Vertical Divider

|

Foxconn Expects to Relocate ~1,300 Chinese to Staff Facility in Wisconsin

November 12, 2018 The WSJ reported that Foxconn TechnologyGroup is considering bringing in personnel from China to help staff a large facility under construction in southern Wisconsin as it struggles to find engineers and other workers in one of the tightest labor markets in the U.S. The company has been trying to tap Chinese engineers through internal transfers to supplement staffing for the Wisconsin plant, according to people familiar with the matter. The state pledged $3 billion in tax and other “performance-based” incentivesto help lure Foxconn, and local authorities added $764 million. Foxconn must meet hiring, wage and investment targets by various dates to receive most of those benefits. The company promised the state it would invest $10 billionand build a 22-million-square-foot liquid-crystal display panel plant, hiring 13,000 employees, primarily factory workers along with some engineers and business support positions. After an earlier version of this article posted online, Foxconn said in another statement, “We can categorically state that the assertion that we are recruiting Chinese personnel to staff our Wisconsin project is untrue.” |

|

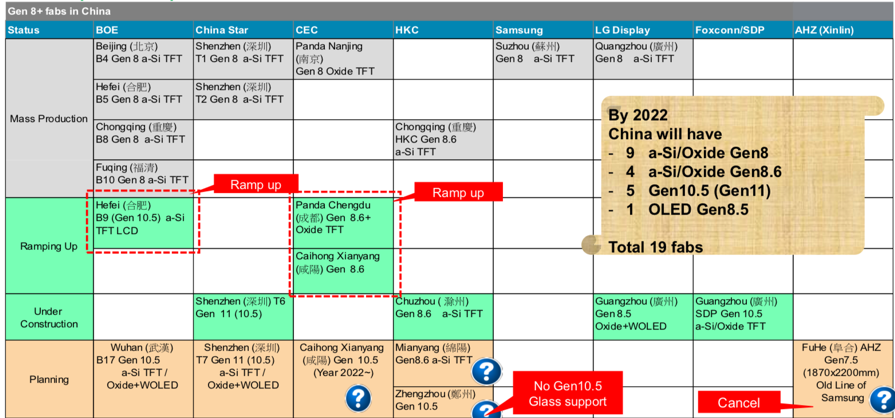

A tight labor marketis making recruiting a challenge. Finding skilled labor is proving to be a problem nationwide. One engineer who declined to give his name said he wouldn’t want to move to a place he worried could be as cold as Harbin, a northern Chinese city known as “Ice City.” Racine’ population is 80% white, and less than 2% is of Asian origin, according to the Census Bureau. Mr. Gou is upset that few Chinese workers have volunteered to move to Wisconsin if called upon, people familiar with the matter said. It is unclear how many the firm is looking to transfer. Work on the plant is likely to slow in the winter, picking up again in the spring, meaning the company isn’t yet hurrying to transfer engineers from China. At a job fair in mid-October in Wisconsin, Foxconn officials interviewed about 300 people out of 1,300 who applied. Applicants came from Wisconsin, Illinois and other states, said Alan Yeung, director of U.S. strategic initiatives at Foxconn. Few, if any, of the positions were for factory workers. Mr. Yeung said those jobs wouldn’t come until the production line was operational. In a statement Tuesday, the company said, “We continue to focus on hiring and training workers from throughout Wisconsin. We will supplement that recruitment from other U.S. locations as required.” Foxconn originally scheduled for the plant to be operational in 2020. The company had planned to construct a Gen 10.5 LCD TV panel manufacturing facility in Racine County, but has since switched to a Gen 6 facility that makes smaller panels. Foxconn saw the growth in large area display capacity in planned for China, which included:

It isn’t clear whether the company’s shift in plans will affect the number of workers it needs, or the balance between factory workers and engineers hired. Foxconn originally projected it would hire 9,817 hourly operators, 2,363 engineers and 820 business support staff, according to an economic impact statement prepared by Ernst & Young LLP in July 2017 for the state on behalf of the company.

In terms of small/medium fabs in China by 2022, there will be:

