Vertical Divider

|

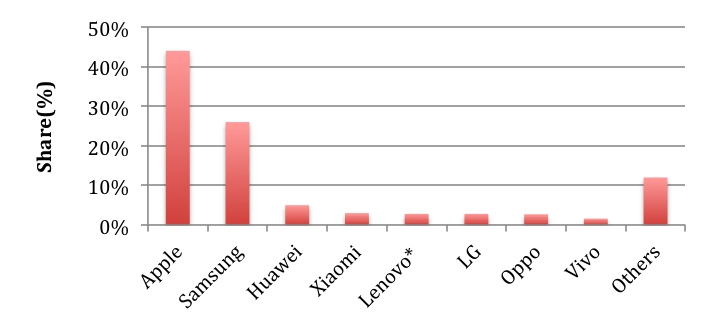

Flurry Analytics Puts Pre-Christmas Activations by Apple at 44% Flat Y/Y and Samsung at 26% up 5% Y/Y

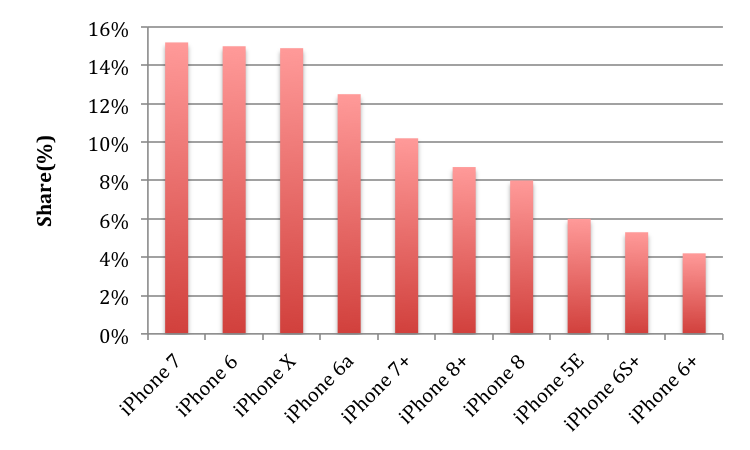

January 08, 2018 Flurry Analytics, a division of Verizon (VZ), provides an app that helps users understand their smartphone while giving developers insights into how they might improve their applications. It also gives Flurry a look at over 1m mobile phones and over 2.1b devices worldwide, to varying degrees. They showed new device activations for the week leading up to Christmas this year, and while they are not the only service of this kind that collects such data, they pumped it out first. Apple took 1st place by a substantial margin when looking at smartphones and tablets, but compared to last year’s 44% during the same period, it remained flat. Samsung was a distant second at 26%, but was up 5% Y/Y, which seems substantial although in 2016, the company was licking its wounds after the Galaxy Note recall last year and was likely seeing negative backlash. While Chinese brand Vivo garnered only a 2% activation share, it was the first year it made the list as it continued to grow sales in both China and India, but the more detailed data reveals a bit more about what was going on with Apple activations and leads to some preliminary thoughts about the new iPhone 8 family and the Apple user base. The device with the most activations was the iPhone 7, which continues to be an extremely popular model among Apple iPhone users, and while the iPhone X was only a bit behind, it lagged by a small fraction the iPhone 6, which was released in September 2014 and the iPhone 8 and 8+ came in toward the lower end of the pack. We note that looking at the iPhone activations by family also gives a bit of color as to how newer models are comparing, but each family has a different number of models, which skews the family results. When looked at as an average activation/unit by each family, the iPhone 7 family still proves to be the most popular, with an average of 12.8%/unit. The iPhone 6 family, while having the most activations, is hindered by only 4 models. The newest family should be one with the most activations, but looking at data from earlier this year (April), before the iPhone 8 family was released, it can be seen that the iPhone 6 family is 56% of the existing iPhone user base (not activations), which indicates that while initial popularity varies with each model and family, family sustainability is enhanced by the number of models available to customers, barring any major software or hardware issues. This is important primarily to Apple, and while the company has to deal with the quarterly results for each new model and family, the longevity of family sales is a big factor for total unit volumes and revenue. We estimate that on a unit volume basis, the iPhone 8 family will represent 35.3% of Apple units in 2017, with the remainder coming from iPhone SE, iPhone 6 and iPhone 7 families. We note that this is still relatively early data in the lifecycle of an iPhone family and is subject to many variables, especially the delayed availability of the iPhone X. Figure 1: Top Device Activations - Pre - Christmas Week 2017 Source: Flurry Analytics

Figure 2: iPhone Activations Pre - Christmas Week 2017 Source: Flurry Analytics

|

|

|

Contact Us

|

Barry Young

|