Vertical Divider

Hyundai Motor Investment & Securities Visits Japan/Taiwan

October 15, 2018

Hyundai published a report covering the flat panel and semiconductor industries. We have excerpted sections of the report that deal with the flat panel industry.

LCD investments down slightly, POLED investments down sharply, expectations for QD up

China appears be reducing subsidies for panel makers, and while LCD oversupply seems unavoidable in the mid to long-term, LCD TV panel price declines will likely be limited in 4Q18. As for flexible OLED production, Chinese investments are plummeting. The key issues of the display sector until the year’s end include:

We believe Samsung’s QD investments are more important than its investments in foldable display.

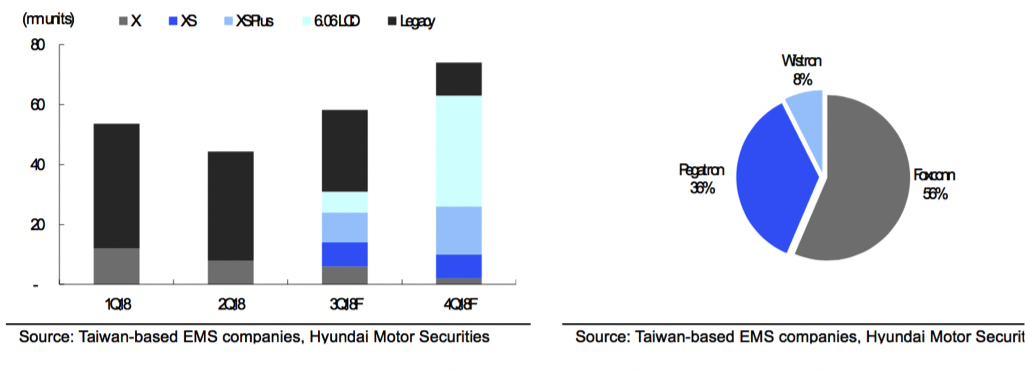

Considering the orders awarded to Taiwanese EMS companies, we estimate the production volume of the iPhone in 2H18 will be 86m units, comprised of:

Although the LCD industry is still likely to be oversupplied, we do not believe the price of LCD TV panels will fall drastically until 20182019 given declining Chinese subsidies and solid demand for LCD TV sets. The BOE yield in the POLED industry is still a paltry 10-20%, and it seems every panel maker including Samsung Display Co (SDC), LG Display and the Chinese are going through difficult times.

In terms of capacity, Samsung’s QD investments are worth noting. Going forward, we expect China’s LCD investments to remain flat (or down slightly for the 8th-generation LCD fabs), POLED investments in Korea and China to contract, and Samsung’s QD investments to increase.

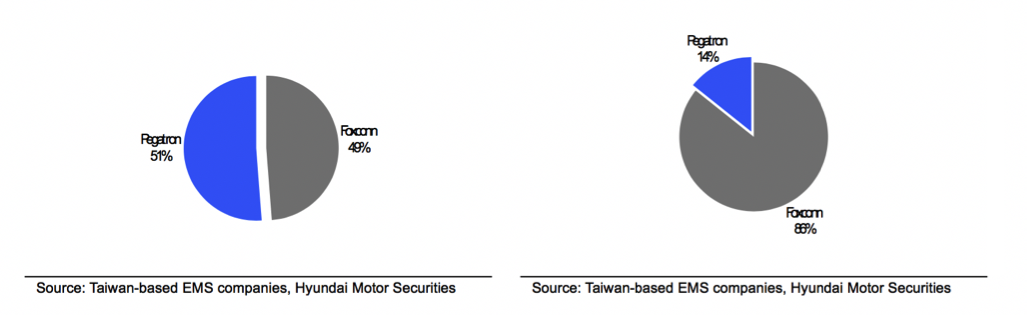

After the visit to the Japanese and Taiwanese companies in the Apple supply chain, we learned that production of the new 6.06-inch LCD version is being delayed due to an issue with BLU and because of this it will come out after the OLED version. Only Foxconn and Pegatron will participate in the production of the new iPhone without Wistron this time. Foxconn is expected to be responsible for 67% of EMS for the new iPhone to be released in 2H18. The expected production volume of the new iPhone is about 86mn units, and LCD will make up 51% of total production. 51% of LCD models will be manufactured by Pegatron and 86% of OLED models by Foxconn.