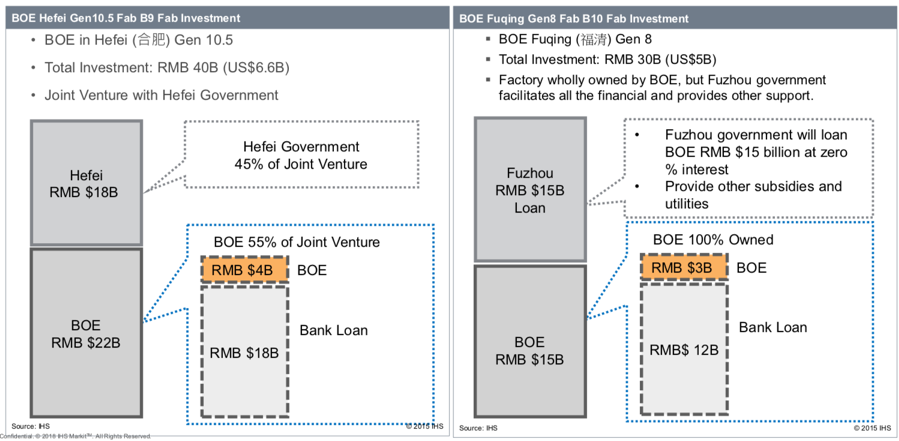

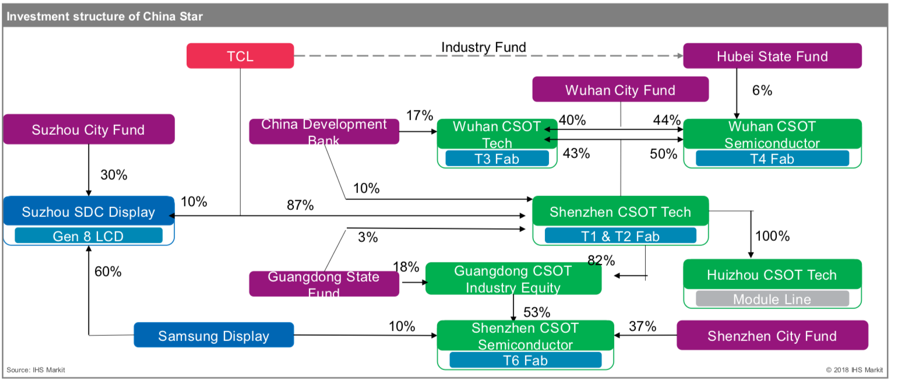

The Chinese government has begun to limit funding to the display industry and existing investments face greater scrutiny than in previous years. Chinese panel producers were able to secure very lucrative subsidies for initial construction of display fabs, and in many cases, on-going subsidies that go toward operating expenses. Similar to LEDs, the Chinese government has aggressively funded the display space, offering state, regional, and local subsidies to those who committed to building LCD and OLED display capacity with the only prerequisite was the desire to build, the experience of the potential producer and the impact on the industry seemed secondary. Such funding has been responsible for the capacity growth of a number of Chinese panel producers, including BOE, Tianma, Visionox, Panda and Truly andHKC. The subsidies take many forms, as in the case of the Ordos OLED fab, where BOE was given $1b worth of coal mining rights along with generous construction funding and infrastructure grants as an incentive to build a fab in the remote inner Mongolia section of China, BOE continues to expand capacity and as it progresses with the construction of its Gen 10.5 fab in Wuhan, it seems that the company has only been required to put up ~10% of the total expected investment cost, with the provincial government funding 45% and bank loans (state owned banks) providing the other 45%, so it would seem that China is still ripe with display funding opportunities.

Figure 1: China’s large Area Fabs

- Gen 8.5 – 9 a-Si/Oxide LCD

- Gen 8.5 – 1 Oxide OLED

- Gen 8.6 – 4 a-Si/Oxide LCD

- Gen 10.5/11 – 3 a-Si/Oxide LCD

- Gen 10.5/11 – 2 Oxide OLED

It isn’t clear whether the company’s shift in plans will affect the number of workers it needs, or the balance between factory workers and engineers hired. Foxconn originally projected it would hire 9,817 hourly operators, 2,363 engineers and 820 business support staff, according to an economic impact statement prepared by Ernst & Young LLP in July 2017 for the state on behalf of the company.

In terms of small/medium fabs in China by 2022, there will be:

- Gen 4.5/5.5 – 4 LTPS LCD/OLED

- Gen 5.5 – 1 a-Si LCD

- Gen 5.5 – 1 Oxide OLED

- Gen 6 -- 3 a-Si/Oxide LCD

- Gen 6 – LTPS LCD

- Gen 6 – 7 LTPS OLED/Flexible

The Chinese government has begun to limit funding to the display industry and existing investments face greater scrutiny than in previous years. Chinese panel producers were able to secure very lucrative subsidies for initial construction of display fabs, and in many cases, on-going subsidies that go toward operating expenses. Similar to LEDs, the Chinese government has aggressively funded the display space, offering state, regional, and local subsidies to those who committed to building LCD and OLED display capacity with the only prerequisite was the desire to build, the experience of the potential producer and the impact on the industry seemed secondary. Such funding has been responsible for the capacity growth of a number of Chinese panel producers, including BOE, Tianma, Visionox, Panda and Truly andHKC. The subsidies take many forms, as in the case of the Ordos OLED fab, where BOE was given $1b worth of coal mining rights along with generous construction funding and infrastructure grants as an incentive to build a fab in the remote inner Mongolia section of China, BOE continues to expand capacity and as it progresses with the construction of its Gen 10.5 fab in Wuhan, it seems that the company has only been required to put up ~10% of the total expected investment cost, with the provincial government funding 45% and bank loans (state owned banks) providing the other 45%, so it would seem that China is still ripe with display funding opportunities.

Figure 1: China’s large Area Fabs

Source: IHS, OLED-A

These funding programs are relatively commonplace in the Chinese display space, given the significant state and local financial control wielded over such companies, but even with the government intervention and the subsidies boosting Chinese panel producer earnings, things don’t always go as planned, and it would seem that the State government finally has come to the same conclusion, funding had gotten a bit out of control. Since the beginning of this year, it has become more difficult for small ‘potential’ display companies to garner financing, both from the government and from government-controlled banks. and even projects developed by well-established Chinese display producers are facing far greater scrutiny than in previous years and will have an effect on the Chinese display space, and particularly the Chinese OLED space going forward.

Figure 2: BOE Fabs Investment Structure

Source: IHS, OLED-A

Figure 3: CSoT—Investment Structure

Source: IHS, OLED-A

|

Contact Us

|

Barry Young

|