers, or they can lower production levels and take a hit to gross margins. Given the better than average margins panel producers have been generating over the last year, managements will likely opt for the former, with the hope that a strong holiday build period will help to bring panel prices back up. This is a tricky game, as reducing panel prices can set a trend where buyers continue to hold back purchases, with the hope that prices will decline further and they can offset the cost of higher priced inventory. This is similar to what happened in 2015 and early 2016, when panel prices declined rapidly, and only due to capacity reductions and limitations at certain panel producers, were they able to recover in 2H 2016, but this year those capacity reductions are already in place and while the 1st half of this year saw a reduction in overall gross display capacity, the 2nd half will see 2 quarters of 2%+ capacity increases, which will be followed by at least 8 quarters of overall industry capacity increases. This has the potential to bring the supply/demand ratio to a less advantageous point for panel producers, and while we would not expect a rapid change in the overall display industry picture this year, we would expect to see a less favorable scenario next year. Much of this will be precipitated by how quickly panel producers respond to what we expect will be a more fluid situation over the next few quarters, with the above scenarios laying the groundwork for the balance next year, lest investors forget that the display space, despite its technology based patois, is still a cyclical industry. Figure 1: Gross Display Industry Capacity Change - 2010 - 2017 Source: SCMR LLC, OLED-A

This is the fourth consecutive year that LG OLED has won the TV Shootout. The LG E7 took home the win in all categories ahead of flagship TVs from Samsung, Sony, Vizio, and Westinghouse. |

Vertical Divider

|

|

Contact Us

|

Barry Young

|