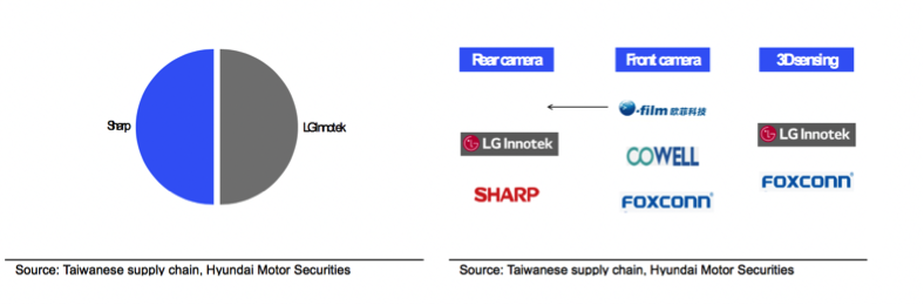

Innotek and Sharp manufactured Face ID for the iPhone X, but for the new model’s face ID, Foxconn will replace Sharp and incorporate it directly into the EMS process. As for dual and single camera modules, LG Innotek and Sharp are likely to supply in similar volumes. Meanwhile, Cowell Electronics, Foxconn, and OFilm manufacture the front camera of the iPhone. There is a possibility that OFilm will supply rear cameras for the new iPhone from 2019 as it acquired Sony’s Guangzhou line.

The new iPhone to be released in 2019 will come with triple rear cameras. Recently, there is a rumor that Luxvision will enter this segment as it bought LiteOn's camera module department. Given that the market for rear cameras and 3D sensing is dominated by Korean and Japanese players, the potential entry of Chinese players into the Apple supply chain in this segment could be negative for sentiment.

As for the new iPhone’s SLP, Compeq, ZDT and UMTC are expected to supply LCDs, and OLED models are likely to be supplied by AT&S, TTM and Compeq. Ibiden is expected to supply less than 5% of total volume, as backup. Meanwhile, Taiwan's Kinsus appears to have not made SLP suppliers this time. Accordingly, Kinsus's negative issues are irrelevant to the new iPhone’s production volume.

Figure 1: iPhone Production Volume and EMS Composition in Q218

October 15, 2018

Hyundai published a report covering the flat panel and semiconductor industries. We have excerpted sections of the report that deal with the flat panel industry.

LCD investments down slightly, POLED investments down sharply, expectations for QD up

China appears be reducing subsidies for panel makers, and while LCD oversupply seems unavoidable in the mid to long-term, LCD TV panel price declines will likely be limited in 4Q18. As for flexible OLED production, Chinese investments are plummeting. The key issues of the display sector until the year’s end include:

- Samsung’s QD investments,

- iPhone’s sales volume in 2H18 (POLED vs. LCD),

- The possibility of LGD supplying POLED for Apple for the first time, and

- The direction of LCD prices in 4Q18.

We believe Samsung’s QD investments are more important than its investments in foldable display.

Considering the orders awarded to Taiwanese EMS companies, we estimate the production volume of the iPhone in 2H18 will be 86m units, comprised of:

- 44mn LCD units

- 42mn OLED units.

- LCD’s percentage of production should be 51%

- The 6.50-inch display’s proportion of OLED iPhone should be 61.9%.

- The new iPhone is expected to be manufactured exclusively at Foxconn and Pegatron, with Foxconn being responsible for 67% of total production volume.

Although the LCD industry is still likely to be oversupplied, we do not believe the price of LCD TV panels will fall drastically until 20182019 given declining Chinese subsidies and solid demand for LCD TV sets. The BOE yield in the POLED industry is still a paltry 10-20%, and it seems every panel maker including Samsung Display Co (SDC), LG Display and the Chinese are going through difficult times.

In terms of capacity, Samsung’s QD investments are worth noting. Going forward, we expect China’s LCD investments to remain flat (or down slightly for the 8th-generation LCD fabs), POLED investments in Korea and China to contract, and Samsung’s QD investments to increase.

After the visit to the Japanese and Taiwanese companies in the Apple supply chain, we learned that production of the new 6.06-inch LCD version is being delayed due to an issue with BLU and because of this it will come out after the OLED version. Only Foxconn and Pegatron will participate in the production of the new iPhone without Wistron this time. Foxconn is expected to be responsible for 67% of EMS for the new iPhone to be released in 2H18. The expected production volume of the new iPhone is about 86mn units, and LCD will make up 51% of total production. 51% of LCD models will be manufactured by Pegatron and 86% of OLED models by Foxconn.

Innotek and Sharp manufactured Face ID for the iPhone X, but for the new model’s face ID, Foxconn will replace Sharp and incorporate it directly into the EMS process. As for dual and single camera modules, LG Innotek and Sharp are likely to supply in similar volumes. Meanwhile, Cowell Electronics, Foxconn, and OFilm manufacture the front camera of the iPhone. There is a possibility that OFilm will supply rear cameras for the new iPhone from 2019 as it acquired Sony’s Guangzhou line.

