Vertical Divider

|

Huawei Smartphone Shipments Expected to Drop Below 200m in 2019

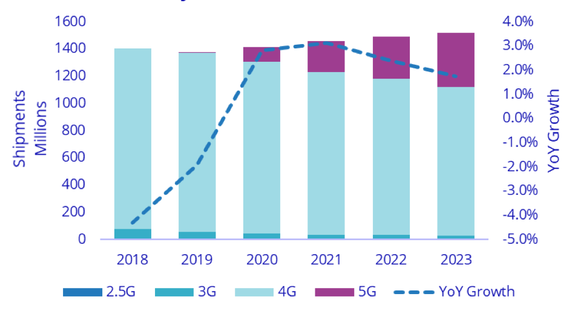

June 17, 2019 In the wake of the U.S. government’s decision to ban businesses from working with Huawei,research firm Canalys has slashed its forecast for the global smartphone market by almost 5%. The firm now projects smartphone shipments of 1.35 billion units in 2019, a year-over-year decline of 3.1% from 1.3931 billion units in 2018. That compares to the previous forecast of 1.417 billion units in 2019, or what would have been a projected 1.7% increase. That 2019 forecast is lower by 4.7%. Huawei was forecasted to ship 246m units in 2019, which would put their volume at 179m, 21m less than their 2018 volume. Huawei reportedly shipped 59.1m units in Q119, which would mean the last three quarters would only average 40m/qtr. Vs. the original forecast of 62m/qtr. While the order issued by U.S. authorities is still officially on hold during a 90-day reprieve, Canalys does expect it to go into effect and the order to strike a blow to Huawei’s ability to roll out new devices. Huawei is scrambling to implement contingency plans. In the short term, it’s unclear whether other smartphone makers will benefit from their rival’s woes. |

|

Figure 1: Revised Smartphone Shipment Forecast

Figure 2: IDC’ Smartphone Shipment Forecast

Source: IDC

Samsung might profit from Huawei’s troubles, given their ability to boost production and compete on price. And Canalys global smartphone sales will increase slightly due in large part to the rise in demand for 5G phones. “Smartphone fatigue and a lack of meaningful innovation are still major market forces,” said Canalys research director Rushabh Doshi in a statement. “Consumers are holding onto phones for longer. But as device lifecycles move toward a new equilibrium point, the rate of quarterly shipment decline will ease.”

Other results of the proposed ban include:

- Foxconn suspending production lines

- ARM suspending business with Huawei. BBC reports, ARM has instructed its employees to suspend “all active contracts, support entitlements, and any pending engagements” with Huawei and its subsidiaries named in the U.S.’s Entity List of the Export Administration Regulations. ARM told its staff not to “provide support, delivery technology (whether software, code, or other updates), engage in technical discussions, or otherwise discuss technical matters with Huawei, HiSilicon or any of the other named entities.” Although ARM is based in the United Kingdom and its parent company is Japan-based SoftBank, ARM is complying with the U.S. trade restrictions because the company says its designs contain “US origin technology.” If the U.S. and China cannot reach a deal, then the one-two punch of Google revoking Huawei’s Android license and ARM suspending all business with Huawei will be the death of China’s largest technology company. The inability to distribute Google Play apps and services, get early access to the next Android platform release and security patches, and even potentially fork AOSP have led Huawei to consider its “Plan B” OS for its smartphones. Although reportedly far from ready, Huawei’s Android alternative has been in development for years, and the company is already seeking alternatives to Google Play. On the other hand, Huawei’s hardware independence (for the most part) from U.S.-based companies has been its one saving grace in this trade war – at least until now. Huawei won’t immediately feel the effects as the company has stockpiled 3 month’s worth of supplies in anticipation of the U.S. trade ban. And as the BBC notes, Huawei and HiSilicon can continue to manufacture existing chips using ARM technology, so current smartphones like the new Honor 20 series should be unaffected. A source told the BBC that the upcoming HiSilicon Kirin 985 will be unaffected by the ban, but that HiSilicon’s next chip design will likely need to be “rebuilt from scratch.” Given the long design and development process for new chips and how dependent Huawei has been on ARM IP, it could take Huawei years to build a new chip without ARM IP. If they survive that long, that is. Huawei’s best hope now is to petition China to resolve its trade dispute with the United States because going it alone just doesn’t seem possible for Huawei with this latest development.

- SumahoInfo reports that Huawei has been removed from the list of partners on the SD Card Association’s website, which could mean that Huawei has lost the ability to sell SD Card-compatible devices. Use of the SD Card logo, essential patents, and SD technology require license agreements. The SD Card Association has so far not confirmed the news. Notably, the Huawei Mate 20 Pro, Huawei Mate 20 X, and Huawei P30 Pro are compatible with “NM Cards,” short for NanoMemory cards, a new flash storage expansion specification designed by Huawei. It’s unclear if NM Cards will be affected in a situation where Huawei is no longer a licensed partner of the SD Card Association. However, Broadcom, one of the leading suppliers of Wi-Fi and Bluetooth chips, has already cut ties with Huawei. Broadcom chips are found in a large number of smartphones, including many from Huawei

- According to Reuters, Interdigital and Qualcomm will likely continue to be able to license their 5G patents to Huawei as patents aren’t covered by the new export restrictions. Huawei’s 5G business is one of the major reasons the company is in this mess in the first place, so it’s interesting to hear that American companies can continue licensing 5G patents to them.

- Huawei has voluntarily withdrawn itself from JEDEC, the company behind flash storage and RAM standards. This limits the company’s ability to provide input into future UFS and LPDDR standards.

- Flextronics, has halted production on Huawei smartphones, according to sources speaking to Nikkei Asian Review. Huawei works with ODMs like FIH Mobile, Wingtech Technology, BYD, and others.

- On the upside, Panasonic has backtracked on an earlier statement it made (via SCMP); the Japanese company now states that it will continue supplying Huawei with hardware components as expected.

- Synopsys, a supplier of electronic design automation (EDA) tools necessary for chip design, has “stopped providing software updates” to Huawei. The company also halted the sales of its IP to Huawei, according to sources speaking to Nikkei.

|

Contact Us

|

Barry Young

|