The new iPhone to be released in 2019 will come with triple rear cameras. Recently, there is a rumor that Luxvision will enter this segment as it bought LiteOn's camera module department. Given that the market for rear cameras and 3D sensing is dominated by Korean and Japanese players, the potential entry of Chinese players into the Apple supply chain in this segment could be negative for sentiment.

As for the new iPhone’s SLP, Compeq, ZDT and UMTC are expected to supply LCDs, and OLED models are likely to be supplied by AT&S, TTM and Compeq. Ibiden is expected to supply less than 5% of total volume, as backup. Meanwhile, Taiwan's Kinsus appears to have not made SLP suppliers this time. Accordingly, Kinsus's negative issues are irrelevant to the new iPhone’s production volume.

Figure 1: iPhone Production Volume and EMS Composition in Q218

Figure 2: iPhone EMS Composition

Figure 3: iPhone SLP Supplier Composition

Figure 4: New iPhone Supplier Composition

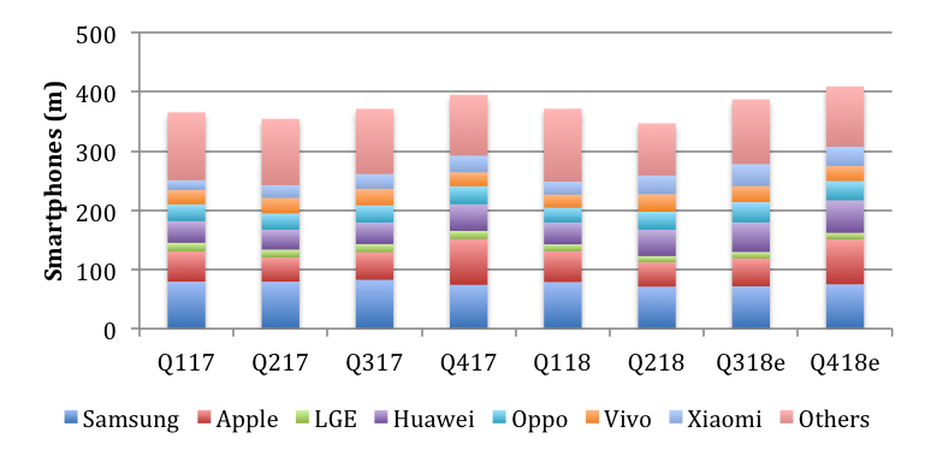

Samsung smartphone shipments weak whereas Huawei’s reach 200mn units

We expect Samsung's smartphone shipments in 2018 to slip 6.1% YoY to 296mn units, which will be the first time for the figure to fall below the 300mn mark since 2013.

Dual SIM is expected to be the major trend going forward because it is difficult to carry two smartphones simultaneously and it is convenient when one has to make frequent business trips overseas. Apple is also likely to support Dual SIM for the Chinese market for its new model to be launched in 2H18. Because of dual SIM, MNP has dropped and the smartphone replacement cycle has lengthened.

Meanwhile, Samsung is expected to install a triple camera module on the back of the Galaxy S10 in 2019, and support In Display (or Under Display), which allows ultrasonic fingerprint recognition. In the past, there was a yield issue when bonding the ultrasonic module with flexible OLED, which appears to have been resolved now for the most part. OLED displays will use the ultrasonic method and the optical method will be used by LCDs.

Figure 5: Smartphone Supply by OEM

We expect Samsung's smartphone shipments in 2018 to slip 6.1% YoY to 296mn units, which will be the first time for the figure to fall below the 300mn mark since 2013.

- Huawei's smartphone shipments this year should reach 200mn units thanks to strategic models such as P20 and some low-end ODMs. If the pace keeps up, Huawei will surpass Apple in 2019 by volume and become the world's second largest smartphone maker.

- Xiaomi’s profitability is low but its market share is rising, mainly in emerging markets such as India and Africa.

- Oppo and Vivo are strengthening marketing especially in greater China. As Beijing blocked the Google Play Store due to its conflict with Google (GOOG), Chinese companies such as Oppo and Vivo have introduced their own version of app stores in their smartphones, which have become a steady source of profits for them. Since they cannot generate such profits outside China, they do not plan to enter foreign markets. Meanwhile, in the Chinese market, dual SIM is quite popular, which supports two numbers with one smartphone.

Dual SIM is expected to be the major trend going forward because it is difficult to carry two smartphones simultaneously and it is convenient when one has to make frequent business trips overseas. Apple is also likely to support Dual SIM for the Chinese market for its new model to be launched in 2H18. Because of dual SIM, MNP has dropped and the smartphone replacement cycle has lengthened.

Meanwhile, Samsung is expected to install a triple camera module on the back of the Galaxy S10 in 2019, and support In Display (or Under Display), which allows ultrasonic fingerprint recognition. In the past, there was a yield issue when bonding the ultrasonic module with flexible OLED, which appears to have been resolved now for the most part. OLED displays will use the ultrasonic method and the optical method will be used by LCDs.

Figure 5: Smartphone Supply by OEM

Source: Hyundai Motors Securities

Figure 6: Smartphone Form and Vivo’s Under Display Fingerprint Reader

Figure 6: Smartphone Form and Vivo’s Under Display Fingerprint Reader

Figure 7: Huawei’s Focus on Cameras and Snapdragon Sense ID

Display Investment: LCD →/ POLED↓/ QD↑

LCD still in oversupply but less severe

We visited major display equipment and panel makers to check the oversupply situation of the LCD industry and to find out iPhone order volume in 2H18 at Japan Display (JDI) and LGD. We also checked Chinese companies’ contracting investments in POLED due to sluggish POLED demand and included our forecast of Samsung's QD investment.

To sum up, LCD oversupply in the mid/long term and panel price declines are likely to sustain. However, we do not expect LCD prices to plummet given:

In the case of small- and mid-sized OLED panels, it is a difficult time for both Korean and Chinese panel makers. This is because:

SDC has reached a point where its reliance on Apple increases and its earnings volatility intensifies depending on Apple’s POLED model strategy. The ASP for Apple's new models and Samsung mobile devices has been sliding every year. Also, as Apple's vendor diversification policy is becoming more and more intense, its dominant market share within Apple may disappear next year.

In addition, as the demand for foldable display does not appear very strong in 2019, there are few factors that can raise expectations for the next year. Chinese demand for rigid panels is growing rapidly but its ASP is not very high. POLED demand is much more important.

3. Samsung’s QD investment-- Implications for Korean beneficiaries and value chain

As Samsung is increasingly likely to invest in QD-OLED, there is growing interest in potential beneficiaries. However, the equipment to be used in most core processes will probably be imported. Although there are many Korean companies that make POLED equipment used in the core processes, Samsung may still opt for foreign-made equipment because it lacks the experience in many processes and it will try to fast-forward the initial mass-production date. For conventional smartphone MG (mother glass), it only had to discard some panels if the yield was poor. However, in the case of large TV panels, the 8th generation MG can only produce four 55-inch panels or three 65-/80-inch panels. This means that even if a small part of the panel is damaged, the loss of production will be severe. Therefore, we expect securing a stable yield to be the top priority. The key value chain set to benefit from QD investments is as follows.

QD capex scale and timeline

In the absence of clear technical standards and value chain, it is premature to estimate the scale of mass-production. At this point, we believe a test run was conducted at the ph3 6K lines in the L8-2 fab and it is likely that the L8-1 fab will be used for mass-production. In the case of L8-1, the total capacity is 195K (80K from the ph1 line, 85K from ph2, and 30K from ph3). Of these three, one or two lines may be used for mass production. At present, some of the capacity is still used for the mass-production of QDEF-LED TVs, thus it is unlikely that heavy capex will be put into the A5 for mass production. Currently, it looks like the A5 investment will be for QD rather than foldable display, but Samsung’s VD division, whose annual LCD TV sales volume has been sliding from 48.1mn units in 2016 to 43.09mn units in 2017 and 40mn units in 2018, is unlikely to boost TV capacity drastically. Our estimated timeline of QD investment is as follows:

LCD still in oversupply but less severe

We visited major display equipment and panel makers to check the oversupply situation of the LCD industry and to find out iPhone order volume in 2H18 at Japan Display (JDI) and LGD. We also checked Chinese companies’ contracting investments in POLED due to sluggish POLED demand and included our forecast of Samsung's QD investment.

- The key issues of the LCD sector are as follows:

- According to equipment makers such as TEL (Tokyo Electron) and Ulvac, the first equipment orders by BOE, CSOT, and Sharp (Foxconn) for their 10.5/11G fabs have been issued, and as a result, LCD oversupply is expected to continue next year.

- BOE’s B17 and CSOT’s T7 are likely to start placing orders beginning at the end of this year.

- Government subsidy reductions that affect Chinese panel makers also seem to be recognized in Japan and Taiwan. Second-tier companies such as HKC and CEC Panda may slow down the pace of capacity expansion. For BOE and CSOT, Chinese subsidy cuts may be not serious enough to delay the construction new fabs, but it could work to limit the decline of LCD prices from the current level which is close to the cash cost. In the short term, we believe LCD TV panel demand and the movement to build up inventory are solid. The LCD TV set shipments are also solid, growing 7.2% Y/Y in 1H18.

To sum up, LCD oversupply in the mid/long term and panel price declines are likely to sustain. However, we do not expect LCD prices to plummet given:

- Solid demand for LCD TV panels and inventory building in the short term; and

- The Chinese government’s subsidy cuts. The business climate is mostly unchanged from a broad perspective, but the worst is over.

In the case of small- and mid-sized OLED panels, it is a difficult time for both Korean and Chinese panel makers. This is because:

- In terms of demand, flexible panel demand is rapidly fluctuating in accordance with Apple's adoption of POLED;

- In terms of supply, all panel makers except SDC suffer from poor yields. For SDC, which has reached a golden yield and is responsible for 95% of global capacity, the issue is weak POLED demand. For LG Display and Chinese panel makers, not only low POLED demand but also massive capex and poor yields initially add to their burdens.

SDC has reached a point where its reliance on Apple increases and its earnings volatility intensifies depending on Apple’s POLED model strategy. The ASP for Apple's new models and Samsung mobile devices has been sliding every year. Also, as Apple's vendor diversification policy is becoming more and more intense, its dominant market share within Apple may disappear next year.

In addition, as the demand for foldable display does not appear very strong in 2019, there are few factors that can raise expectations for the next year. Chinese demand for rigid panels is growing rapidly but its ASP is not very high. POLED demand is much more important.

3. Samsung’s QD investment-- Implications for Korean beneficiaries and value chain

As Samsung is increasingly likely to invest in QD-OLED, there is growing interest in potential beneficiaries. However, the equipment to be used in most core processes will probably be imported. Although there are many Korean companies that make POLED equipment used in the core processes, Samsung may still opt for foreign-made equipment because it lacks the experience in many processes and it will try to fast-forward the initial mass-production date. For conventional smartphone MG (mother glass), it only had to discard some panels if the yield was poor. However, in the case of large TV panels, the 8th generation MG can only produce four 55-inch panels or three 65-/80-inch panels. This means that even if a small part of the panel is damaged, the loss of production will be severe. Therefore, we expect securing a stable yield to be the top priority. The key value chain set to benefit from QD investments is as follows.

- Oxide TFT

- Oxide IGZO sputtering deposition: AMAT

- Coaters, developers, etchers, Ashers: AMAT, TEL, ICD

- Oxide TFT annealing: Wonik Tera Semicon

- Deposition of QD materials on CF by inkjet printing

- Inkjet equipment: Kateeva (uses Epson’s nozzle)

- QD materials: Hansol Chemical

- Formation of OLED organic material layer and encapsulation process

- Blue OLED 2 or 3 stack deposition: Canon Tokki

- HTL, HIL, EIL: Samsung SDI, Duksan Neolux

- Glass encapsulation process: AP Systems

- Korean equipment and materials names set to benefit:

- Equipment: AP systems (encapsulation) ≒Wonik Tera Semicon (oxide annealing) > ICD (dry etchers)

- Materials: Duksan Neolux (e.g., HTL, HIL, EIL) > Hansol Chemical (QD materials)

QD capex scale and timeline

In the absence of clear technical standards and value chain, it is premature to estimate the scale of mass-production. At this point, we believe a test run was conducted at the ph3 6K lines in the L8-2 fab and it is likely that the L8-1 fab will be used for mass-production. In the case of L8-1, the total capacity is 195K (80K from the ph1 line, 85K from ph2, and 30K from ph3). Of these three, one or two lines may be used for mass production. At present, some of the capacity is still used for the mass-production of QDEF-LED TVs, thus it is unlikely that heavy capex will be put into the A5 for mass production. Currently, it looks like the A5 investment will be for QD rather than foldable display, but Samsung’s VD division, whose annual LCD TV sales volume has been sliding from 48.1mn units in 2016 to 43.09mn units in 2017 and 40mn units in 2018, is unlikely to boost TV capacity drastically. Our estimated timeline of QD investment is as follows:

- The value chain will likely be finalized for the most part by the year’s end;

- Pilot line PO will be partly awarded in 1H19;

- Equipment set-up and test line operation will be conducted for about a year through mass-production PO in 2H19; and

- Mass-production should begin in earnest from end-2020 or early 2021.

|

Contact Us

|

Barry Young

|